-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

-

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

Current & Historical NAV / Dividend

Oops! service is unavailable, please try after some time.

Methodology for calculating subscription and redemption price of units.

- Subscription / Switch-in (from other schemes/plans of the Mutual Fund) (This is the price investor need to pay for purchase/switch-in)

If the applicable NAV is Rs. 10/- and since there will be no entry load, then the purchase price will be Rs. 10/- - Redemption / Switch - out (to other schemes/plans of the Mutual Fund)(This is the price investor will receive at the time of redemption/ switch-out)

If the applicable NAV is Rs. 10/- and exit load is 0.5% then sale price will be 10 - (10 * 0.5%) = 10 - 0.05 = Rs. 9.95/-

Declaration

The information and data contained in this Website do not constitute distribution, an offer to buy or sell or solicitation of an offer to buy or sell any Schemes/Units of Aditya Birla Sun Life Mutual Fund (ABSLMF), securities or financial instruments in any jurisdiction in which such distribution, sale or offer is not authorised. In particular, the information herein is not for distribution and does not constitute an offer to buy or sell or the solicitation of any offer to buy or sell any securities or financial instruments in the United States of America ("US") and Canada to or for the benefit of United States persons (being persons resident in the US, corporations, partnerships or other entities created or organised in or under the laws of the US or any person falling within the definition of the term "US Person" under the US Securities Act of 1933, as amended) and persons of Canada.

By entering this Website or accessing any data contained in this Website, I/We hereby confirm that I/We am/are not a U.S. person, within the definition of the term 'US Person' under the US Securities laws/resident of Canada. I/We hereby confirm that I/We are not giving a false confirmation and/or disguising my/our country of residence. I/We confirm that Aditya Birla Sun Life Mutual Fund / Aditya Birla Sun Life AMC Limited (ABSLAMC) is relying upon this confirmation and in no event shall the directors, officers, employees, trustees, agents of ABSLAMC associate/group companies be liable for any direct, indirect, incidental or consequential damages arising out of false confirmation provided.

- ABSLAMC-Knowledge-Centre

- ViewPoint

- Trend Watch Insights on the Indian Economy

Trend Watch: Insights on the Indian Economy

Transcript

Mar 12, 2024

2 Mins Read

Vinod Bhat

Vinod Bhat

Listen to Article

I had the opportunity to participate in a few conferences last month, where I engaged with a diverse array of industry experts and company leaders, gaining valuable insights from their perspectives and experiences.

In Asia, key macro data indicates that India is the only country in a full-blown business cycle upturn which could continue for the next 5 years.

Here are some interesting insights and trends I picked up.

Macro Environment

Jim Walker of Alethia Capital highlighted that based on domestic stress indicators such as Return on Equity (ROE), Real lending rate, Bank credit relative to Gross Domestic Product (GDP), Investment relative to GDP, and Broad money supply, India scores the highest.

In contrast, in China, ROE is on a downtrend and profit data does not support an upturn in credit or investments. With property prices on a downtrend, consumer confidence has also fallen sharply. And in Korea, Hong Kong, and Thailand, key indicators point to another tough year.

Source: Alethia Capital

In India, Credit and Investment cycles have been subdued for some time but that is no longer the case. Profits (signalled by Nifty or Sensex ROE) are providing a springboard for renewed business capital spending. After 8 years in a downturn, the Investment cycle has turned and has a lot further to go. We could see a 5-year upcycle. There is plenty of support from the banking system and non-food credit growth is leading nominal GDP growth for the first time since 2012. (Source: Isec)

Indian Economy – Consumption Trends

Consumption (at 60% of GDP) has been a big driver of India’s growth. And consumption itself has been driven by rising incomes.

Abheek Singhi from BCG highlighted four themes which are emerging:

Services – Services categories, especially health, education, and travel) are displaying faster growth (11-13% value growth) compared to product categories (6-8% value growth).

Premiumization – In various segments such as smartphones, auto, apparel, Fast Moving Consumer Goods (FMCG), Consumer Durables, etc., the premium segment is growing faster than the mass/value segment.

eCommerce – This channel is growing faster than offline. eCommerce has expanded 2x in the past 5 years and has seen a 40% CAGR over the past 10 years. A case in point here is an online marketplace founded in 2015 that facilitates trade between suppliers, resellers and customers which has already reached around 150 million monthly active users.

Small is big – Small towns are seeing much faster growth in consumption as compared to Tier I cities.

There is a prevailing myth that consumption is driven by youth, increasing urbanization, and men driving purchasing decisions. However, actual drivers of consumption are:

Middle and older age groups (35+): They are driving population growth.

Tier II or Bharat: Rate of increase in urbanization is gradual - only 2-3% per decade.

