-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

2018 - Financial Market Review of the Year

Dec 31, 2018

7 mins

4 Rating

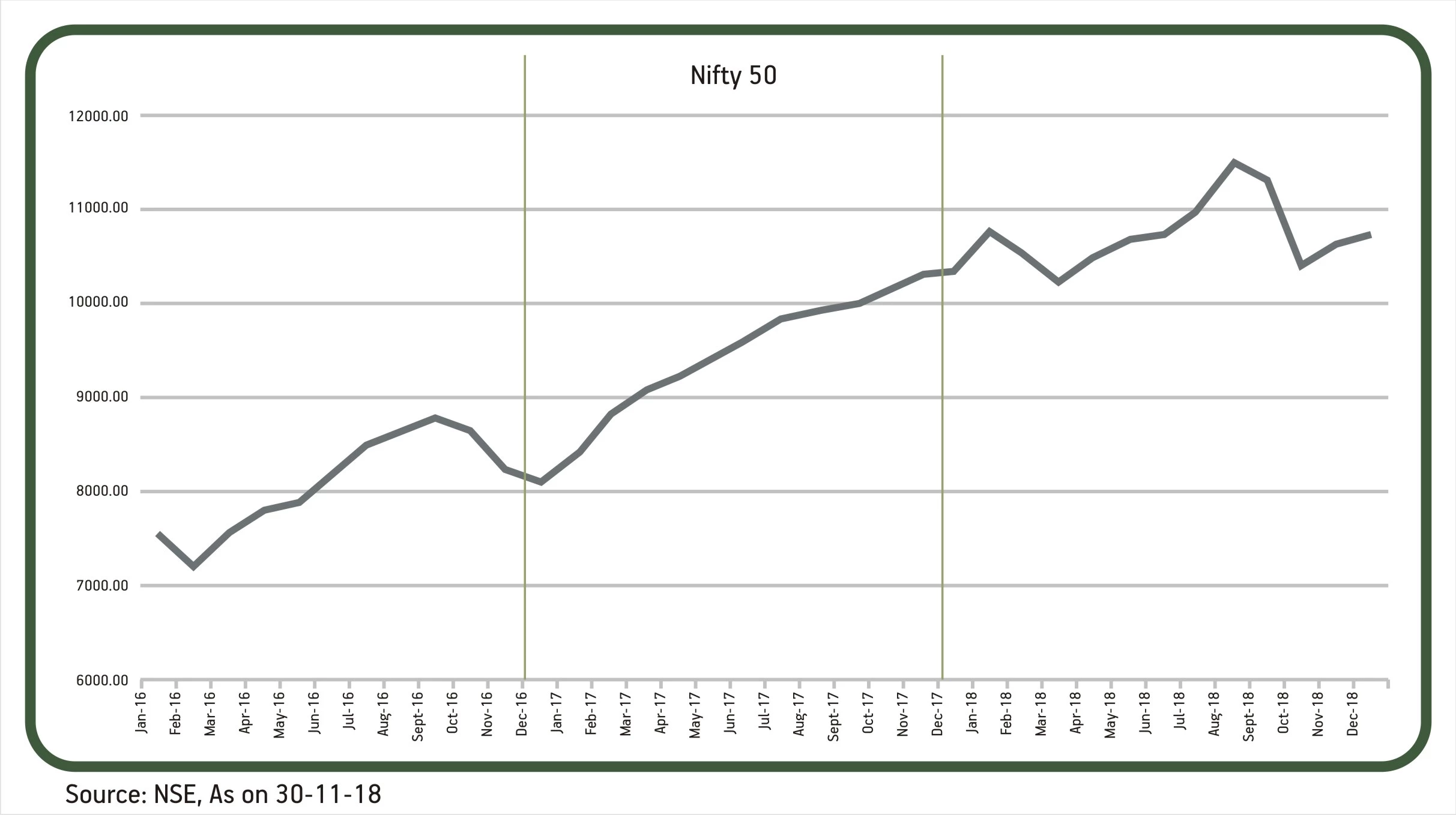

