-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

A look at past credit cycles – Difference in origin and industry reaction

Sep 21, 2020

5 Rating

Sunaina Da Cunha

Sunaina Da Cunha

By: Ms. Sunaina Da Cunha

What is different between 2008, 2015 and 2018?

2008 was an imported problem

The 2008 crisis came to India in the backdrop of a very strong economic boom that lasted from 2004-2007. Earnings were strong but balance sheets were levered since many companies had undertaken debt led expansions and acquisitions. Confidence prior to Lehman Brothers collapse was high. India growth story and “decoupling theory” abounded right until the Lehman Brothers collapse, which then impacted India. But this was an imported problem that was papered over quickly with lots of liquidity / forbearance / fiscal profligacy thrown at it which resulted in a short-lived problem of just 3-6 months (since it was not really our problem but an imported one) and then a V-shaped quick recovery in India. Companies impacted during this time were:

Financials, particularly those that had in the boom time loosened credit standards (many including the storied MNCs that subsequently shut down, had lent with very low margins of sometimes under 50bps in the chase for growth) and those that lent unsecured personal loans (that product category was subsequently wound down by all except one NBFC that tweaked the product and underwriting framework and another leading private bank, and the asset class ‘Loan Against Property’ was born).

Asset Heavy Companies like Real Estate had a double whammy of sharp fall in prices and leverage since it had seen a boom in the previous years, wherein debt acquisition of land banks had been undertaken.

Levered Manufacturing balance sheets, particularly those that had gone on a debt led acquisition spree and those with Unhedged Forex Liabilities.

2015 was primarily a Commodity linked issue

When the 2015 fears of hard landing in China and consequent commodities crash emanated, many smart balance sheets had already used the interim time to de-lever and hence most (with a few exceptions who defaulted) companies (it was primarily the commodity linked companies that were majorly impacted) were able to side step this mini-crisis. Mutual Fund investors this time were thought to be more educated and the MFs that faced losses passed them on including in ‘institutional funds’. This period also coincided with the birth and quick expansion of a new category of funds viz credit funds. These funds had chased assets and chased down spreads which then blew out. Crisis didn’t seem to last long. Credit funds then grew in size and complexity of investments grew with them consciously moving down the rating curve.

2018 - A home grown one and now in its second year

This cycle officially started with IL&FS defaulting in 2018 and resulting in a freeze in financing markets with subsequently many NBFCs / HFCs defaulting and growing into an asset valuation destruction issue (across liquid assets like shares and illiquid ones like property). This is a home-grown crisis which has snowballed engulfing many storied names and groups and blemishing many more. In the backdrop of this, the Coronavirus and consequent lockdown seemed like the proverbial straw. Temporarily in the aftermath of one of the most stringent lockdowns in the world in India, companies that were already badly bruised with depressed earnings, balance sheets stretched, saw liquidity dry up. Spreads blew out. On top of it all, a fund house decided to close down six of its credit- oriented funds. But that was probably the peak of the credit crisis and things have rebounded from thereon. Regulators reacted with alacrity and sharply brought down rates, ensured that the system was flooded with liquidity, introduced time bound moratoriums (initially for debt stressed by Covid-19) and now introduced restructuring with certain constraints. Specific targeted schemes were also announced by the Finance Ministry for various sectors including financial sector, MSMEs, Power sector etc.

How has Corporate India reacted to these crises?

