-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Aditya Birla Sun Life Balanced Advantage Fund Wealth Creation Study

Jun 09, 2025

10 min

0 Rating

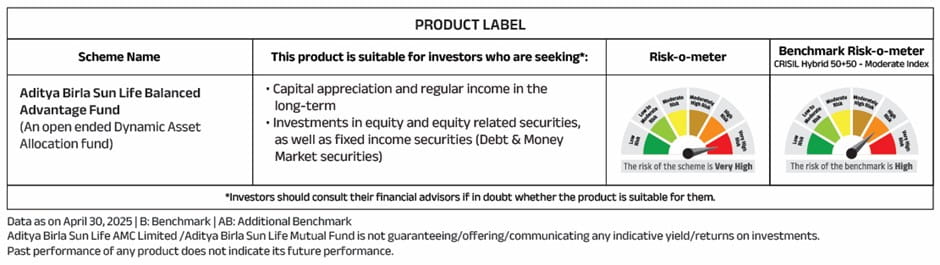

When it comes to building wealth over the long term, choosing the right investment vehicle is important. A strategy that balances risk and return can help investors stay confident through difficulties in the market. One such strategy is to invest in the Balanced Advantage Fund category, which aims to offer long-term capital appreciation with controlled volatility.

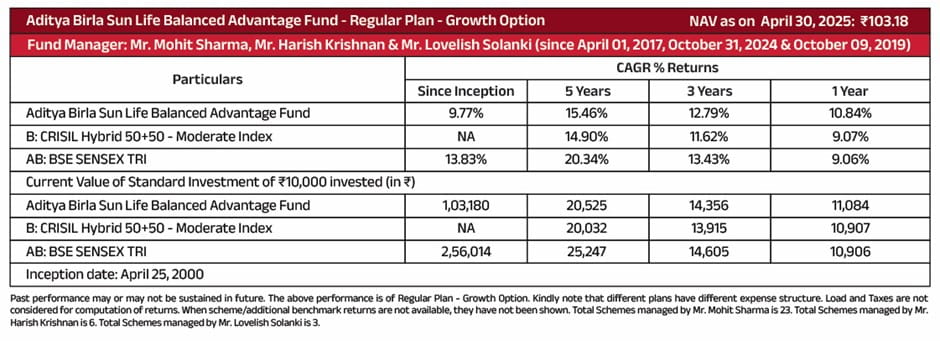

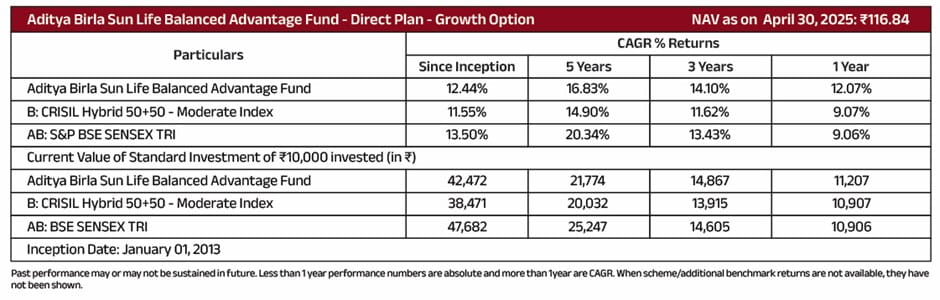

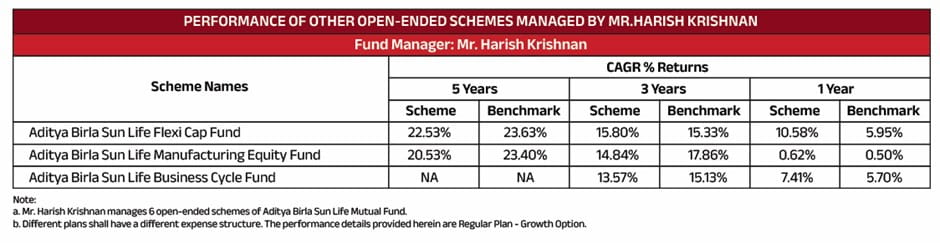

Over the years, one of the funds in this category with a long-standing history, Aditya Birla Sun Life Balanced Advantage Fund helped investors create wealth. The Aditya Birla Sun Life Balanced Advantage Fund, managed by Aditya Birla Sun Life AMC (ABSLAMC), recently completed 25 years of its journey. The long-term performance of the Aditya Birla Sun Life Balanced Advantage Fund highlights its potential in wealth creation.

A Fund That Adapts with the Market

Launched on 25th April 2000, the Balanced Advantage Fund from ABSLAMC has gained popularity among investors looking for long-term capital growth with reduced market volatility. This fund follows a dynamic asset allocation strategy—it adjusts its equity and fixed income exposure based on market valuations.

When markets are expensive, the fund lowers equity exposure to protect capital. During market corrections or attractive valuations, it increases equity allocation to capture potential gains. This strategy allows the fund to manage risks better while aiming to generate consistent returns in the long run.

