-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

×

Fund Of Funds

Fund of Funds: Explore Fund of Funds from ABSLMF. Fund of Funds is a type of mutual fund whose portfolio is constituted with investments in other mutual funds.

A Fund of Fund (FoF) is an investment strategy that focuses on building a diversified portfolio by holding multiple mutual funds, rather than investing directly in individual stocks, bonds, or securities. In a fund of funds scheme, the primary emphasis is on investing in units of other mutual fund schemes.

A little key can open big doors’ – and a Fund of Fund does just this! It is a single investment gateway to access multiple mutual funds often across economies, multiple asset classes and multiple fund managers, in a simple hassle-free manner. This approach, often referred to as multi-manager investment, allows investors to spread their investments across multiple funds, offering them the opportunity to diversify risk. The underlying investments of a FOF consist of units from either the same mutual fund or other mutual fund houses.

FOFs can be particularly beneficial for smaller investors seeking access to a wide range of asset classes.

What is a Fund of fund (FoF)?

A Fund of Funds is a type of mutual fund that utilizes its pool of resources to invest in various other mutual funds available in the market. It also invests in other hedge funds. A key characteristic of such mutual funds is that they are managed by highly skilled and trained professionals who are called fund managers. This expertise helps in making informed market predictions and reducing the potential for losses.

The risk levels in the portfolios of Fund of Funds mutual funds are customised to match the specific goals of the fund manager. When looking for higher yields, the fund manager may be willing to take on increased risk by investing in mutual funds with higher Net Asset Values (NAV). Alternatively, when looking for stability and capital preservation, the fund may allocate its resources towards low-risk instruments, aiming to minimize potential fluctuations in value. This strategic approach of investing allows the fund manager to optimize the Fund of Funds risk-return profile and cater to the specific preferences and goals of the investors.

Fund of Funds mutual funds offer the flexibility to invest in both domestic and international funds, depending on the decision-making authority of the fund manager or the investment strategy of the scheme. This flexibility of investment increases FOF fund’s portfolio diversification.

Types of Fund of Funds (FOF)

Fund of Funds come in various types, with each type determined by the specific investment objective of the fund. Here are different types of FoF funds that provide investors with diverse investment options:

-

International Fund of Funds

These FOFs target mutual funds operating in foreign countries. By investing in international markets, investors have the potential to benefit from the best-performing stocks and bonds in specific countries.

-

Asset Allocation Funds

FOFs of this type consist of a diverse asset pool, including equity, debt instruments, precious metals, and more. This allows for a balanced allocation of investments across various securities, aiming to generate higher returns while managing risk effectively.

-

Multi-Manager Fund of Funds

One of the most common types, these FOFs have an asset base comprising multiple professionally managed mutual funds. Each mutual fund within the portfolio is handled by a different portfolio manager, offering investors exposure to a range of asset classes and investment strategies.

-

ETF Fund of Funds

These FOFs include exchange-traded funds (ETFs) in their portfolio. By investing in an ETF through a FOF, investors can access a diversified basket of securities without the need for a separate Demat trading account. However, it is important to note that ETFs carry a slightly higher risk as they are traded like shares in the stock market, making FOFs with ETFs more susceptible to market volatility.

-

Gold Funds

FOFs in this category primarily invest in mutual funds that trade in gold securities. The portfolio can consist of either mutual funds or gold trading companies, depending on the investment strategy of the scheme. Gold funds provide exposure to the performance of the gold market.

Each type of FOF offers distinct benefits and investment opportunities, catering to different risk preferences and investment goals of investors.

