-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Business cycle investing – It’s all about being prepared!

Preparation is the key to success! Life is uncertain and while we can't predict this uncertainty, we can certainly prepare for it. Be it by taking an insurance policy or being ready with an emergency fund. “To be prepared”, they say is winning half the battle!

Money – earnings, savings and investments; is a big part of each one of our lives. So, how can we prepare our investments for market/economic uncertainty?

One effective way could be ‘business cycle investing’.

But what is this economic uncertainty we must prepare for?

Economic uncertainty presents itself in the inevitable ups and downs in activity that every economy faces - what is commonly collectively referred to as "business cycle". There are broadly 4 phases that each economy's business cycle goes through:

1. Expansion – economic growth is on the rise

2. Peak – high growth plateaus at this point

3. Contraction – economic growth begins to decline

4. Trough – low growth stabilises

Typically, one phase leads to another which in turn leads to the next – making these phases ‘cyclical’

Why must we be prepared to face these business cycles?

Stock market-based investments are deeply impacted by each business cycle. Market price movements are driven just as much by financial performance of companies as by investor sentiment - and business cycle effects both these aspects.

In a phase of expansion for example, discretionary sectors can witness high growth owing to euphoric consumer and investor sentiment. In a contraction phase on the other hand, outlook becomes cautious - discretionary sectors may see a decline with non-discretionary, more essential sectors stabilising.

Being prepared for business cycles means being prepared to capitalise on changing market opportunities with changing economic circumstances.

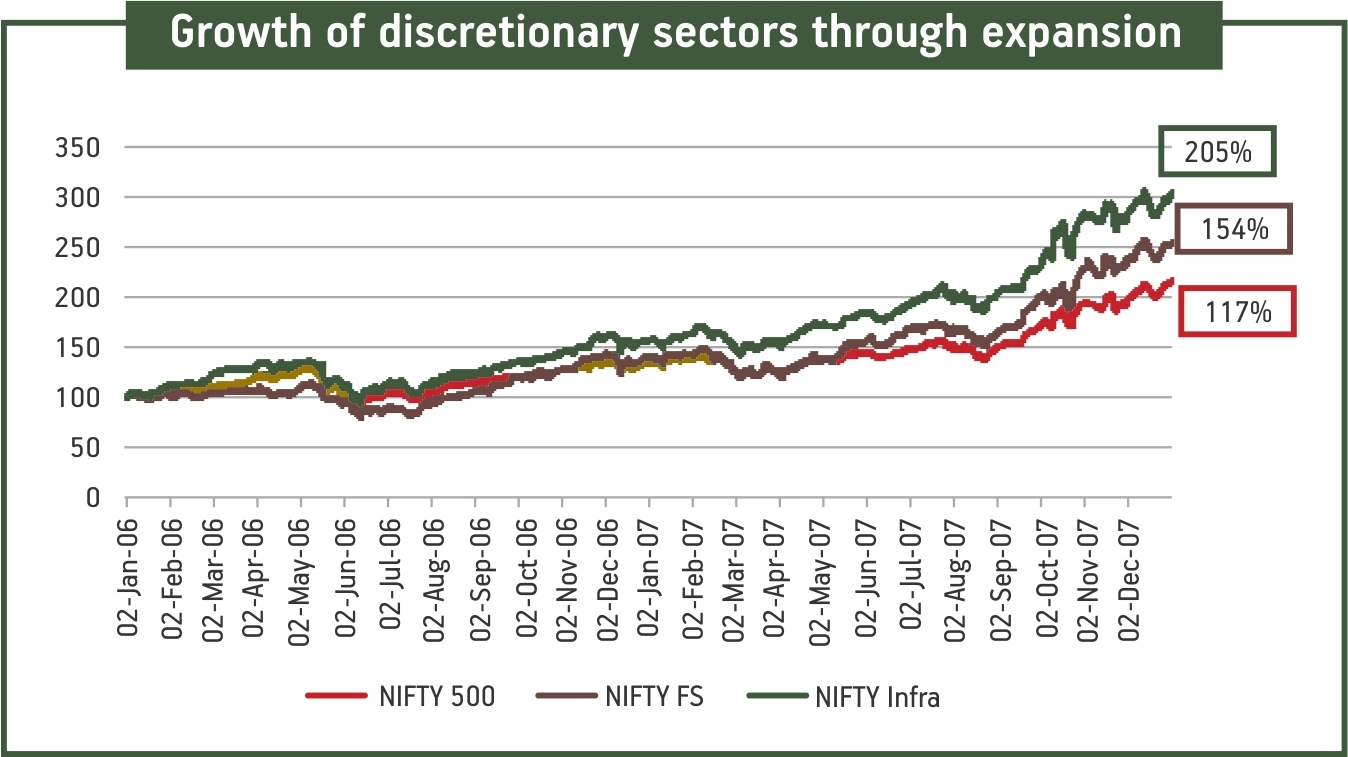

Let’s take and example from history. India witnessed an expansionary phase prior to the 2008 financial crisis. Discretionary sectors significantly outperformed the general market here.