Women influencing purchasing decisions with better education: Women's enrolment in education has overtaken that of men for the first time.

As incomes rise in India, not all consumption segments will benefit equally. The ‘S’ curve, which is typically seen in the technology sector may not hold in Consumption

Source: BCG

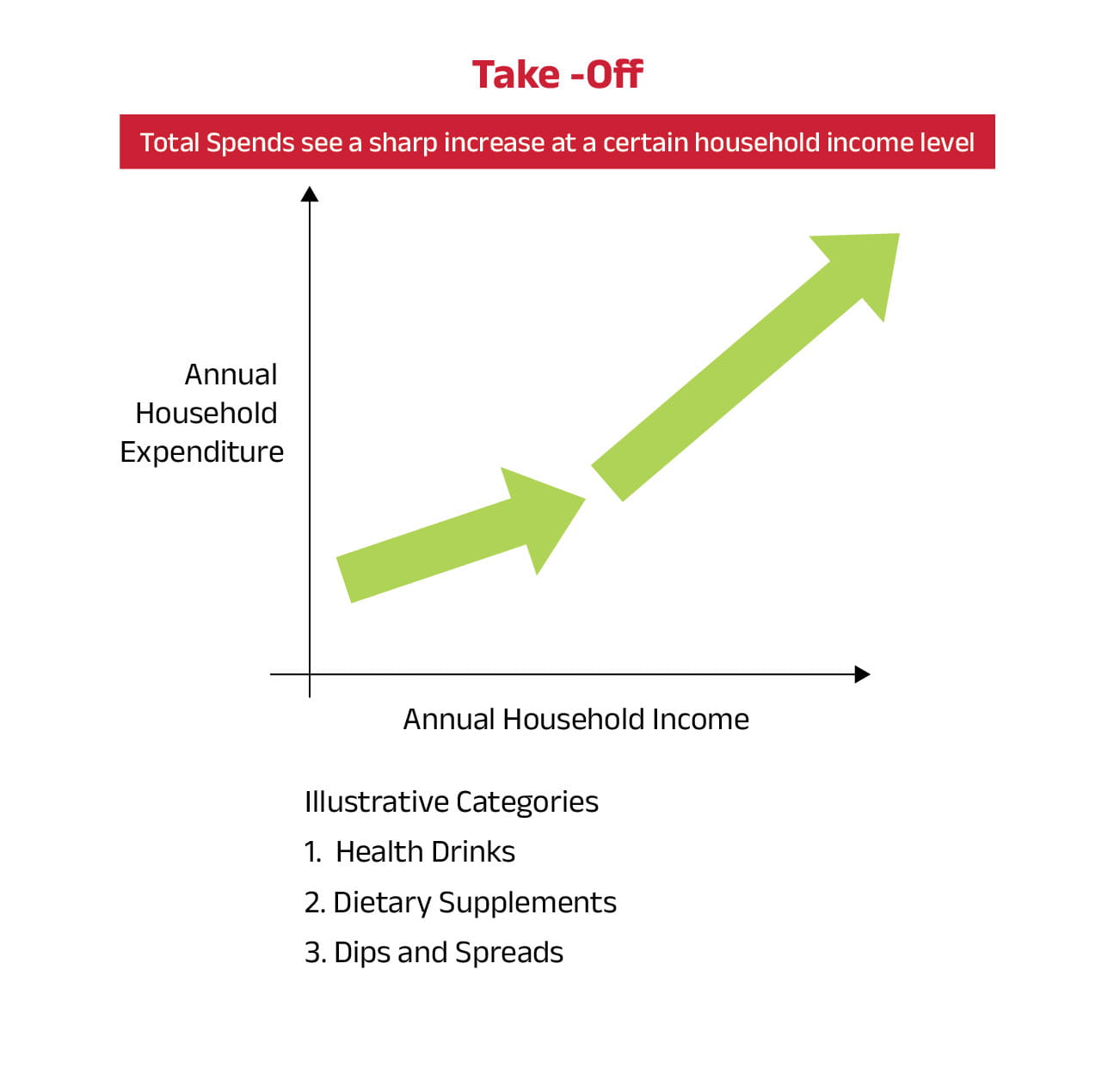

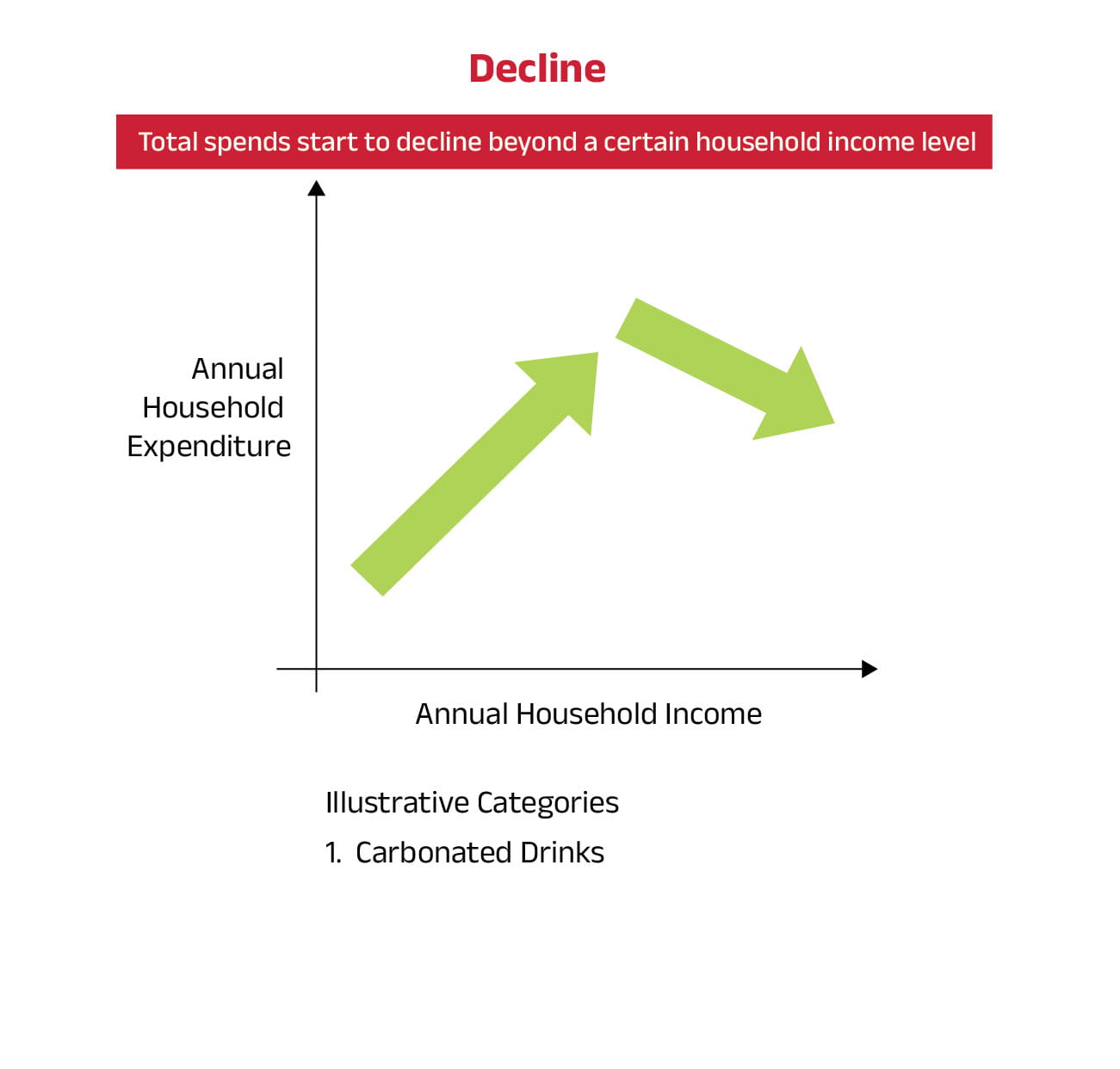

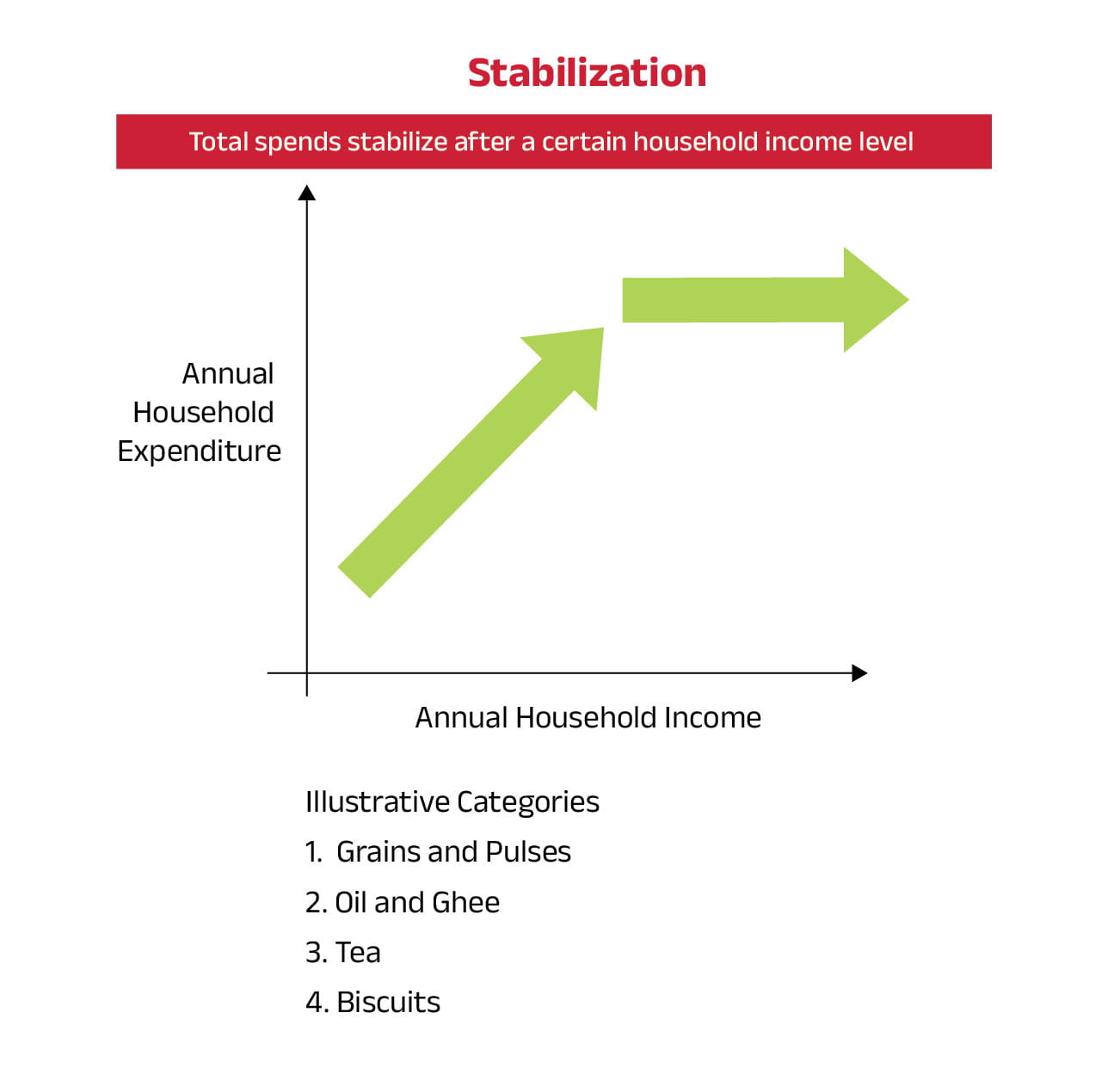

The chart above illustrates four trends in consumer spending on different categories as their income rises.

1. Take-off: Health drinks, dietary supplements, dips and spreads. In addition, travel and tourism is also likely to pick up as people prioritize experiences over goods consumption.

2. Linear: Milk, chocolates, Packaged snacks

3. Stabilization: Grains and pulses, oil and ghee, tea, biscuits

4. Decline: Carbonated drinks