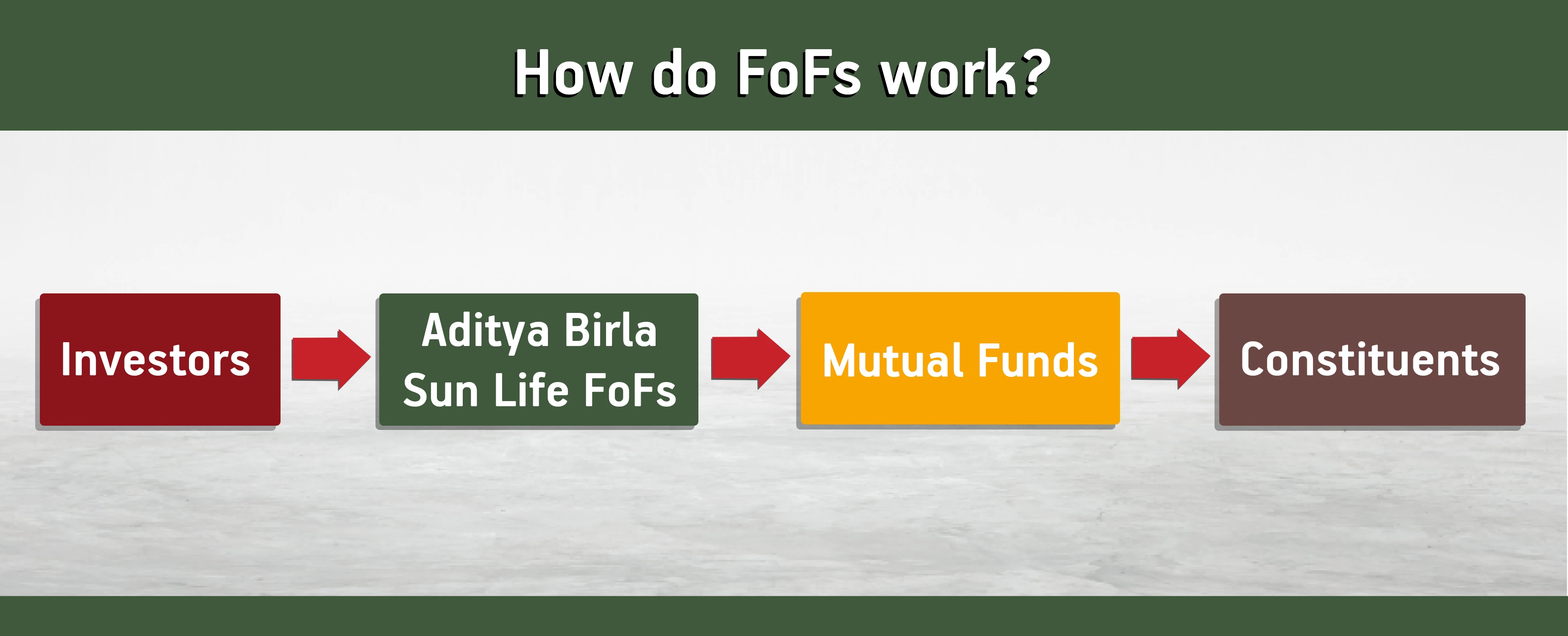

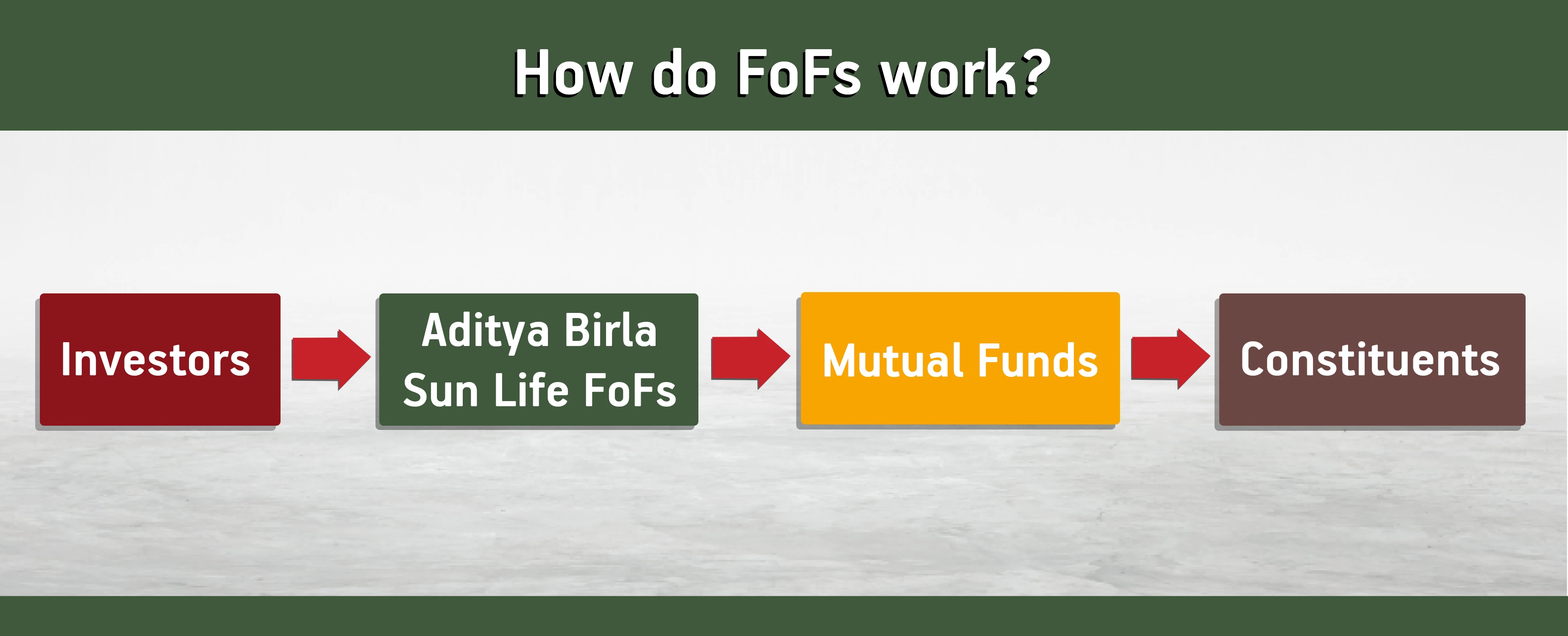

How do Aditya Birla Sun Life Fund of Funds work?

Fund of Funds follow a unique approach by investing in other mutual funds. The fund manager has the flexibility to invest in a single fund or a combination of funds from different fund houses. The fund manager of a FoF seeks out mutual funds whose investment objective and strategy align with that of the Fund of Funds. By investing in units of the selected mutual funds, the fund gets access to the returns of their underlying securities, without investing in the securities directly.

For example – an international Fund of Funds seeks out international mutual funds that invest in global markets. In this way, the international Fund of Funds gets access to the growth in global markets through diversified mutual fund investments rather than by directly investing in the global stocks.

Factors to Consider Before Investing in Fund of Funds (FOF)

Before making investment decisions in the best fund of funds, it is crucial for investors to consider several key factors. These factors include:

-

Long-Term Commitment

Often fund of funds operate with a long-term perspective, which means that investors should be prepared to lock in their investments for a significant period.

-

Volatility and Market Fluctuations

While fund managers strive to minimize risk through effective management and diversified investments, fund of funds are still subject to market volatility. It is important for investors to be aware that their investments may be influenced by market fluctuations.

-

Expenses and Tax Implications

Fund of funds schemes often have higher expenses and potential tax implications. These factors can impact the returns on investment and may result in lower-than-expected outcomes for investors.

It is crucial for investors to understand these factors and conduct thorough research before committing their resources to fund of funds list of mutual funds. By doing so, investors can make informed decisions that align with their investment goals and risk tolerance.