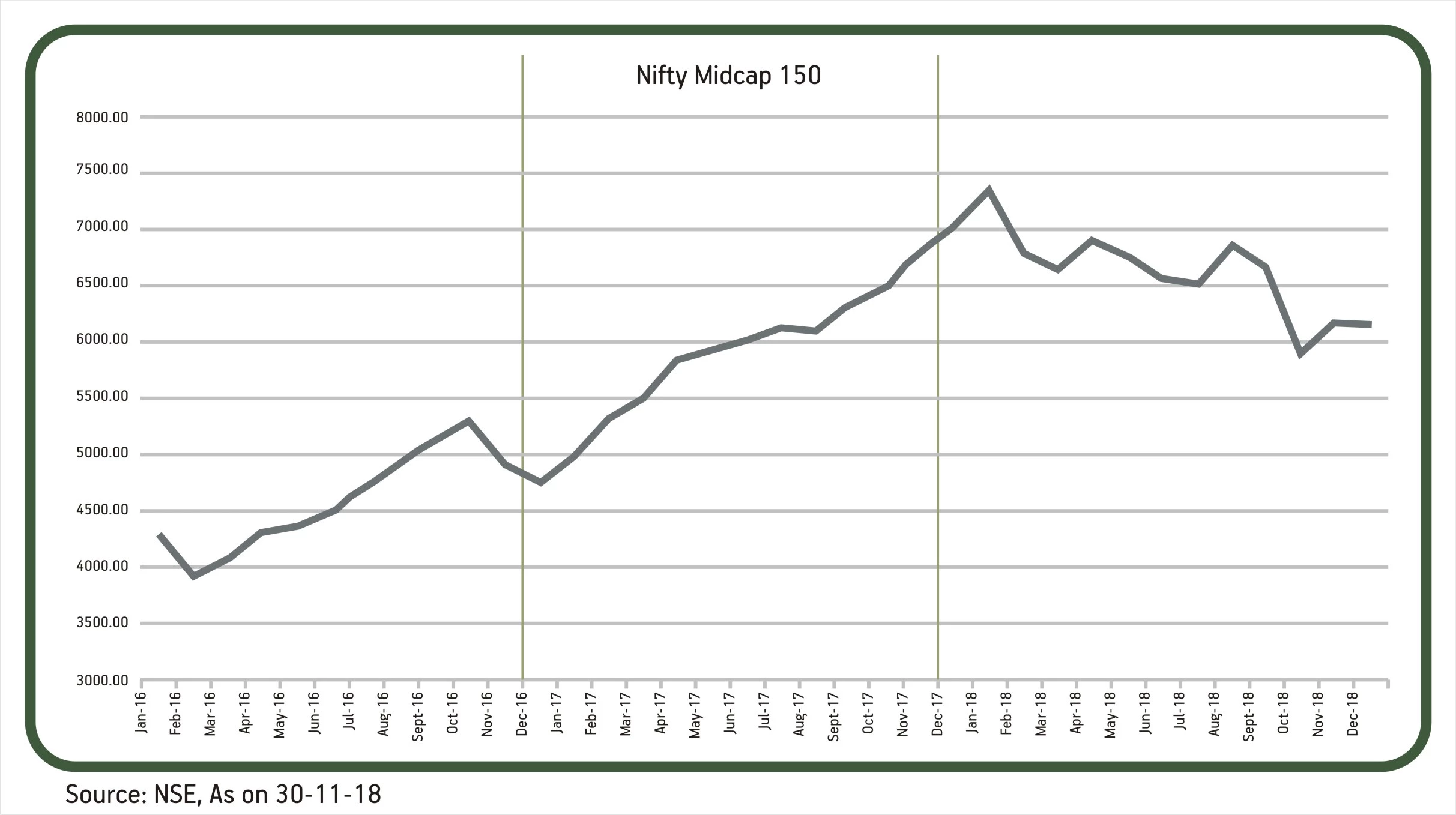

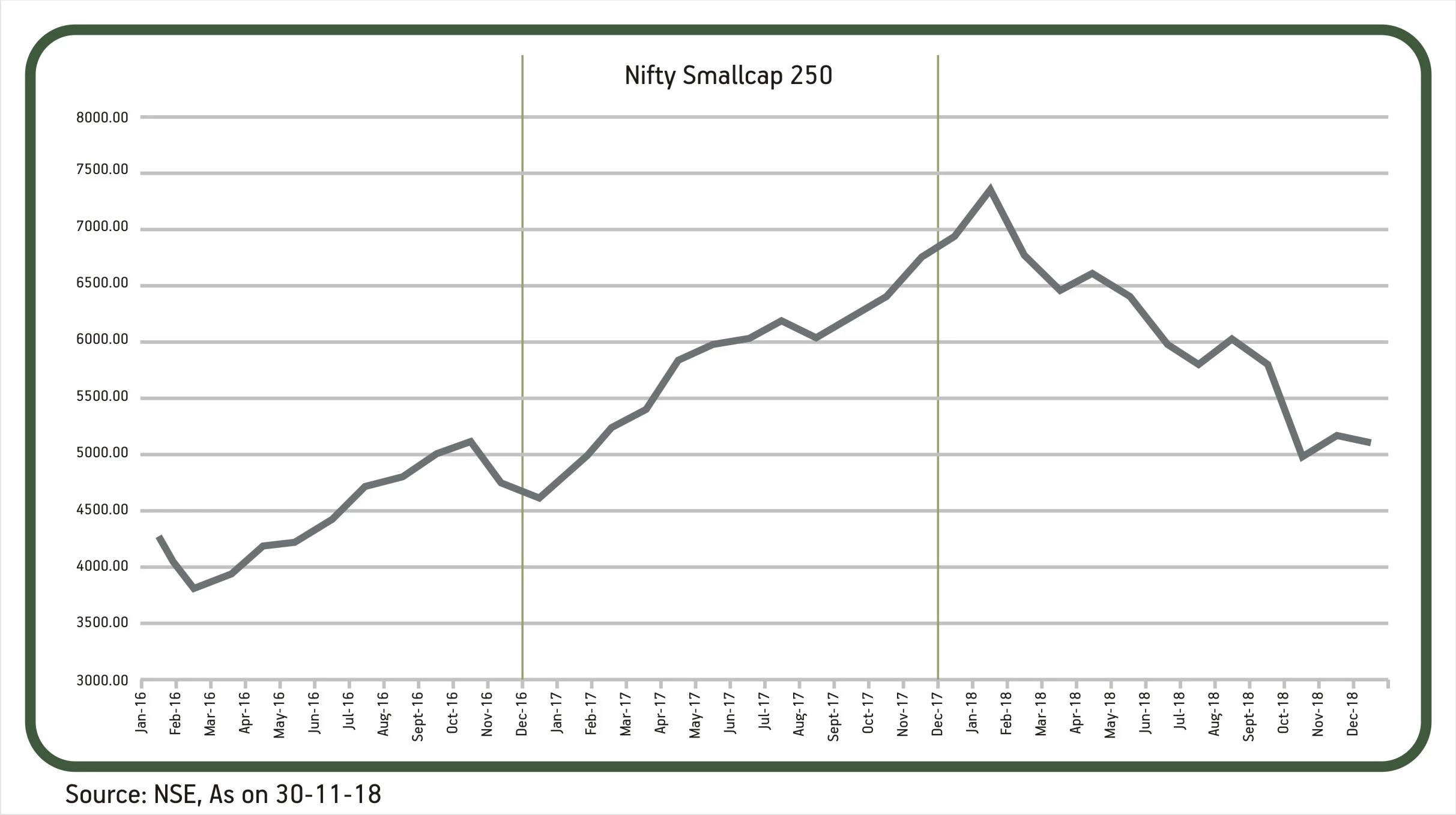

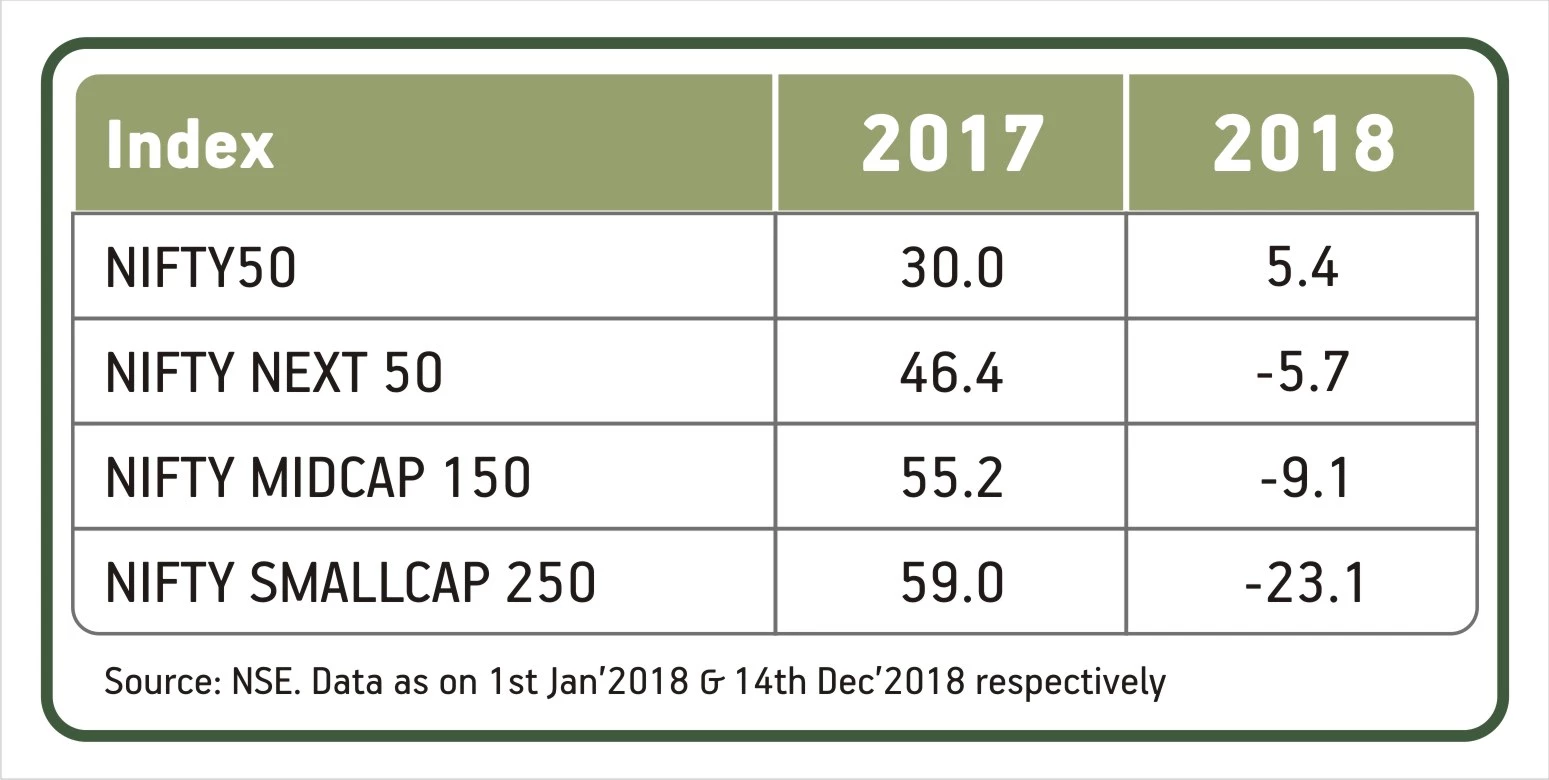

2017 was a stellar year and it set the tone for 2018. In 2017, Nifty 50 closed the year with a return of 30%, midcap index at 52% and smallcap index at 59%. (Source: NSE). 2018 started with the hope that key government reforms implemented in 2017 and earlier like GST, IBC, RERA, Recapitalization of banks etc., would bear fruit and returns would continue to be robust.

