-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

-

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

Current & Historical NAV / Dividend

Oops! service is unavailable, please try after some time.

Methodology for calculating subscription and redemption price of units.

- Subscription / Switch-in (from other schemes/plans of the Mutual Fund) (This is the price investor need to pay for purchase/switch-in)

If the applicable NAV is Rs. 10/- and since there will be no entry load, then the purchase price will be Rs. 10/- - Redemption / Switch - out (to other schemes/plans of the Mutual Fund)(This is the price investor will receive at the time of redemption/ switch-out)

If the applicable NAV is Rs. 10/- and exit load is 0.5% then sale price will be 10 - (10 * 0.5%) = 10 - 0.05 = Rs. 9.95/-

Declaration

The information and data contained in this Website do not constitute distribution, an offer to buy or sell or solicitation of an offer to buy or sell any Schemes/Units of Aditya Birla Sun Life Mutual Fund (ABSLMF), securities or financial instruments in any jurisdiction in which such distribution, sale or offer is not authorised. In particular, the information herein is not for distribution and does not constitute an offer to buy or sell or the solicitation of any offer to buy or sell any securities or financial instruments in the United States of America ("US") and Canada to or for the benefit of United States persons (being persons resident in the US, corporations, partnerships or other entities created or organised in or under the laws of the US or any person falling within the definition of the term "US Person" under the US Securities Act of 1933, as amended) and persons of Canada.

By entering this Website or accessing any data contained in this Website, I/We hereby confirm that I/We am/are not a U.S. person, within the definition of the term 'US Person' under the US Securities laws/resident of Canada. I/We hereby confirm that I/We are not giving a false confirmation and/or disguising my/our country of residence. I/We confirm that Aditya Birla Sun Life Mutual Fund / Aditya Birla Sun Life AMC Limited (ABSLAMC) is relying upon this confirmation and in no event shall the directors, officers, employees, trustees, agents of ABSLAMC associate/group companies be liable for any direct, indirect, incidental or consequential damages arising out of false confirmation provided.

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

One Fund. Dual Earnings

Aim to get both tax saving and capital growth!

Investor App

One Fund. Dual Earnings

Aim to get both tax saving and capital growth!

Investor App

Why ELSS?

Living in a consumer driven era, being spoilt for choices, we are always looking to cut the best deal & those '1 plus 1 free' offers while we shop. Wish this could apply to Tax Planning as well? Equity Linked Savings Schemes (ELSS) aims to give you a dual benefit of tax savings along with wealth building. The inherent compounding benefit, long term nature of the fund as well as the access to fund manager expertise helps you leverage the capital growth potential of equity along with the tax saving.

Why Aditya Birla Sun Life Tax Relief '96?

Last minute unplanned tax saving investments, can get you stuck with products which simply save tax and not increase your investment portfolio. The Aditya Birla Sun Life Tax Relief '96 can help you achieve your medium to long term goals through wealth building while saving taxes along the way.

It invests majority (more than 80%) of its corpus in diversified equity and equity related instruments, which has the potential to outperform other investment modes over the long term, giving you an opportunity for capital growth and wealth building.

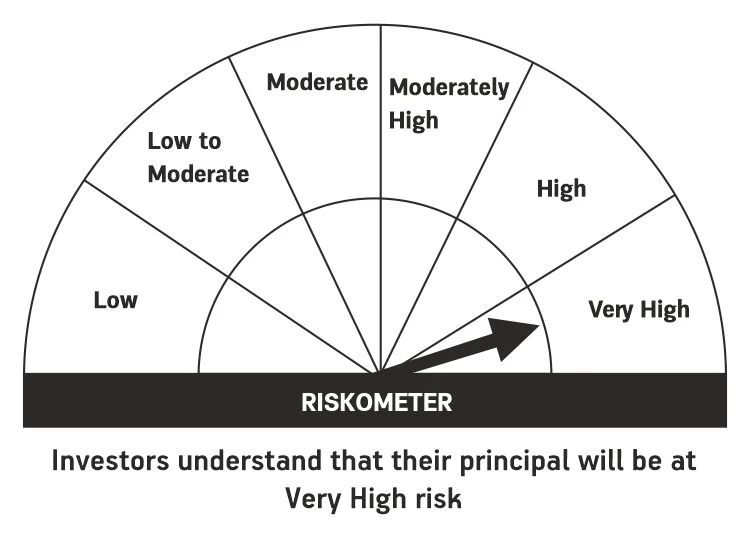

Riskometer

(An Open Ended Equity Linked Savings Scheme with a statutory lock in of 3 years and tax benefit.)

