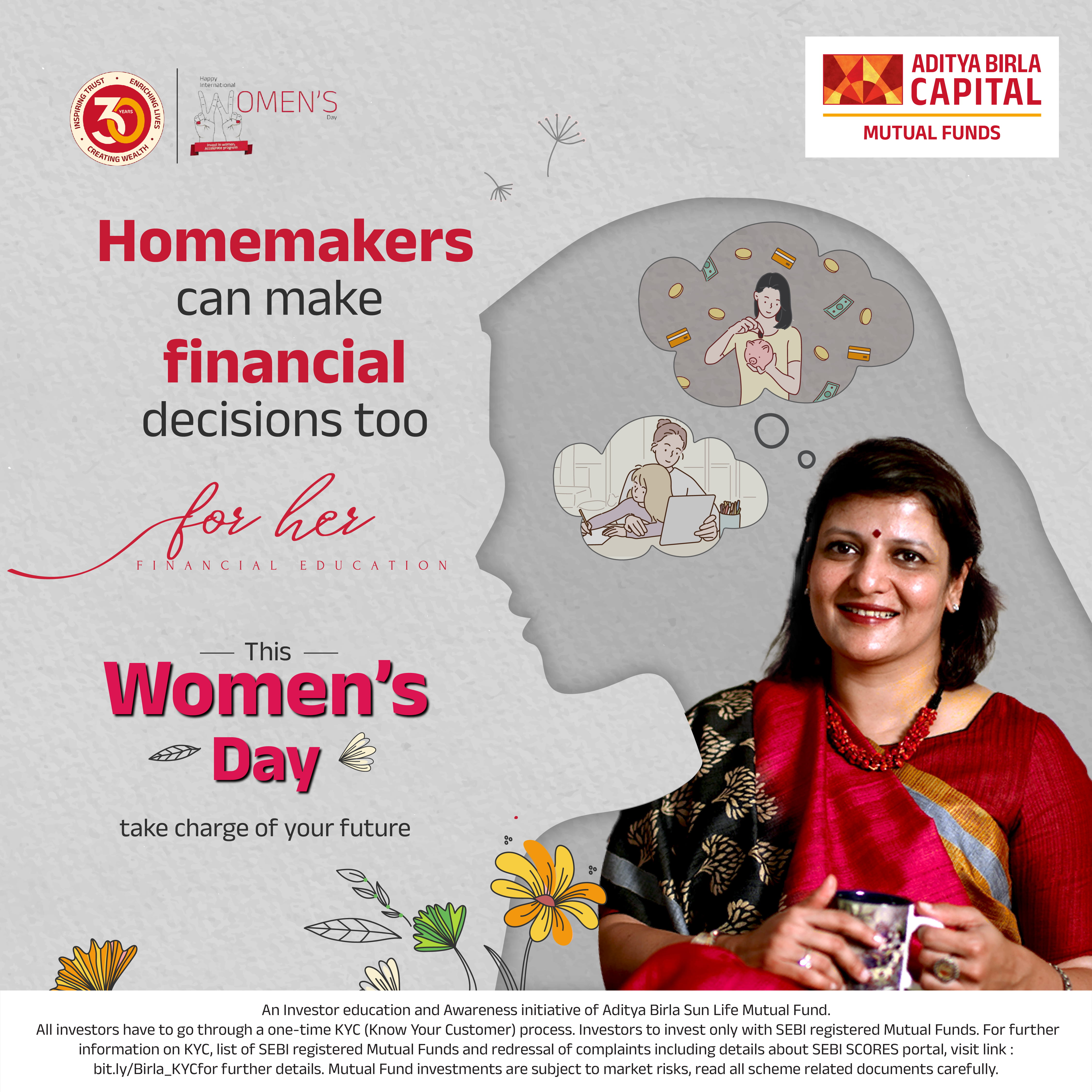

In the evolving modern India, the role of the homemaker has gone beyond the traditional confines of the kitchen. Today, homemakers are not only the backbone of our households but are also emerging as important players in financial decision-making. This shift showcases a tectonic shift towards empowerment and financial confidence for Indian women.

Financial Literacy for Informed Decision-making

The cornerstone of financial confidence is financial literacy. Homemakers are increasingly taking charge to understand the nuances of budgeting, investments and savings. Thanks to numerous workshops, community programs, online courses and initiatives undertaken by financial institutions, women are enhancing their financial knowledge.

Smart Budgeting

Prudent budgeting had always been a forte of women. They are taking it a step ahead by becoming adept at optimizing expenses. Whether grocery shopping or utility bills, women are taking charge to ensure they run their house within budgets, covering all bases. Through smart budgeting, they are not only ensuring financial stability for their families but also opening opportunities for savings and investments.

Investing Wisely

While the investment world has always been thought to be a male bastion, women are breaking the barriers by delving into this realm. Be it mutual funds or stocks, many homemakers are exploring diverse avenues to grow their wealth. As per AMFI data, the number of women investors in mutual funds saw a jump to 74.49 lakhs at the end of December 2022, as against 46.99 lakhs in December 2019. As per the Economic Survey 2023, the proportion of women investing in equities has seen a jump from 16% to 24% in two years.

Entrepreneurship and Side Hustles

The digital age has allowed homemakers to give wings to their entrepreneurial ventures and side hustles. Many are leveraging their skills to create an alternate source of income. Be it starting an online business or freelancing, these endeavors contribute to financial independence and personal fulfilment. As per an IBEF report, the country has nearly 15.7 million women-led startups, with 20.37% women running the MSME sector.

In Conclusion

The evolving role of Indian homemakers is a testament to the resilience and adaptability of women. Beyond kitchens, they are actively shaping the financial landscape of their households. Celebrating these strides, we need to foster an environment that encourages their financial empowerment.

An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link :https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details. Mutual Fund investments are subject to market risks, read all scheme related documents carefully

म्यूचुअल फं ड निवेश बाजार जोखिम के अधीि हैं, योजिा संबंधी सभी दस्तावेजो ंको सावधािी से पढ़ें।

1800-270-7000

1800-270-7000