-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

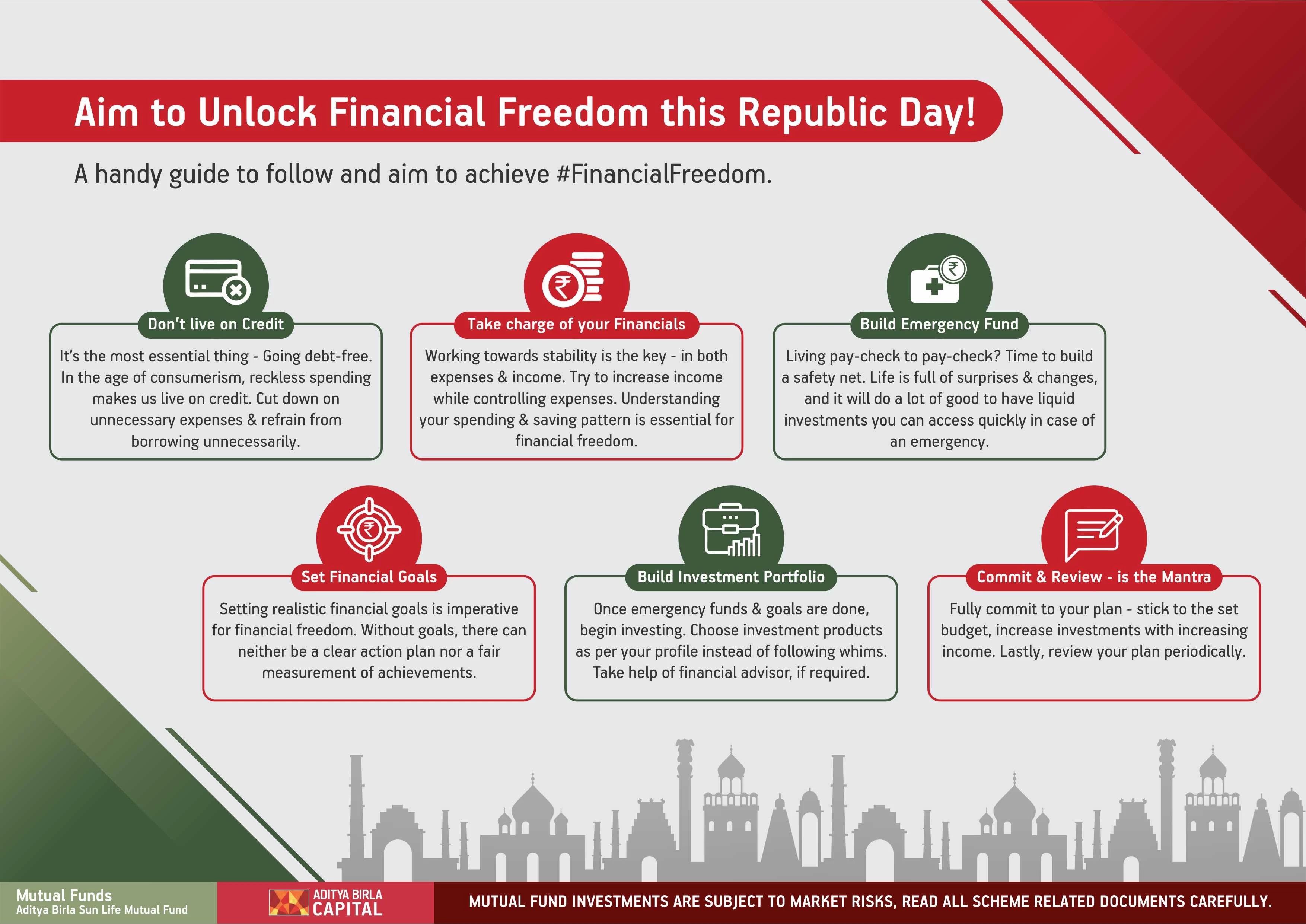

Aim to Unlock Financial Freedom this Republic Day!

Jan 23, 2021

4 mins

5 Rating

One can often hear of cases of retirement at 40 or 45 years these days. When we go to read how it was achieved – the answer would not be very different from ‘Financial Freedom’. Read a bit more and it will tell us that financial freedom just doesn’t happen like that. It happens with a plan and a strong will to adhere to it.

We all do have some idea of what it means to be financially free. But a concrete plan is what it takes to help achieve it. We are trying to lay out a listthat you can tick markand aim to be in the state of #FinancialFreedom.

• Not living on credit

It’s the most essential thing - Going debt-free. In the day and age of consumerism, reckless spending occurs, making us live on credit. The first step to financial nirvana is cutting down on unnecessary expenses and; refrain from borrowing tools giving us access to easy credit.

• Stable income which perhaps more than takes care of the basic needs

Working towards stability is the key – in both expenses and income. Unless we are assured of being able to save consistently, financial freedom will remain at bay.

-

Increasing your income

-

Controlling your spending habits

-

Understanding your savings patterns

-

Determining your investment objectives

-

Defining your long-term financial goals

If we can steadily increase income – while keeping spending levels low– we may generate investible surplus and therefore possibly reach all of our financial goals much more quickly.

-

• Emergency savings

If we have been living pay check-to-pay check up to this point, our first savings goal should be to create a safety net. We can do that by creating an emergency fund.

Life is full of surprises and changes, and it will do a lot of good to have a liquid stash of cash one can access quickly in case of an emergency. Emergencies like getting laid off, the car dying, or the child needing an urgent medical treatment, and the health insurance doesn’t quite provide the coverage one thought it did, are just some of the many exigencies we could be facing.

• Set financial goals

Unless there are goals, there can neither be clarity about action plan nor a fair measurement of achievements.

Up until now, it was about just managing inflows and outflows. Financial freedom requires setting down of some serious goals – wehave to take stock of our current vs. future money needs, what amount will help create the cushion for us and how to achieve it.

• Investment Portfolio

Once our emergency fund is adequately stocked, and financial goals are set, we can begin investing money. This is important, because investing is about using our money to earn more money. The larger our investment portfolio becomes, the closer we get to financial independence.

As pointed earlier, we should aim for increasing our income and use it as investible surplus. To hit financial freedom, we shouldn’t get complacent and start spending incremental income. It should strictly be used to increase investment kitty.

Systematic Investment Plan can be counted upon by all those planning financial freedom over long term. It uses the ‘power of compounding’ which can give reasonable inflation adjusted potential returns. And as income rises, it can be used to increase SIP amount.

• Shield as Much Income from Taxes as Possible

Taxes eat up a major part out of our income, which means we will have less money available to pay off debt, save and invest. By using strategies that reduce the tax burden, we'll be able to keep more of our income.

• Retirement Plans

A critical part of planning is to provide for retirement. Often, it gets ignored as we go along the flow and comes as a nasty surprise when we hit our golden years. It depends situation to situation but on an average, last 10 years of work life should actively contribute towards retirement corpus.

Sometimes, calculating the actual money required post retirement could be difficult as there are various factors into play like inflation. It is advisable to take professional help of financial advisors to ascertain the desired amount and investment avenues to achieve it.

• Commit & Review – is the mantra

In order to become financially independent, we will need to fully commit to our plan. We should have a written plan – to be reviewed annually as goals vis-a-vis achievement.

The purpose is twofold:

To make sure our goals are on track, and

To keep ourselves focused on the ultimate goal of becoming financially independent

This is incredibly important, particularly number two. It's very easy to get side-tracked on the road to financial independence. It’s a decently long path and temptations might beseech us.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Similar Articles

1800-270-7000

1800-270-7000