-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

All you need to know about Aditya Birla Sun Life Banking and PSU Debt Fund

Sep 21, 2020

5 Rating

The key word that surrounds the economy and market today is ‘uncertainty’. Companies and industries across sectors have suffered losses and several may even risk facing closure in the months and years to come.

As an investor, are you contemplating fixed income investments to balance risk? In today’s volatile and uncertain times however, debt-based instruments also need to be chosen prudently to manage risk. Let us look at one of the investment avenues amongst debt- based instruments – a mutual fund scheme investing in high quality PSUs, PFIs and securities issued by Banks.

What are PSUs and PFIs?

Public Sector Undertakings (PSU) are companies whose majority stock are held by the government – can be the central government, one or more state governments or a combination of both. PSUs are generally engaged in core industries of the economy such as oil and gas, power, infrastructure, natural resources etc.

Public Financial Institutions are companies engaged in the business of large scale industrial/infrastructural financing and granted such status by the RBI.

These entities being backed by the government enjoy near sovereign status.

What does the banking sector in India encompass?

The banking system of a country is the lifeline of its economy. Particularly in the era of digitisation that we are in, a robust banking system assumes utmost importance. As of April, 2020, India has 12 public sector banks, 22 private sector banks, 44 foreign banks, 45 regional rural banks and 33 State cooperative banks in addition to rural, urban and other cooperative credit institutions1. Large, established players in this sector are vital to the functioning of the overall banking system.

Sectoral background

There are two key characteristics that make investments in PSU, PFI and large banks desirable:

Risk level

Being largely backed by the government and being engaged in core sectors of the economy helps these entities to enjoy a pivotal status. Bonds issued by them can have low risk of default. Depending upon their financial health these bonds may enjoy high rating from credit rating agencies due to the low default risk that they carry.

High Liquidity

The of these bonds and increased investor desirability ensures trading of these bonds at high volumes in the stock market. This lends another key advantage of high liquidity to its bondholders.

Sectoral outlook

India is a developing economy, the fastest growing economy in the world today. To maintain this position, it is imperative that the core sectors of the country grow – everything from agriculture to infrastructure needs to grow exponentially to support a fast-paced growing economy. This can keep PSUs and PFIs engaged in these core sectors at the forefront of the country’s growth story.

In the same way, a fast-growing economy provides considerable impetus to the banking system. From FY 2016 to FY 2020, the credit off-take of the banking sector grew at a CAGR of 13.93%2. This is indicative of the pace at which the banking business is growing in the country.

Both public companies and large cap banking companies can be one of the investment avenues as they are vital to the core of the economy.

So, how can you invest in these sectors?

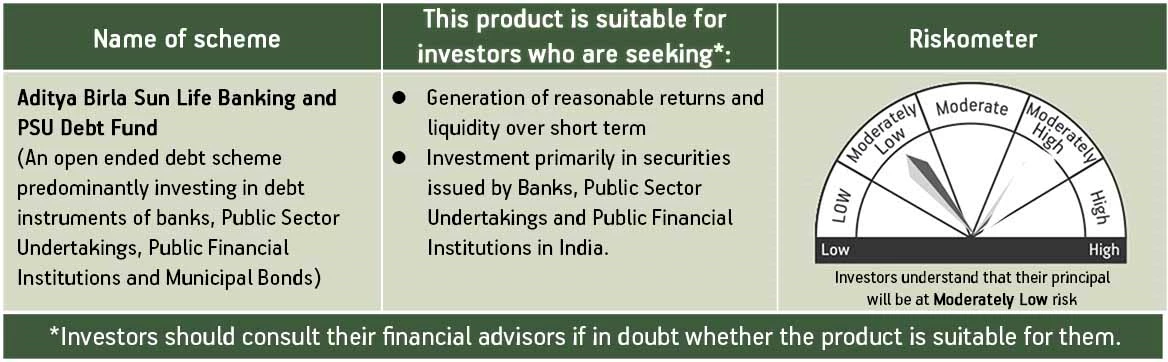

Aditya Birla Sun Life has an open ended debt fund – Aditya Birla Sun Life Banking and PSU Debt Fund that provides an investor with a combined portfolio of bonds of PSUs and PFIs as well as securities issued by Banks. The Scheme will invest in securities issued by banks and financial institutions across maturities with an intention to offer reasonable level of yields at lower levels of risk while maintaining sufficient portfolio liquidity. Aditya Birla Sun Life Banking and PSU Debt Fund could be one of the avenues to make a diversified investment in this sector.

About fund investment strategy

The fund manager will focus on credit quality as an important criterion for investment decision making. The Fund will typically invest in short to medium term securities and as a result significant proportion of the total returns is likely to be in the form of income yield or accrual. The general maturity range for the portfolio will be determined after considering the prevailing political conditions, the economic environment (including interest rates and inflation),the performance of the corporate sector and general liquidity as well as other considerations in the economy and markets.

When can you consider such investments?

The choice of investments for you is guided by your individual investment objective and strategy. The combined objective of, high liquidity at reasonable return levels, can make this fund one of the investment avenues for your short-term investments to park funds and earn reasonable returns.

To know more about this fund and to invest click here

Sources:

1. https://m.rbi.org.in/commonman/English/Scripts/BanksInIndia.aspx#rrb

2. RBI data - https://www.ibef.org/download/Banking-May-2020.pdf

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000