Factors to Consider Before Investing in Fund of Funds (FOF)

Before making investment decisions in the best fund of funds, it is crucial for investors to consider several key factors. These factors include:

-

Long-Term Commitment

Often fund of funds operate with a long-term perspective, which means that investors should be prepared to lock in their investments for a significant period.

-

Volatility and Market Fluctuations

While fund managers strive to minimize risk through effective management and diversified investments, fund of funds are still subject to market volatility. It is important for investors to be aware that their investments may be influenced by market fluctuations.

-

Expenses and Tax Implications

Fund of funds schemes often have higher expenses and potential tax implications. These factors can impact the returns on investment and may result in lower-than-expected outcomes for investors.

It is crucial for investors to understand these factors and conduct thorough research before committing their resources to fund of funds list of mutual funds. By doing so, investors can make informed decisions that align with their investment goals and risk tolerance.

Advantages of Investing in Fund of Funds (FOF)

FOF funds offer numerous advantages to investors. These include:

-

Diversification

One of the biggest advantages of FOFs is access to a diversified portfolio of mutual funds through a single investment. Instead of investing in multiple funds individually, FOFs provide the convenience of gaining exposure to various funds with different investment objectives.

-

Ease of Investing in International Markets and Gold

FOFs offer convenience when investing in international markets or specific asset classes like gold. Investors can easily access global companies or invest in gold without the need for separate accounts or intermediaries.