Why Investors Prefer the Balanced Advantage Strategy

There are several reasons why investors across risk profiles consider investing in a Balanced Advantage Fund. Here are a few key benefits:

Dynamic Asset Allocation

The fund’s key strength lies in its ability to adjust between equity and debt based on prevailing market conditions. This helps reduce exposure during high market valuations and increases allocation when valuations are attractive, thereby capturing growth potential while managing risk.

Reduced Volatility

Compared to funds that are fully invested in equities, the Balanced Advantage strategy provides a smoother investment journey. It experiences lower drawdowns during market corrections, helping investors stay invested for the long term.

Long Term Returns

By aiming to capture upside potential while limiting downside risk, the fund has historically delivered sustainable returns in the long run. This makes it suitable for long-term investors, including those who are new to mutual fund investing.

Suitable for SIPs and Lumpsum Investments

The Balanced Advantage Fund is ideal for investors using the SIP route as well as those making lump-sum investments. SIPs help build wealth gradually while benefiting from rupee cost averaging. At the same time, lump-sum investments can make the most of market cycles when timed right.

Simplified Investor Experience

The fund is suitable for investors who do not have the time or expertise to actively manage their asset allocation. The fund does the rebalancing on the investor’s behalf, offering convenience along with disciplined portfolio management.

SIP and Lumpsum Investment Growth: Key Data Points

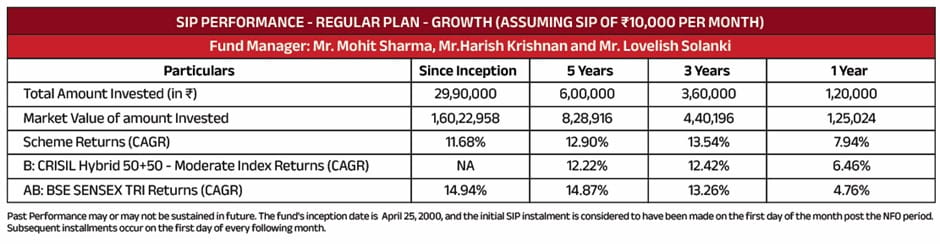

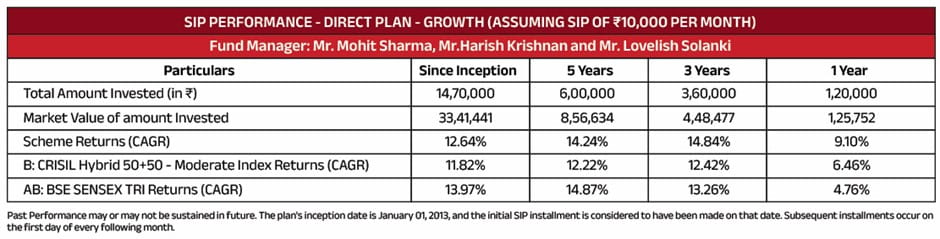

According to the recent Wealth Creation Study, a monthly SIP of ₹10,000 in the Aditya Birla Sun Life Balanced Advantage Fund over the last 25 years would have grown to approximately ₹1.6 crore — which translates to a compound annual growth rate (CAGR) of 11.7%, highlighting the fund’s potential in long-term wealth creation.

Similarly, a lump-sum investment of ₹1 lakh made 25 years ago would have grown to over ₹10.3 lakhs. The performance illustrates the power of disciplined investing and compounding when combined with a strategy that balances market risks smartly.

The fund also shows a track record of strong downside protection. Since 2015, it has managed to generate around 80% of the returns delivered by the Nifty, while maintaining an average net equity exposure of about 52%. Due to this lower equity exposure, it experienced only 66% of the volatility typically seen in the broader market index.

Over the past nine years, the fund has delivered returns above 8% in more than 86% of all rolling 3-year periods — reflecting its consistent performance across different market conditions.

Conclusion: A Fund That Stands the Test of Time

The Aditya Birla Sun Life Balanced Advantage Fund has not just performed well in numbers—it has also earned the trust of investors over 25 years. Its ability to manage market volatility, provide sustainable returns in the long run, and simplify the investing journey makes it a compelling choice for anyone looking to build long-term wealth with peace of mind.

As with any investment, it is important to align your choices with your financial goals and risk appetite. But if you are looking for a fund that combines smart strategy with reliable performance, the Balanced Advantage category—especially the offering from ABSLAMC—deserves your attention.

About ABSLAMC

Aditya Birla Sun Life AMC (ABSLAMC) was established in 1994 and is one of India’s leading asset management companies. The AMC offers a wide range of mutual fund products that cater to different investor goals and risk profiles. With a strong nationwide presence and a robust network across urban and rural locations, ABSLAMC services millions of investor folios across India.

In addition to mutual funds, the AMC also manages alternative strategies like portfolio management services, real estate investments, and alternative investment funds. ABSLAMC has built of trust, offering investment solutions that are both innovative and investor centric. As of March 31, 2025, the company manages assets worth over ₹4,000 billion, serving investors across various financial categories.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000