Graph plotted from data derived for the period January 2006 to December 2007 from https://www1.nseindia.com/products/content/equities/indices/historical_index_data.htm

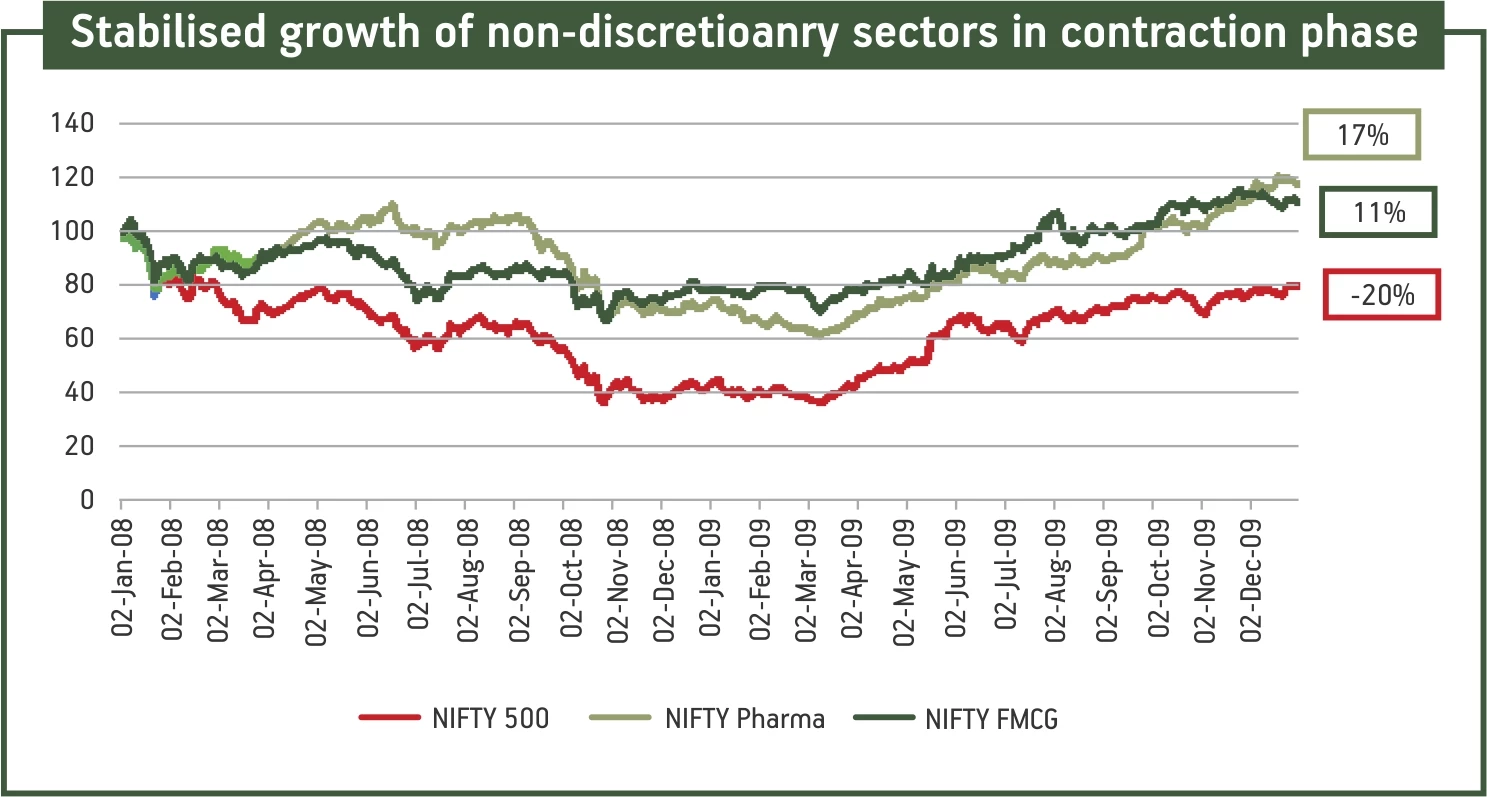

Cut to the sharp contraction in 2008-2009: while the broader market contracted, non-discretionary sectors yet achieved stable growth levels

Graph plotted from data derived for the period January 2008 to December 2009 from https://www1.nseindia.com/products/content/equities/indices/historical_index_data.htm

An investment model conscious of these cyclical changes and that switched between these sectoral opportunities in a timely manner could have achieved reasonable growth through all phases of the business cycle.

How can we do it?

Business cycle investing, as the name suggests is all about modifying investment strategy to suit each phase of a business cycle.

Business cycle investing has two aspects as its key focal points:

- Identifying winds of change - Catch them young

Being abreast with what’s happening in the economy helps identify cyclical opportunities. Each phase of business cycle generally has some tell-tale signs – business cycle investing seeks to be on a constant lookout for these.

Identifying these opportunities at their early stage and taking timely investment decisions is the core premise of business cycle investing

Business cycle investing is synonymous with ‘being prepared.’ Armed with a business cycle investing strategy you can be prepared with a plan to face whichever leg of the business cycle that presents itself.

Being visionary about cyclical changes and taking investment decisions accordingly can be an arduous task for an individual, inexperienced investor. Seeking professional fund manager help through specialised ‘business cycle fund’ can be your go-to strategy.

Presenting Aditya Birla Sun Life Business Cycle Fund – an open ended fund equity scheme following a business cycle based investing theme. Click here to know more about this fund.

For more information on the scheme, please refer to the SID/KIM of the scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000