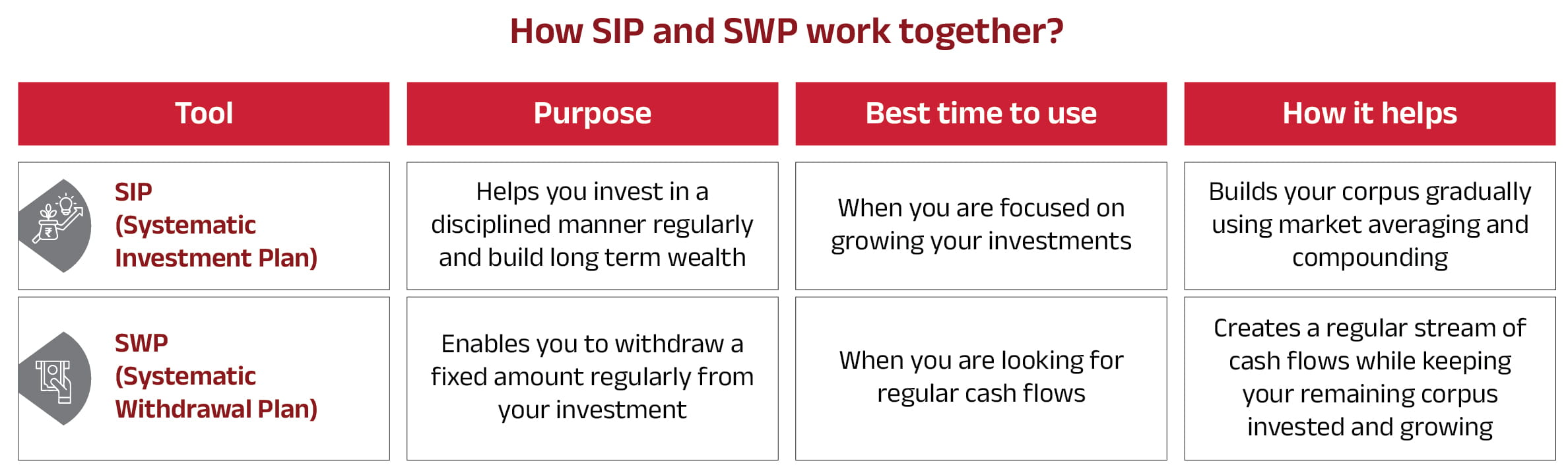

Investors who wish to build wealth over the long term and later access it in a structured manner may consider using Plan for Life. SIP is suitable for investors who want to invest regularly and grow their wealth over time through disciplined contributions. SWP is suitable for investors who want to withdraw a fixed amount periodically from their accumulated corpus, such as retirees or those seeking regular cashflows without redeeming their entire investment at once.

SIPs are generally started during earning years, when investors can contribute regularly and allow their investments to grow over time. SWPs are usually started later, when investors want to receive periodic withdrawals from their accumulated corpus. In this way, SIP helps in building the corpus, while SWP provides a mechanism to access it in a systematic manner.

Yes, both SIPs and SWPs offer good flexibility. SIPs can usually be paused, stopped, or modified after completing the minimum required instalments (commonly six). SWP withdrawal amounts, and frequency can also be adjusted, subject to the terms of the scheme, to suit changing financial needs.

SIP and SWP together provide a structured approach. SIP enables disciplined wealth accumulation during earning years, while SWP allows systematic access to that wealth later through periodic withdrawals. This combination helps investors align their investments with both long‑term goals and evolving cashflow needs.

The Plan for Life strategy combines SIP to build wealth and SWP to withdraw it. You invest regularly through SIP, create a corpus over time, and later use SWP to receive fixed, periodic payouts.

Anyone looking to invest systematically and later receive regular cashflow: such as young earners, long-term planners, and retirees, can benefit from the Plan for Life approach.

Equity funds are generally preferred for long-term SIPs, while hybrid or debt funds may be considered before starting SWP to help manage volatility.

Yes. SIPs benefit from rupee-cost averaging, while SWPs may need careful monitoring since withdrawals during downturns can reduce your corpus faster.

Both SIP and SWP are subject to capital gains tax based on fund type and holding period. Each SWP withdrawal triggers taxation on the units redeemed.

Key risks include market fluctuations, potential capital depletion during SWP, and the impact of negative market years early in withdrawal.

Inflation may require increasing your SIP over time and adjusting your SWP amount periodically to maintain purchasing power.

An investor education and awareness initiative by Aditya Birla Sun Life Mutual Fund.

All investors have to go through a one-time KYC (Know Your Customer) process. Investors to invest only with SEBI registered Mutual Funds. For further information on KYC, list of SEBI registered Mutual Funds and redressal of complaints including details about SEBI SCORES portal, visit link : https://mutualfund.adityabirlacapital.com/Investor-Education/education/kyc-and-redressal for further details.

SIP does not assure a profit or guarantee protection against loss in a declining market.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

म्यूचुअल फंड निवेश बाजार जोखिमों के अधीन हैं, योजना से संबंधित सभी दस्तावेजों को ध्यान से पढ़ें

1800-270-7000

1800-270-7000