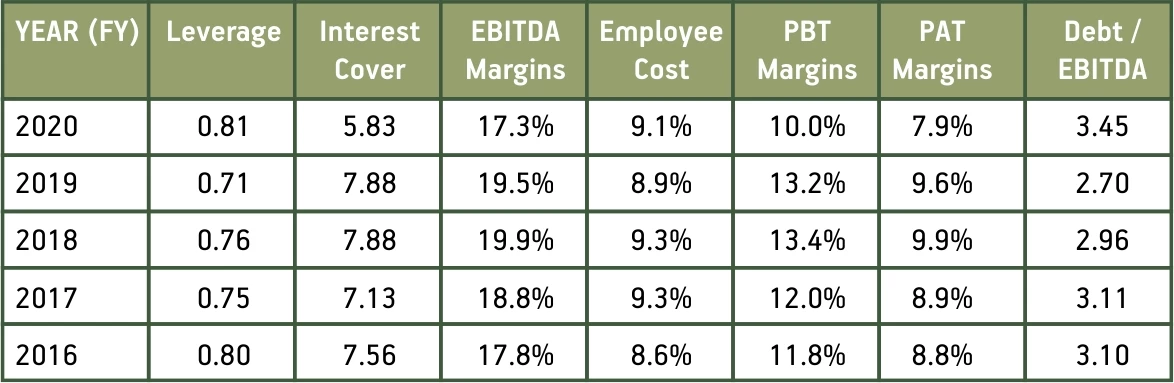

An analysis of the BSE-500(excluding financials) corporates over the past 5 years show that while as a whole Corporate India embarked on minor de-leveraging from FY 2016 to FY 2019, last year in FY 20, things deteriorated and went to the worst point of last 5 years with Debt / EBITDA at 3.45x and Debt – Equity spiking to 0.81x. Other debt metrics like interest cover also weakened.

Source: Capitaline Database, ABSLAMC Internal Estimates

The Q1 FY 21 Numbers (of those that have declared their results) tell an expected story, coming on the back of the strict lockdown, with sales down 33% on YoY basis. However Corporate India seems to have gone on a cost cutting spree across the board and thus EBITDA was also down 33% YoY. PBT was down 92%.

How have Mutual Funds reacted to this Crisis?

Looking at various fund houses behaviour over past 2 years post the credit crises, most MFs have cut the risk exposures over the past two years. If we measure credit risk exposure as non AAA / A1+ / Cash / Sov, then data shows (Source: B&K data and ABSLAMC Research) that the industry as a whole was at 19% in June 2018 and brought that down to 8% in July 2020. In certain cases, at individual AMC level the number ranges between 10-15% to as much as 65% as on July 2020. As a fund house, even prior to IL&FS incident we had started cutting down on credit risk and this can easily be seen from the fact that after systematically cutting risk we have now a low risk carrying portfolio at 5% only as on July 2020. In line with our view, we have moved to a conservative positioning. The non-Sovereign / Cash / AAA portion of the portfolio accounts for just 15% for ABSLAMC. The same for the Industry is 17%.

Road Ahead

Manufacturing activity is expected to resume quickly and the companies in those sectors are likely to recover faster. Consumer discretionary spending and associate companies may take a little more time to recover. The organised sector is likely to benefit and “big will get bigger”. We continue to look for opportunities to invest in stable cash flow generating companies, with reasonable capital structures and good vintage and parentage. Essentially, we believe that policy makers are now looking to create a low volatility environment with excessive liquidity to nudge financial markets and banks to start credit cycle. Thus, we believe the credit stress which started with the IL&FS saga has come to an end. With the rate cut cycle nearing an end, abundant liquidity, proactive steps being taken by regulators to reduce the credit stress and steep yield curves, “accrual strategy” is the way forward. But this is a slow process. Low duration and Short-term funds may be best risk adjusted places for fixed income investors to have "accrual returns" over other fixed income assets.

The author is Senior Fund Manager at Aditya Birla Sun Life AMC Ltd.

The views and opinions expressed are those of Sunaina da Cunha, Senior Fund Manager and do not necessarily reflect the views of Aditya Birla Sun Life AMC Ltd (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”). ABSLAMC/ the Fund is not guaranteeing/offering/communicating any indicative yield on investments. ABSLAMC or any of its officers, employees, personnel, directors make no representation or warranty, express or implied, as to the accuracy, completeness or reliability of the content and hereby disclaim any liability with regard to the same. Recipients of this material should exercise due care and read the scheme information document (including if necessary, obtaining the advice of tax/legal/accounting/financial/other professional(s) prior to taking of any decision, acting or omitting to act. Further, the recipient shall not copy/circulate/reproduce/quote contents of this interview, in part or in whole, or in any other manner whatsoever without prior and explicit approval of ABSLAMC.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000