-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

-

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

Everything About Aditya Birla Sun Life Pure Value Fund

May 15, 2024

5 min | Views 0

Smart investors avoid chasing short-term gains in a volatile market. Instead, investing in undervalued stocks can be a beneficial tactic. Aditya Birla Sun Life Pure Value is a good value fund to consider during uncertain times.

What is Aditya Birla Sun Life Pure Value Fund?

As an open-ended equity scheme managed under SEBI Mutual Fund Regulations , Aditya Birla Sun Life Pure Value Fund adopts a concentrated approach with a mandate to largely invest across equities trading at steep discounts relative to intrinsic business worth alongside the exhibition of early turnaround signals. Fund virtues include:

Investment Objective

The Fund aims for long-term capital appreciation by investing in deep-value stocks straddling varied market caps showing potential earnings revival prospects based on proprietary filters assessing historical pricing multiples, capital efficiency metrics, operating leverage prospects, etc., to pinpoint reconstitution iappeal.

Fund Management

The Fund's skilled stock-picking has successfully minimised drawdowns during past crisies, enabling the discovery of hidden potential in leading value-style portfolios.

How Does an Aditya Birla Sun Life Pure Value Fund Work?

The analysts in Aditya Birla Sun Life Pure Value fund management team assess aspects like market position durability, capital allocation track record, financial stability metrics and cash flow quality to ascertain the management's credibility in steering the business towards an earnings recovery. After that, proprietary models evaluating historical trading multiples, asset yields, operating leverage kickers, etc., gauge the extent of lucrative upside once temporary challenges abate.

By committing investor capital into such screened value ideas undergoing temporary business climate stress but stacked with healthy turnaround triggers, the Fund aims to generate high risk-adjusted returns over the long run as the market course corrects valuation anomalies once growth normalisation returns. The wide basket construct insulates against isolated stock risks.

Hence, Aditya Birla Sun Life Pure Value Fund strives to harness the virtues of discipline, patience, and selection rigour inherent to the time-tested value investing philosophy propagated globally.

Factors to Consider Before Investing in Aditya Birla Sun Life Pure Value Fund

Evaluating mutual fund suitability constitutes pivotal due diligence for investors seeking portfolio enhancement rather than chasing ephemeral hype cycles. Some vital aspects to examine with Aditya Birla Sun Life Pure Value Fund comprise:

Analyse historical NAV patterns to determine the ability to contain declines during past turbulence while capturing the upside. Assess periodic style drift vulnerability, given that value algorithms carry market cap flexibility. Confirm consistency in portfolio manager oversight to ensure continuity of diligence, rigour, and execution discipline.

After that, scrutinise portfolio concentration spans to balance adequate diversification against potential return dilution from excessive coverage universe. Check average market capitalisation to verify liquidity risk minimisation for redemption exits alongside confirming adequate small/micro-cap representation harnessing a wider opportunity funnel.

Lastly and most critically, benchmark your risk appetite and return expectations against long-term value-style investing virtues to ensure appropriate alignment exists. Those lacking patience for prolonged underperformance spells before turnarounds emerge must temper expectations when embracing value funds like Aditya Birla Sun Life Pure Value Fund offering despite virtues during uncertainty periods. Hence, setting realistic return objectives allows for efficiently harnessing portfolio enhancement potential over full cycles.

How to Invest in Aditya Birla Sun Life Pure Value Fund?

Investing in Aditya Birla Sun Life Pure Value Fund follows protocols similar to those of subscribing to any open-ended equity scheme. First-time investors must furnish KYC by providing identity and address proof either online or at the branch office along with bank details.

After that, register on the https://mutualfund.adityabirlacapital.com/website with your chosen user ID and password for login access. Using the intuitive site navigation, select Aditya Birla Sun Life Pure Value Fund Growth under the' Equity Value Fund' classification and Carefully specify one-time or systematic SIP investment amount and fund debit bank details.

