-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

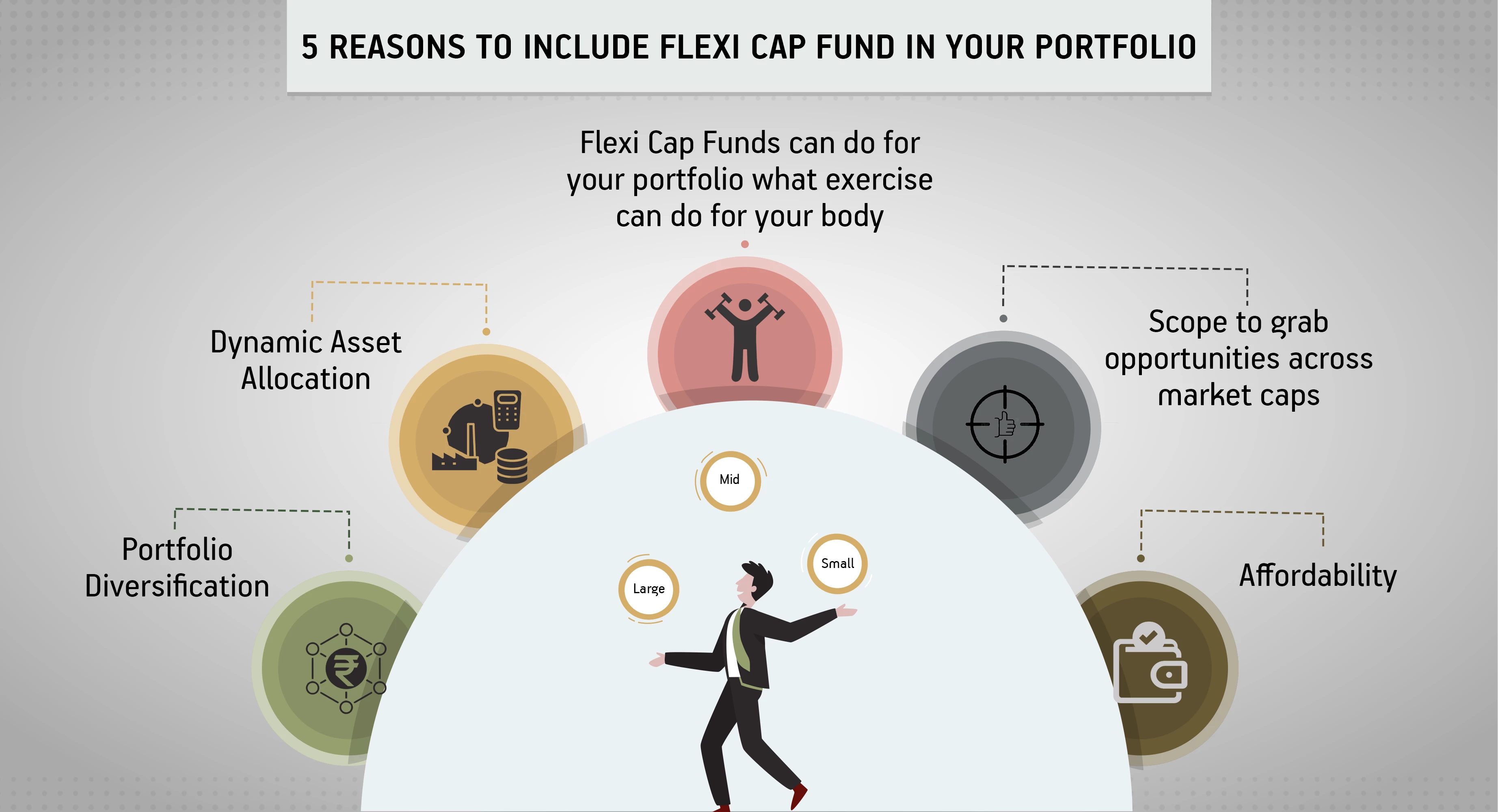

5 Reasons to include Flexi Cap Fund in your Portfolio

Aug 25, 2022

3 Min

4 Rating

Imagine your most favourite pair of pyjamas – without elastic. Or you being unable to twist or bend at all. Rub-ber bands that won’t stretch, bags without adjustable straps, balloons that won’t inflate, springs that won’t com-press and bounce back. It would be a very uncomfortable and difficult world to live in without the flexibility these common, simple things provide.