January 2018 was perhaps the month that played to this positive note, & the equity markets were driven by FPI flows particularly the ETF flows. FPIs pumped in over USD 2 bn while DIIs were net sellers of USD 140 mn (however, mutual funds were net buyers of USD 786 mn) (Source: Bloomberg)

But by the month of March, it became evident that the trade wars would influence the market sentiment for the rest of the year resulting into a tug of war between the macros and the micros. (Source: ABSLAMC Research,). In terms of performance of the markets, the large cap Nifty Index fell for second consecutive month with a return of -3.6%. The midcap index fell 4.6% and small cap index fell 6.8%.

To quickly summarize the year, there were three large themes that emerged during the year

- Trade war started by the United states government to reduce their own trade deficit

- Oil prices and resultant depreciation of Indian Rupee

- Rising interest rates in India and World wide

- Liquidity and NBFC crisis

- India becomes the fastest growing large economy in the world

The trade war primarily between USA and its major trading partners was due to the fact that the United States ran a deficit of USD 566 bn in both goods and services in the year 2017. Of this, China alone contributed USD 375 bn in goods deficit. The US President Trump wants to narrow this by at least USD 100 bn. With this in mind, he proposed to put a tariff of 25% on goods worth USD 50 bn imported from China. As a retaliatory measure, China also proposed to put tariff on goods imported from US. Though the economic impact for India is minimal, the overall sentiment of the market turned negative. Through the year, the blow hot blow cold did keep the markets on edge.