Investors understand that their principal will be at Moderate High risk

Check if this product is suitable for you

This product is suitable for investors who are seeking:

If you are investor looking out for tax saving options and have not otherwise exhausted the limit of INR 1,50,000 (such as through employee PF or home loan principal instalments), you can aim to benefit from this fund. This is specifically true if you fall in one of these categories:

- Newly employed individuals who have low contribution to their employee provident funds (EPF)

- Early investors who do not have high home loan EMI payments (which otherwise can get covered in the INR 1,50,000 limit)

- Self-employed individuals who do not have EPF contributions

Where ELSS stand among other tax saving instruments?

| Investment Option | ELSS | PPF | NSC | FD |

|---|---|---|---|---|

| Lock in period (in years) | 3 Years | 15 Years | 5 Years | 5 Years |

| Return potential | 11.7% p.a. 1 | 7.9% p.a. 2 | 7.9% p.a. 2 | 7% to 8% p.a. 3 |

| Possibility for Dividends | Yes, with dividend option | No | No | No |

| Tax on returns | Long term capital gains above INR 100,000 taxed 10% 4 | Tax free after 15 years | Taxable at applicable tax slab rate | Taxable at applicable tax slab rate |

| Investment strategy | Active, market linked returns | Passive, pre-determined returns | Passive, pre-determined returns | Passive, pre-determined returns |

1 ELSS Category Average, as on 15th November, 2019, source: Morningstar Direct.

2 PPF and NSC, source: India Post.

3Bank Fixed Deposit, source: Average FD rates of PSU Banks for non-senior citizens

4Applicable surcharge & cess extra

Note: Unlike PPF, NSC & FDs investments in Mutual Funds are subject to market risks.

Benefits of investing in Aditya Birla Sun Life Tax Relief'96

Tax advantage

Annual tax saving up to INR 46,800* u/s 80C Income Tax Act, 1961

Investment discipline

3-year lock-in feature discourages you from making early redemptions & inculcates discipline in your investing

Market linked returns

You can benefit from long term capital growth potential of Equities

Expertise

You get access to the years of expertise of fund managers in stock selection and portfolio management

Who should invest?

Goal Planners

Anyone planning for goals like retirement, child's education or any other long-term goal along with saving tax can consider investing in this fund.

Tax Savers

It is also suitable for young salaried individuals who are investing in equities for the first time with the twin objective of tax savings as well as capital appreciation. Read more…

Related Articles

* under section 80C of the Income-tax Act, 1961

**this is considering income in the 30% tax bracket and 4% cess – for individuals with income in excess of INR 50 lacs and up to INR 1cr – the benefit owing to impact of surcharge would increase to INR 51,480 and for those with income in excess of INR 1cr – the benefit would increase to INR 53,820

Please note that savings mentioned above are based on general provisions of the Income tax act, 1961 and investors are advised to consult their tax advisors to determine tax benefits applicable to them. Amount mentioned above may undergo a change if assumptions specified herein do not hold good.

Further, Investment in ELSS schemes is subject to lock in period of 3 years from the date of allotment of units.

Investors are advised to consult their tax advisor in view of individual nature of tax benefit. Investors are requested to note that tax laws may change from time to time and there can be no guarantee that the current tax position may continue in the future. Note: The comparison of ELSS Vs other traditional savings instruments has been given for the purpose of the general information only. Investment in ELSS carry higher risk, does not guarantee returns and any investment decision needs to be taken only after consulting the Tax Consultant or Financial Advisor. Aditya Birla Sun Life Mutual Fund / Aditya Birla Sun Life AMC Limited will not accept any liability/ responsibility/loss incurred on any investment decision taken on the basis of this information.

Past performance may or may not be sustained in future. Please note that savings mentioned above are based on general provisions of the Income tax act, 1961 and investors are advised to consult their tax advisors to determine tax benefits applicable to them.

1800-270-7000

1800-270-7000