-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Nifty 50 Index Funds vs Nifty Next 50 Index Funds: What is the Difference?

Sep 16, 2025

10 min

0 Rating

What are the first few words that come to mind when you hear investing? Maybe complications, profits, and losses! Well, investing shouldn’t be about the first one. There are funds that make investing simple in different companies all at once. Yes, we are talking about index funds! These funds allow you to invest in many companies simultaneously, which is why they are gaining so much popularity in India.

Among them are two main types: the Nifty 50 index fund that tracks the largest 50 companies. And the nifty next 50 index fund, which invests in the next big 50 players on the rise.

So, what really sets these two funds apart? In this blog, we will be talking about that difference. By the end, you’ll know which one fits your financial goals.

What is the Nifty 50 Index Fund?

A Nifty 50 Index Fund is a mutual fund that copies the Nifty 50 Index. The index tracks 50 of the largest companies in India’s stock market. The fund automatically invests in these companies in the same proportion as the index. You do not need to pick individual stocks.

Key Features:

Tracks the Nifty 50 Index

Passive investment strategy

Low management fees

Diversified across sectors

These funds are ideal for beginners and busy investors. They grow wealth gradually without the stress of choosing stocks. You can invest small amounts regularly using SIPs.

What is the Nifty Next 50 Index Fund?

The Nifty Next 50 Index Fund lets you invest in 50 companies just below the top 50 in India’s stock market. It tracks the Nifty Next 50 Index, which includes companies expected to grow into the market leaders of tomorrow. You don’t need to pick stocks individually.

Key Features:

Tracks Nifty Next 50 Index

Includes mid-to-large companies

Low-cost and passive fund

Suitable for long-term investors

Investing in this fund provides a mix of growth and stability. SIPs allow you to invest regularly in small amounts.

Difference Between Nifty 50 and Nifty Next 50 Index Funds

Nifty 50 vs Nifty Next 50 Index Funds: What is the actual difference between these two? Let us find out:

Feature |

Nifty 50 Index Fund |

Nifty Next 50 Index Fund |

Companies Tracked |

Top 50 companies in India |

Next 50 large companies after Nifty 50 |

Market Position |

Established market leaders |

Emerging large-cap companies |

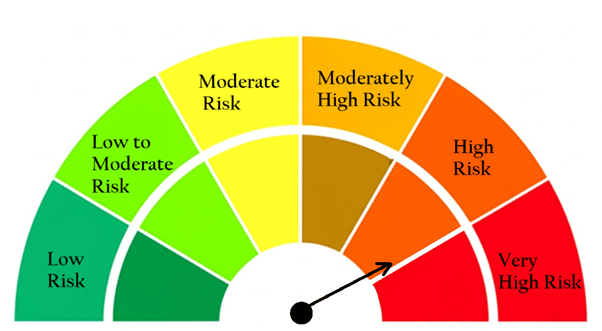

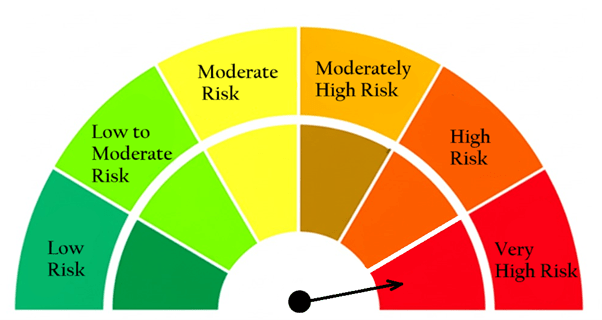

Risk Level |

Lower risk |

Slightly higher risk |

Potential Returns |

Steady, consistent |

Higher growth potential |

Volatility |

Less volatile |

More volatile |

Investment Goal |

Stable, long-term growth |

Growth-focused, long-term |

Dividend |

Often regular |

Less frequent, depends on the company |

Diversification |

Covers major sectors |

Covers upcoming sectors |

Ideal For |

Conservative investors |

Growth-oriented investors |

Expense Ratio |

Generally low |

Generally low but may vary |

SIP Friendly |

Yes |

Yes |

Popularity |

More widely held |

Popularity has been growing recently |

Constituents & Sector Exposure

The Next 50 index funds are renowned among investors, but they function for different purposes. It is essential to know how their constituents and sectors vary from each other, so that you can make wise investment decisions.