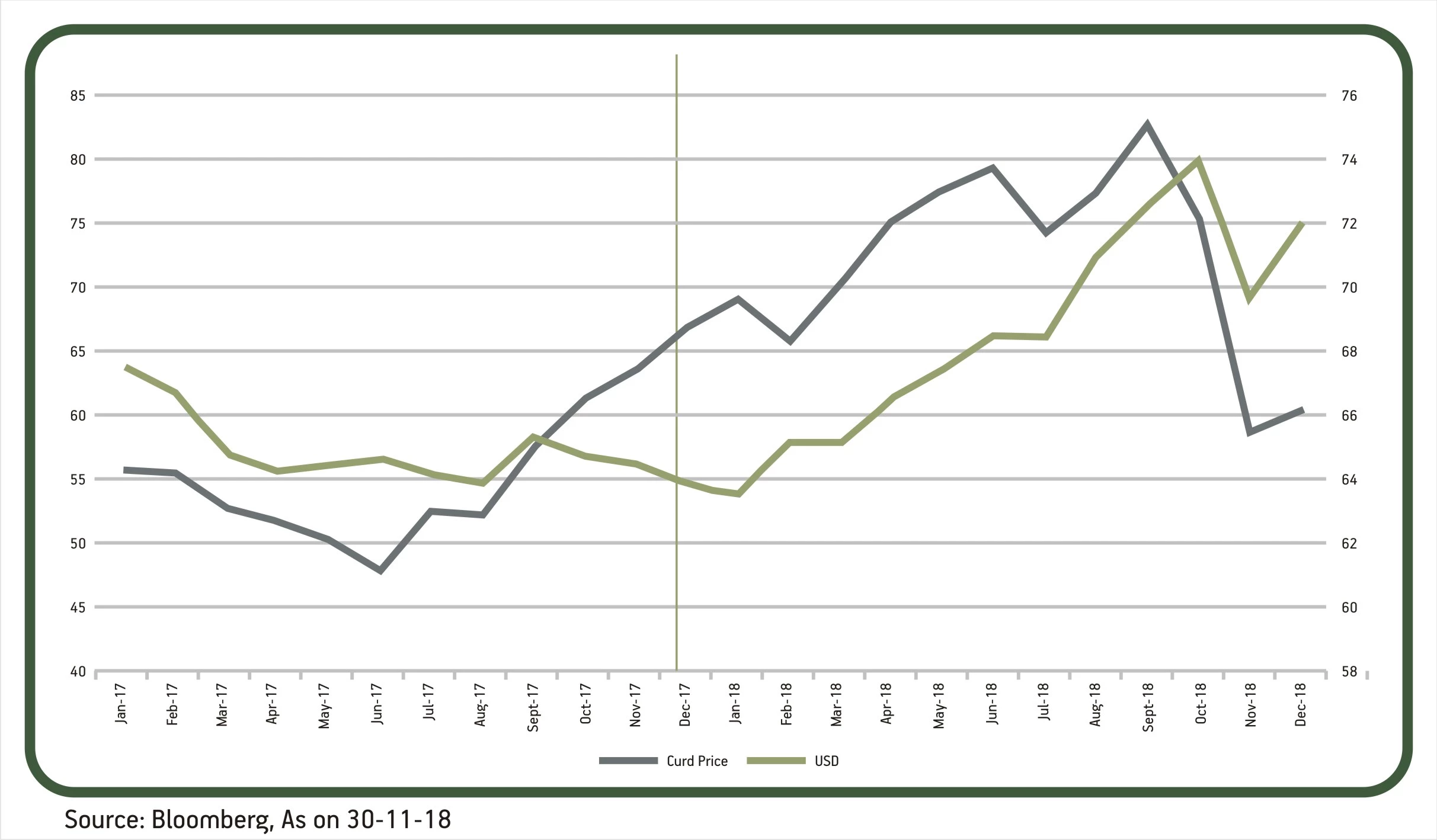

Secondly, by end of March, crude oil prices started to rise dramatically, primarily led by threat of sanctions on Iran and possible reduction of oil supply. India being a big oil importer had a large rise in current account deficit. Overall, it resulted in the fall of Indian Rupee vs. the Dollar. This played on till October when Oil prices reduced with sanctions on Iran being relaxed by USA and US shale oil production increasing. Rupee also gained some ground from its historic lows.

Source: https://www.thebalance.com/u-s-trade-deficit-causes-effects-trade-partners-3306276, Bloomberg

Another factor that impacted markets was the rise of interest rates by Federal Reserve of USA which usually results in FIIs preferring safe US govt bonds and deposits. When in August, Fed suggested a more gradual rate increase markets rallied worldwide. This coupled with good corporate earning in Q1 helped Indian markets to rally to all time highs in August. However, the all time highs did not bring cheer across the investing fraternity as it was a narrow rally based on a select few stocks.

https://www.businesstoday.in/markets/stocks/sensex-hit-all-time-high--nifty-rises-small-caps-midcaps/story/281751.html

In August, we had the IL&FS meltdown which spooked the markets. This also brought the liquidity status of large NBFCs under scrutiny. Overall, the market sentiments turned negative. This along with high crude prices, depreciating rupee, current account deficit and uncertainty / noise around assembly elections resulted in markets coming off their highs.

In all this, Mid and small cap indices corrected returns after a spectacular 2017. As on 14th December 2018, the calendar year returns for Midcap and Small Cap index were significantly down. In all this, the learning for investors was clear - risk is significantly high in these categories. Longer horizons and Systematic Investment Plans are ideal ways to invest in these high volatility instruments.

