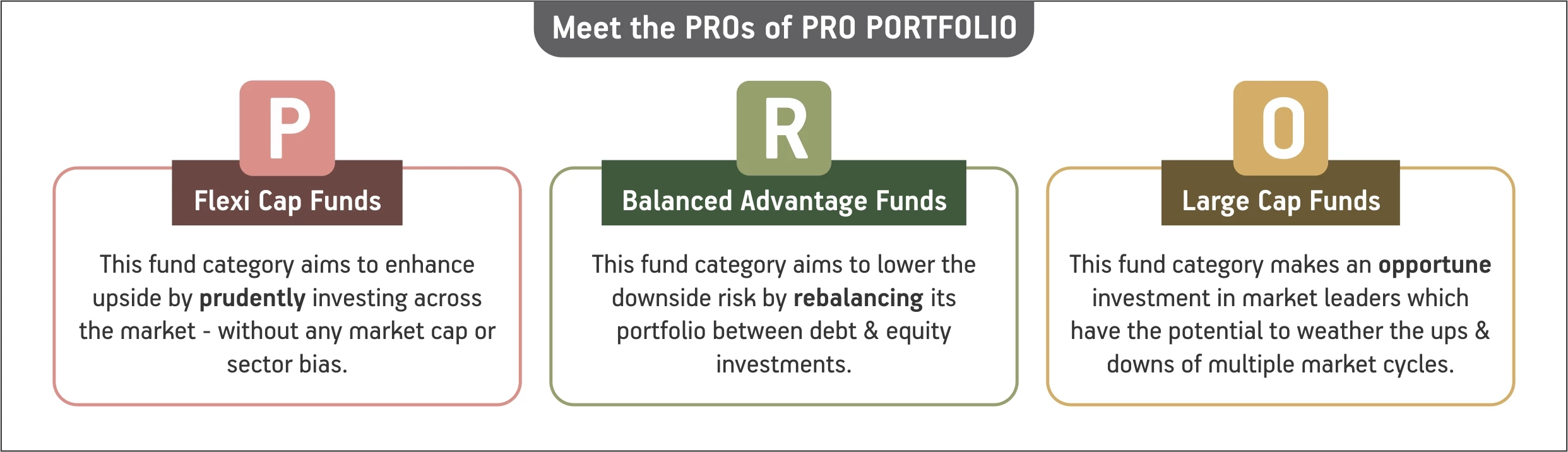

PRO-PORTFOLIO brings together a winning partnership of three mutual fund categories that aim to enhance returns in a bull market while managing risks in a bear market.

Balancing risks and accelerating returns, this partnership seeks to perform in every market environment, converting your investment into wealth in the long term.

What Pro Portfolio combination brings to the table?

• 1 portfolio, three different mutual categories - Flexi Cap, Hybrid, Large Cap.

• Exposure to market leaders by investing in large-cap stocks.

• Rebalances portfolio across different market caps and debt and equity to maximize returns and minimize risk in a volatile market.

• Aims to creates wealth in the long term by smoothening equity investing journey.

• Benefit of equity taxation.

Pro Portfolio is Ideal for

• Those looking for a diversified portfolio that aims to perform in all market conditions. Or Those looking to build an all-season investment portfolio.

• Those looking to create wealth in the long term.

• Those investing for bigger financial goals like retirement planning, house, children’s education, own business.

Make the most of the Pro portfolio Start an SIP in each of the three fund categories for long term.

An Investor education and Awareness initiative of Aditya Birla Sun Life Mutual Fund

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link : https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully

1800-270-7000

1800-270-7000