-

Expertise of Multiple Fund Managers

FOFs benefit from the expertise of multiple fund managers and their research teams. By investing in a portfolio managed by different fund managers, investors can potentially benefit from different investment styles and strategies.

-

Simplified Portfolio Rebalancing

Portfolio rebalancing is crucial for maintaining the desired asset allocation. FOFs facilitate easy rebalancing without incurring capital gains tax. Investors can benefit from portfolio adjustments while avoiding the tax implications associated with individual selling and buying transactions.

-

Risk Mitigation

Through the diversified nature of FOFs, investors can mitigate risk. By spreading investments across multiple funds, the impact of poor performance in one fund may be offset by the positive performance of others, reducing overall risk.

-

Access to Specialized Funds

FOFs provide access to specialized funds that focus on specific sectors or markets. This allows investors to take advantage of expert management and targeted exposure to specific investment themes.

By considering the above advantages, investors can make informed decisions and potentially enhance their investment portfolios.

Should You Invest in Fund of Funds?

Fund of funds are ideal for novice investors as well as experienced investors.

For novice investors, they serve as a great entry point. FoFs provide a diverse selection of mutual funds that invest in a range of assets and securities. This can assist new investors in gaining exposure to various asset classes and creating a well-rounded investment portfolio.

For experienced investors, they offer access to certain asset classes that might otherwise be difficult to invest in through conventional mutual fund schemes. Experienced investors can leverage this advantage to diversify their portfolios by investing in international funds or other specialized sectors.

Before investing in a FoF, it is important to ensure that there is no portfolio overlapping with your existing investments and that the FoF scheme aligns with your risk profile and overall asset allocation strategy.

Note: The investors will bear the recurring expenses of the Fund of Fund (‘FoF’) scheme in addition to the expenses of the Underlying Schemes in which Investments are made by the FoF scheme.

Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments. The document is solely for the information and understanding of intended recipients only.

Frequently Asked Questions

Fund of Funds (FOF) is a type of mutual fund scheme that pools investor resources and invests them in a portfolio that comprises of other mutual funds. A FoF thus seeks out broad diversification through investment in diversified mutual funds rather than directly investing in stocks and other securities.

In Aditya Birla Sun Life (ABSL) Fund of Funds, the fund manager tracks suitable mutual funds that are aligned with the objectives of the Fund of Funds. Accordingly, investment is made in the selected mutual fund/s through which the FoF gets exposure to the underlying securities of the selected funds without directly investing in them.

Also read about : Types of Mutual Funds

For example – the objective of the ABSL Asset Allocator FoF is to achieve capital appreciation by taking advantage of cyclical movement of different asset classes. It tracks cyclical movement in the markets and chooses a suitable mix of equity and debt schemes to maximise returns while managing overall portfolio risk.

Also read about : Types of Mutual Funds

For example – the objective of the ABSL Asset Allocator FoF is to achieve capital appreciation by taking advantage of cyclical movement of different asset classes. It tracks cyclical movement in the markets and chooses a suitable mix of equity and debt schemes to maximise returns while managing overall portfolio risk.

- Broader diversification

By investing across various mutual fund schemes – often across various asset classes, ABSL FoFs give investors higher diversification for their portfolio.

- Low minimum investment requirement

ABSL FoFs have low minimum investment amounts (as low as Rs.500/-). Thus, high diversification can be achieved even at low investment levels.

,br> - Managed volatility

Negative correlation between various asset classes and high degree of diversification even within each asset class, means FoFs have the potential for lower volatility.

- Global access

Certain ABSL FoFs invest in global schemes giving investors portfolio exposure to global securities, which they may otherwise not be able to access.

- Access to expertise of multiple fund managers

ABSL FoFs gives you access to the thorough research and continuous portfolio monitoring through fund management expertise of several mutual funds. This gives your portfolio an expert edge.

By investing across various mutual fund schemes – often across various asset classes, ABSL FoFs give investors higher diversification for their portfolio.

- Low minimum investment requirement

ABSL FoFs have low minimum investment amounts (as low as Rs.500/-). Thus, high diversification can be achieved even at low investment levels.

,br> - Managed volatility

Negative correlation between various asset classes and high degree of diversification even within each asset class, means FoFs have the potential for lower volatility.

- Global access

Certain ABSL FoFs invest in global schemes giving investors portfolio exposure to global securities, which they may otherwise not be able to access.