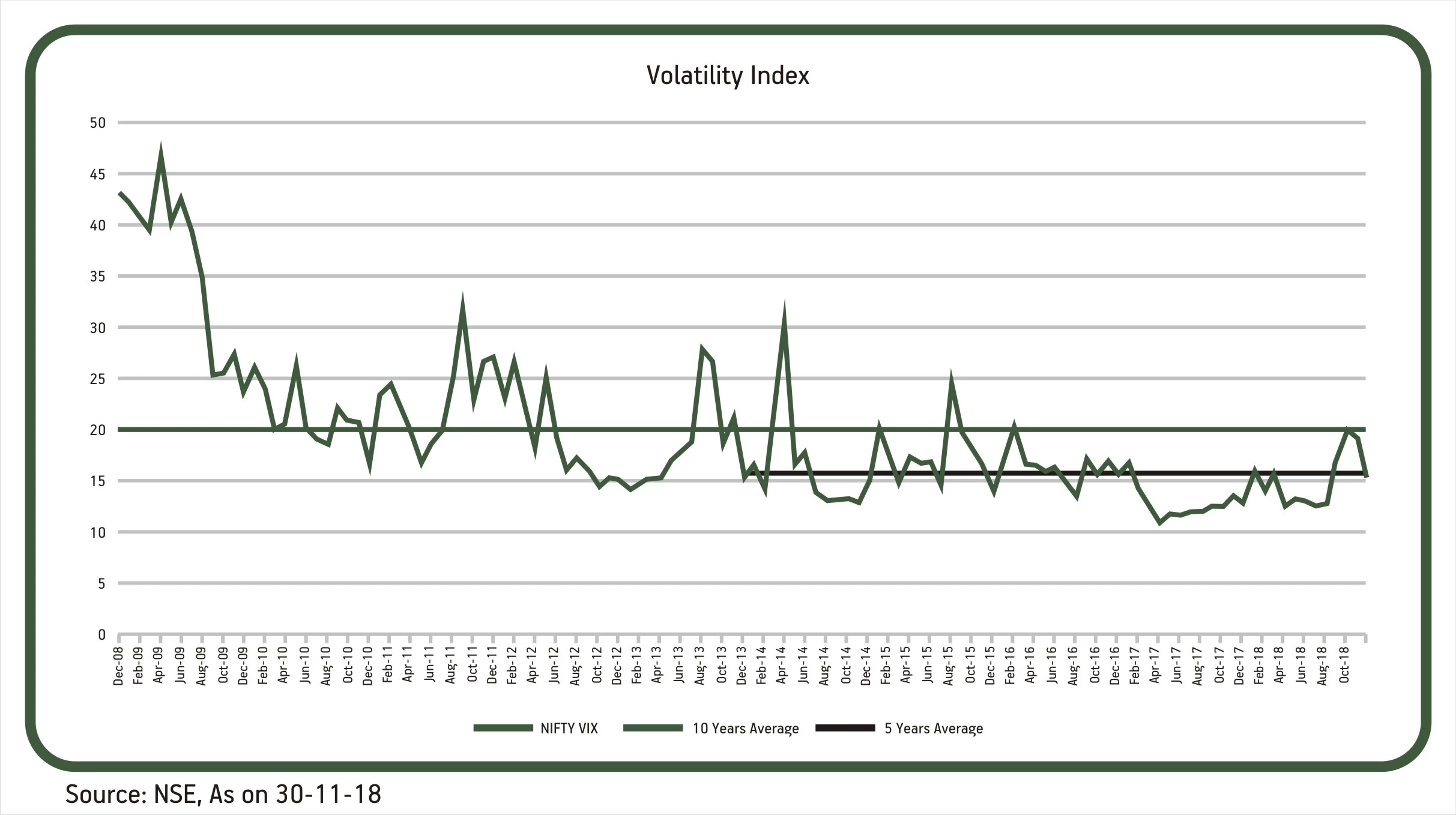

To put the year in perspective, the volatility may have seemed to be high but it was well within the 10 year average for NIFTY VIX. Also, only after Aug’18 did the volatility index move above the five year average for a short period between Sept’ 18 till Nov’18. As on 14th Dec’18, it is below the 5 year average.

However, as the year closes, the positives on Indian economic macro continues. Even though Q2FY19 GDP numbers were lower at 7.1%, India still remain the world’s fastest growing economy.

The NBFC challenges in terms of liquidity and rollovers which were a big problem a month back, have eased off. Overall credit growth has remained strong as banks have stepped in to substitute for NBFCs. The Q2FY19 earnings season saw around 3/4ths of the Nifty 50 companies coming in-line or above estimates. Nifty companies have shown robust revenue growth of 20%+. However, due to rising crude and commodity prices and currency depreciation, operating margins and PAT have been in the low-to-mid teens. With fall in crude prices and a stable currency, profitability can revive in the coming quarters

In 2019 the breadth of the market can improve and one can expect meaningful returns from a bigger basket of companies. A broad-based recovery can be expected around the time of elections in May ’19 as major events would have played out. Over the past 3 years, the Nifty has given a return of around 13% annualized. (ABSLAMC Research)

| GST - Goods & Services Tax | IBC - Insolvency and Bankruptcy Code | NIFTY VIX – Nifty Volatility Index |

| FPI - Foreign Portfolio Investment | DII - Domestic Institutional Investors | ETF - Exchange-Traded Fund |

| NBFC - Non Banking Financial Company | RERA - Real Estate Regulatory Authority |

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000