-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

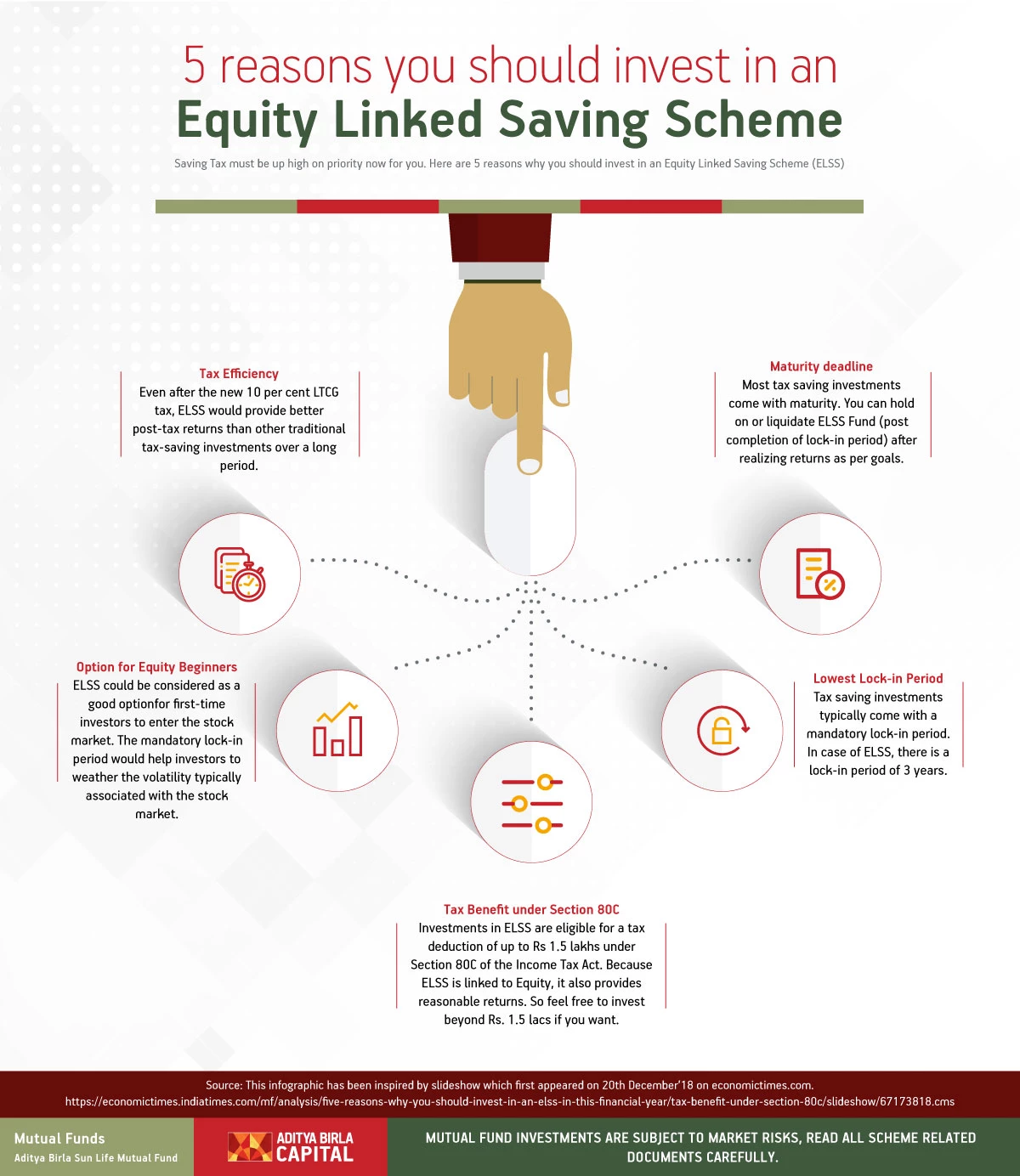

5 reasons you should invest in an Equity Linked Saving Scheme

Dec 22, 2019

5 mins

5 Rating

Saving Tax must be up high on priority now for you. Here are 5 reasons why you should invest in an Equity Linked Saving Scheme(ELSS):

-

• Tax Benefit under Section 80C

Investments in ELSS are eligible for a tax deduction of up to Rs 1.5 lakhs under Section 80C of the Income Tax Act. Because ELSS is linked to Equity, it also provides reasonable returns. So feel free to invest beyond Rs. 1.5 lacs if you want. -

• Lowest Lock-in Period

Tax saving investments typically come with a mandatory lock-in period. In case of ELSS, there is a lock-in period of 3 years. -

• Option for Equity Beginners

ELSS could be considered as a good optionfor first-time investors to enter the stock market. The mandatory lock-in period would help investors to weather the volatility typically associated with the stock market. -

• Tax Efficiency

Even after the new 10 per cent LTCG tax, ELSS would provide better post-tax returns than other traditional tax-saving investments over a long period. -

• Maturity deadline

Most tax saving investments come with maturity. You can hold on or liquidate ELSS Fund (post completion of lock-in period) after realizing returns as per goals.

This infographic has been inspired by slideshow which first appeared on 20th December’18 on economictimes.com.

https://economictimes.indiatimes.com/mf/analysis/five-reasons-why-you-should-invest-in-an-elss-in-this-financial-year/tax-benefit-under-section-80c/slideshow/67173818.cms

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000