- Access to expertise of multiple fund managers

ABSL FoFs gives you access to the thorough research and continuous portfolio monitoring through fund management expertise of several mutual funds. This gives your portfolio an expert edge.

Investors can invest in ABSL FoFs directly through the portal of Aditya Birla Sun Life without the need to open a demat account. The minimum investment requirements vary across different Fund of Funds and can be as low as Rs.500/-.

Alternatively, investors can invest in ABSL FoFs investing through a distributor of their choice.

Alternatively, investors can invest in ABSL FoFs investing through a distributor of their choice.

The key points of difference between FoFs and mutual funds and ETFs are:

| Fund of funds | Mutual funds | ETF | |

|---|---|---|---|

| What do they invest in? | One or more mutual fund schemes that in turn invest in securities; whose objective aligns with the objective of the FoF | In equity, debt or other securities, as per the objective and investing strategy of the fund. | Securities that are comprised in the underlying index |

| Return objective | To earn returns commensurate with the returns of the selected funds that it invests in | Objectives differs from fund to fund – such as to earn long term capital appreciation, regular income for its investors etc | To mimic returns of the benchmark index |

| Mode of investment | Invested at NAV – either through AMC or through demat | Invested at NAV – either through AMC or through demat | Trade like shares – can be bought and sold at ‘real-time’ prices on the stock exchange |

| Need for demat | Demat account is not mandatory to invest | Demat account is not mandatory to invest | Demat and trading account is a necessity |

Yes, ABSL FoFs provide facilities of SIP, STP and SWP to its investors.

ABSL FoFs typically have low minimum investments, can be as low as Rs.500/- through lumpsum option. Multiples of Re.1/- thereafter are permitted.

For SIP plans – the minimum investment is Rs.1000/- for a monthly SIP, with a minimum of 6 instalments; and Rs.100/- per week for a weekly SIP, also with a minimum of 6 instalments.

For more details, please refer to SID of respective FoFs.

The primary cost of investing in ABSL FoFs is the Total Expense Ratio (TER) of the fund. As per SEBI regulations, the maximum permissible TER for FoFs is 2.25% of its NAV.

The TER of the direct plan and regular plan will differ to the extent of distribution charges/commission; the TER of regular plan being higher.

Rephrase: the TER for FOFs is reasonably low because they invest into direct plans of MFs For more information on TER refer click here

The TER of the direct plan and regular plan will differ to the extent of distribution charges/commission; the TER of regular plan being higher.

Rephrase: the TER for FOFs is reasonably low because they invest into direct plans of MFs For more information on TER refer click here

An exit load is a % of the NAV of a fund which is charged by the issuing AMC to investors to redeem units from the mutual fund scheme. The exit load varies from scheme to scheme, for more information on scheme specific exit loads refer SID & KIM of the scheme

Subject to availability of distributable surplus, the Schemes having IDCW option may declare IDCW under the Income Distribution cum Capital Withdrawal (IDCW) option.

IDCW can be opted for by investors through two modes

For more information on various plans and options offered by the Scheme, please refer SID & KIM of the applicable schemes.

For any investments/units purchased after March 31, 2025 (or prior to April 1, 2023) and redeemed after April 1, 2025:

Short Term Capital Gains will be taxed for investments held within 24 months at income slab rate).

Long-term capital Gains will be applicable in respect of units held for a period of more than 24 months (in case of listed units a period of more than 12 months will be applicable for LTCG) and will be chargeable u/s.112 of the Act at the rate of 12.50% (plus applicable surcharge and cess).

Popular Search

Mutual Funds Investment

Equity Mutual Funds

Debt Mutual Funds

Hybrid Funds

Index Funds

ETF

FoF

Target Maturity Funds

Tax Saving Mutual Funds

PSU Equity Fund

Small Cap 50 Index Fund

Structure of Mutual Fund

What is Mutual Fund

How to Invest in Mutual Funds

SIP Full Form

What is Equity Fund

What is Debt Fund

What is Hybrid Fund

What is Index Fund?

ETF Full Form

Types of Mutual Funds

Systematic Transfer Plan

Systematic Withdrawal Plan

Mutual Fund Tax Benefits

Expense Ratio

Exit Load

IDCW

AUM

AMC

Bank Nifty

FinNifty

Nifty

XIRR

Market Mood Index

NFO

Folio Number

What is Investment?

What is Tax?

CAGR

1800-270-7000

1800-270-7000