Discretionary Consumption in India is a theme we are positive on as highlighted in our Annual Outlook. The chart above gives a good visualization of which consumption segments and companies may benefit as per capita income in India rises over the next decade.

Finally, an interesting point to note is that there are 10 consumer trends taking shape in India as shown in the chart below. Companies that tick 3 to 4 boxes in these trends have potential to see good tailwinds for growth. Top two trends to note are:

a. Indulgence (Every member of a household may be using different brands, less guilt in terms of spending on self)

b. Pride in Indian (higher than ever)

Source: BCG

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

Vinod Bhat

About Author

Mr. Vinod Bhat is a Portfolio Manager and Equity Strategist at Aditya Birla Sun Life AMC Limited (ABSLAMC). Vinod comes with an overall experience of two decades with close to 15 years in the financial markets and investment banking space. He has been associated with ABSLAMC since July 2018.

Prior to joining ABSLAMC, he was the Vice President - Corporate Strategy and Business Development with Aditya Birla Management Corporation Pvt. Ltd. Previously he was an Investment Banker at Credit Suisse and Ocean Park Advisors in the USA.

Vinod is a CFA (USA) and has done his MBA in Finance from The Wharton School, University of Pennsylvania (USA). He holds an M.S. in Industrial Engineering from Pennsylvania State University (USA) and B.Tech in Mechanical Engineering from IIT Bombay.

You May Also Like

Stay updated with the latest insights from ABSLAMC Knowledge Centre

Are you an existing investor

* Mandatory fields

Please fill all mandatory fields

Subscribe

Hi There!

Thank you for subscribing to our thought leadership platform ABSLAMC Knowledge Centre – as we bring to you viewpoints, insights and special reports, which will be delivered to your inbox.

Regards

Team ABSLAMC Knowledge-Centre

Loading...

1800-270-7000

1800-270-7000