Flexibility provides not just comfort, but a much longer utility value to things. The more elastic and adjusting a material or thing is, the more is its usefulness in your day-to-day activities. If we put so much thought into such basic things as clothes and bags, why not apply the same wisdom to our investments?

Flexi Cap Funds, as the name suggests, has a potential to offer similar flexibility to your investments as any of the above examples. This inherent quality becomes all the more important in volatile times such as these when global and national, political and social movements change the course of the stock market on a daily basis.

If you have been contemplating investing in a Flexi Cap Fund but are not yet sure, here are a few points to help clear your confusion. Here are 5 reasons as to why a Flexi Cap Fund can be opted in every portfolio:

-

Portfolio Diversification:

A basic thumb rule of investing is diversification of your money. The more di-versified your portfolio is, the stronger it is against market fluctuations. A Flexi Cap Fund, by default, invests across all three market caps – large, mid and small. Large caps being the market leaders stay on course of the market. At the same time, small and mid-cap companies with potential for growth and expansion can also be tapped into in the initial stages itself. This lends your portfolio the triple ad-vantage of diversification, market-linked returns as well as scope for growth. Together these strengths can help your portfolio beat the market highs and lows in the long term.

-

Dynamic Asset Allocation:

Flexi Cap Funds are actively managed funds. This gives your portfolio the benefit of having an experienced Fund Manager constantly adjust your investments to make the most of the market situation. Thanks to the flexibility to move across market caps, sectors, industries and themes, the Fund Manager has the freedom to assess and adjust the fund’s exposure to the segments depending on the risk and opportunities in the market. Fund Managers have access to a variety of tools and research that enable them to make informed decisions. They can reduce exposure to seg-ments where risk is high and increase exposure to areas with significant growth opportunity. Through this opportunistic buying and selling, the fund’s chances of generating better returns increase. At the same time, the bias of the Flexi cap fund towards large caps act as a hedge against any threats, errors or sudden changes in bearish market conditions.

-

Affordability:

Flexi Cap Fund being a mutual fund has the ability to give you exposure across market caps and sectors for a small investment. An initial investment of Rs 5,000 can give you a combination of some of the best stocks trading on the exchange and the portfolio management expertise of the fund manager. Facilities such as Systematic Investment Plan (SIP) makes this even easier as you can keep giv-ing small amounts of money at regular intervals, without burning a hole in your usual budget. This flex-ibility is very important since it does not use up the funds you might have kept aside for day-to-day ex-penses or other necessary expenditures. You get the flexibility of dynamic asset allocation and small regular investments.

-

Scope to grab opportunities across market caps:

The ability to move funds across market caps can give the category of Flexi Cap Fund an opportunity to earn reasonable returns in all sectors and caps over the long term. This is particularly favourable in the case of mid and small caps where harnessing the right opportunity can give a major boost to your portfolio. Opportunity doesn’t always lie in market cap. There are other factors like company’s growth potential, track record, value prospects, etc. The fund gives a great combination of growth and value, smoothening your equity journey while managing risk and volatility in a single fund.

-

Flexi Cap Funds can do for your portfolio what exercise can do for your body

it can keep it flexible, healthy and ready for opportunities to grow and progress. Therefore, the real question is not whether investing in a Flexi Cap Fund is good for your portfolio or not; the real question is how soon and for how long are you willing to stay invested? For the longer you stay, the better it will be.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000