-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

5 Things you should know about Net Asset Value (NAV)

Mar 14, 2019

5 mins

4 Rating

What is NAV?

Whenever we decide to invest in Mutual Funds, one term always comes up – NAV. Now, what does NAV really stand for? Well, NAV is the short form of Net Asset Value. In simple terms, this means the price of one unit of a mutual fund scheme. It is the price at which we buy or sell the unit of mutual fund scheme. Investors can track the performance of the mutual fund by noting the percentage increase or decrease in its NAV over a period of time.

How is NAV calculated?

NAV of a fund is the sum total of the market value of all the securities held in its portfolio including cash less the liabilities, divided by the total number of units outstanding. Thus, NAV of a mutual fund unit is nothing but its 'book value'. The NAV of a fund is calculated on a daily basis, at the closing time of the market after taking into account the closing market prices of the securities it holds. If you invest in a mutual fund scheme (other than liquid schemes) before 3 p.m. on any trading day, you will get it at the NAV of that day. However, if you invest after 3 p.m., you will get it at the NAV calculated at the end of the next trading day.

For Liquid Schemes:

where the application is received up to 2.00 p.m. on a day and funds are available for utilization before the cut-off time without availing any credit facility, whether, intra-day or otherwise - the closing NAV of the day immediately preceding the day of receipt of application;

where the application is received after 2.00 p.m. on a day and funds are available for utilization on the same day without availing any credit facility, whether, intra-day or otherwise - the closing NAV of the day immediately preceding the next business day; and

irrespective of the time of receipt of application, where the funds are not available for utilization before the cut-off time without availing any credit facility, whether, intra-day or otherwise - the closing NAV of the day immediately preceding the day on which the funds are available for utilization.

Is the NAV affected by loads?

A mutual fund’s NAV is affected by loads. When we sell or redeem a mutual fund scheme, the NAV reduces if there is an exit load on the scheme. Exit load is always represented as a percentage of NAV.

Is NAV same as an Equity Share Price?

It would not be prudent to think that the NAV of a mutual fund is same as the price of an equity share.

When we buy Mutual Fund units at its prevailing NAV, we are buying those units at their book value i.e. we are paying the exact price of those units whether it is Rs 10 or Rs.100. There is no such thing as it being overvalued/higher or undervalued/lower price at any point of time. Whereas the share price of a company could be higher or lower than its real book value since investors’ perception of the company's future performance and the demand-supply scenario in the market also affects the price of a company’s share.

Is lower NAV better than higher NAV?

If you’re wondering whether you should buy units only at a low NAV, think again. Investing at a lower or higher NAV hardly makes a difference to the returns generated by a mutual fund scheme.

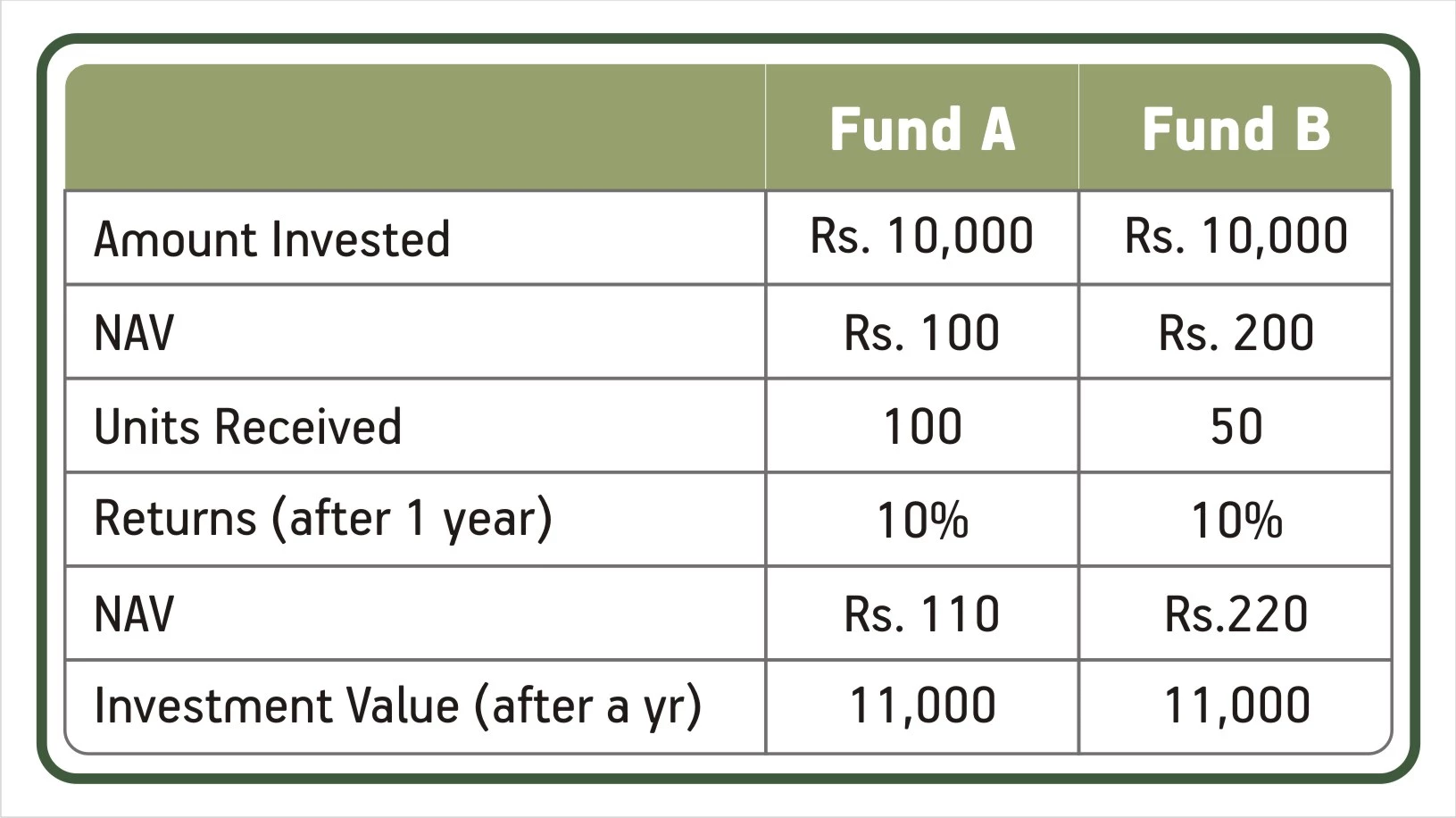

Illustration: Let’s see what happens to Rahul’s money when he invests in two funds having identical portfolios but different NAVs

As you can gauge from the table, although the NAV of fund B is twice of Fund A still the investment value after one year is same since both the funds gave the same returns. Hence, what matters is the fund performance or returns generated by the fund which in turn is dependent on factors like portfolio quality, investment style, fund management etc. and not NAV.

For further information on cut off timing and NAV applicability please refer Scheme Information Document of the respective Schemes.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000