Upon submitting a request after preview, investors receive real-time confirmation of a time-stamped investment application with the allotment of fund units at prevailing NAV on a T+3 basis. Post unit credit, investors can track live portfolio valuation and manage add-on investments in Aditya Birla Sun Life Pure Value Fund using their account dashboard to harness intermittent market volatility episodes through a tactical value-style exposure blend.

Thus, efficient access pathways promote hassle-free investing across promising mutual fund offerings like Aditya Birla Sun Life Pure Value Fund aligned with investor objectives.

Conclusion

Investors who want to build an all-weather portfolio that can balance risk-adjusted returns across cycles can consider the Aditya Birla Sun Life Pure Value Fund. By investing in Value-style biased companies and identifying attractive investment opportunities during market downturns, you can balance your portfolio during times of volatility.

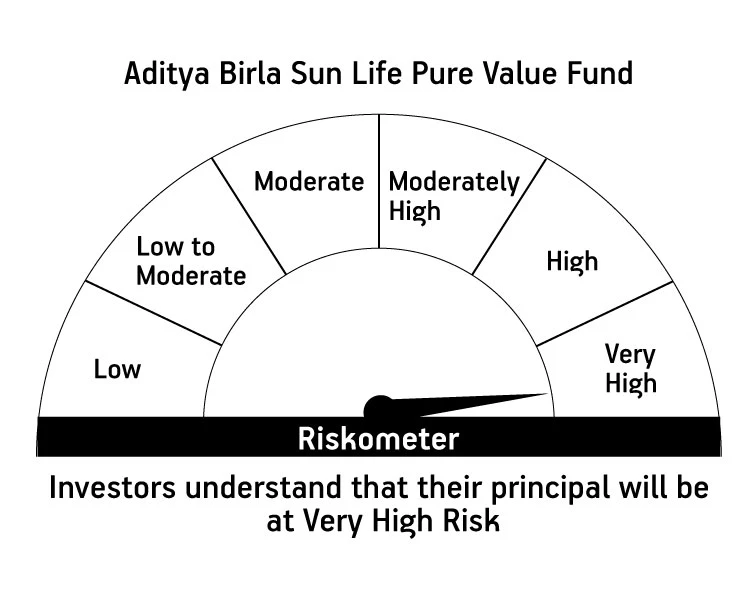

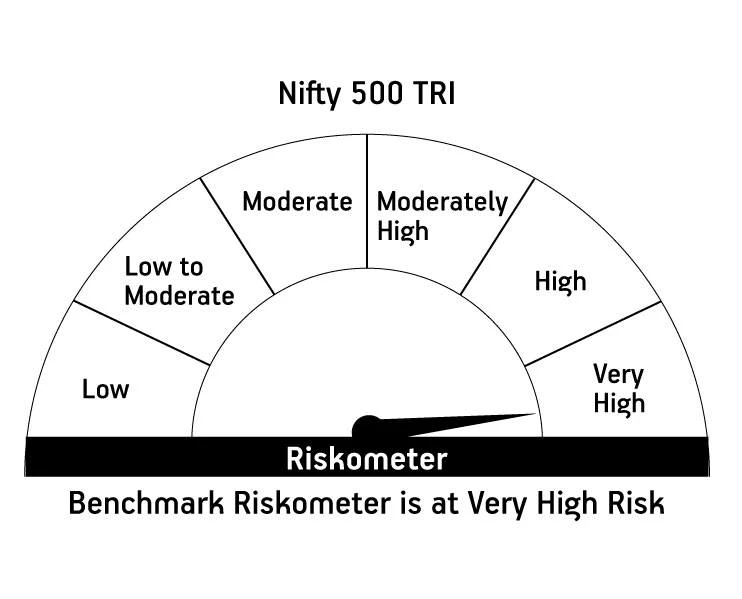

| Aditya Birla Sun Life Pure Value Fund | ||

| (An open ended equity scheme following a value investment strategy) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Rate this

Rate this Article

Our Experts

Our Experts

Tools and Calculator

Tools and Calculator

RSS News Feed

RSS News Feed

Archives

Archives

Close

Hover to Zoom

1800-270-7000

1800-270-7000

Thank You

Message will change according to your requirement.