Nifty 50 Index Fund:

Dominated by finance, IT, and energy

Blue-chip companies with mature businesses

Lower risk and predictable performance

Suitable for conservative investors

Focuses on consistent returns

Nifty Next 50 Index Fund:

Sectors include pharma, consumer goods, and industrials

Emerging companies with potential to become market leaders

Slightly higher risk with growth potential

Suitable for investors seeking capital appreciation

Offers broader sector diversification

Both funds provide a way to invest in multiple companies at once. Nifty 50 focuses on stability, and Nifty Next 50 emphasises growth.

Risk & Volatility

Every investment comes with some level of risk, and index funds are no exception. They have different risk and volatility profiles because of the companies they include.

Nifty 50 Index Fund:

Lower risk, less volatile

Stable performance even during market fluctuations

Suitable for cautious investors

Long-term steady returns

Nifty Next 50 Index Fund:

Slightly higher risk and moderate volatility

Potential for faster growth over time

Includes emerging market leaders

Ideal for investors with a higher risk appetite

Higher reward potential

Performance Trends

They provide insight into how different index funds react to market conditions. Both funds in discussion have shown distinct patterns due to the types of companies they track.

Nifty 50 Index Fund:

Shows steady growth with less dramatic swings

Performs consistently in both bullish and bearish markets

Lower volatility, safer returns for conservative investors

Suitable for those seeking stable long-term gains

Blue-chip dominated for predictability

Nifty Next 50 Index Fund:

Can deliver higher growth over the long term

More sensitive to market cycles and trends

Higher potential returns during strong market phases

Slightly higher short-term volatility

Ideal for investors with a moderate risk appetite

Understanding these trends helps investors balance stability and growth according to their personal investment strategy.

Market Cap Orientation

Market cap orientation is a key factor that differentiates the Nifty 50 from the Nifty Next 50 index funds. It reflects the size and maturity of the companies included and influences risk and returns.

Nifty 50 Index Fund:

Includes heavyweight, mature, and stable firms

Lower volatility and predictable returns

Focused on safety and consistency

Suitable for cautious investors

Nifty Next 50 Index Fund:

Emerging large-cap companies with growth potential

Broader sector diversification

Moderate volatility with higher long-term returns

Potential future market leaders

Ideal for growth-oriented investors

By looking at market cap orientation, investors can decide whether they prefer stability and safety or moderate risk with higher growth potential.

Which is better for investors?

You must be thinking about the above question, so let us make it easier for you to decide:

Nifty 50:

Offers predictable performance during market downturns

Suitable for building a stable core portfolio

Lower exposure to volatile sectors

Long-term wealth accumulation with minimal shocks

Nifty Next 50:

Captures potential future leaders of the market

Provides exposure to high-growth opportunities

Adds variety to a portfolio already invested in top companies

Can amplify gains during bullish phases

Decision Factors:

Nifty 50 for conservative, steady investment strategies

Nifty Next 50 for growth-oriented, moderate-risk strategies

Consider investment horizon, financial goals, and personal comfort with short-term fluctuations

Conclusion

So now you know the major differences between the two Index funds. At the end of the day, the best fund is the one that fits your needs. Match your choice with your goals, invest consistently, and enjoy the journey.

Disclaimers:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Nifty Next 50 often gives more, but it goes up and down more, too.

Yes, they are riskier because their prices can rise and fall faster than Nifty 50 funds.

Yes, you can invest in both at the same time to get a mix of safety and growth.

Both can work for the long term; Nifty 50 is safer, while Nifty Next 50 may grow more over time.

A common mix is 70% in Nifty 50 for stability and 30% in Nifty Next 50 for faster growth, based on your comfort.

1800-270-7000

1800-270-7000