-

Our Products

Our FundsTop Performing Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Goal Planning Calculators

- Back

-

Shareholders

All you need to know about Corporate Bond Fund

Dec 02, 2019

5 mins

4 Rating

When it comes to debt, capital preservation is as important as capital appreciation

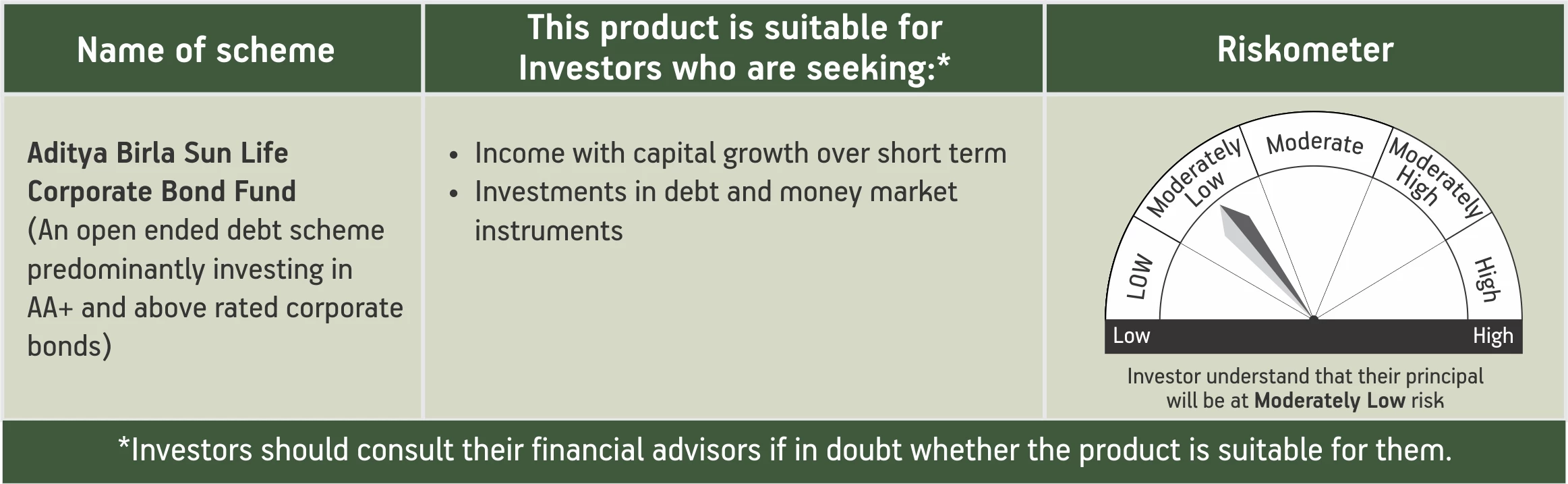

Thumb rule of investing says, “High Risk – High Rewards”. Often while investing you have to choose between safety and returns. But what if you don’t want to choose? Is there an option which could aim to give the best of the two worlds? There is. Aditya Birla Sun Life Corporate Bond Fund - An open ended debt scheme predominantly investing in AA+ and above rated corporate bonds.

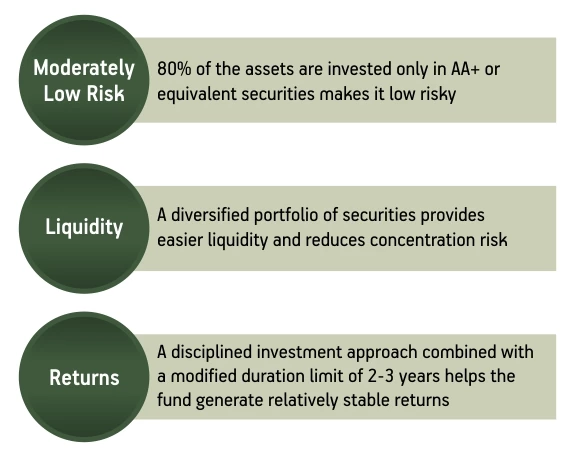

How does the scheme aim for reasonable returns with moderately low risk?

The credit goes to the strong framework which guides the entire investment and portfolio creation process.

Let’s now see why it could be a good time to invest.

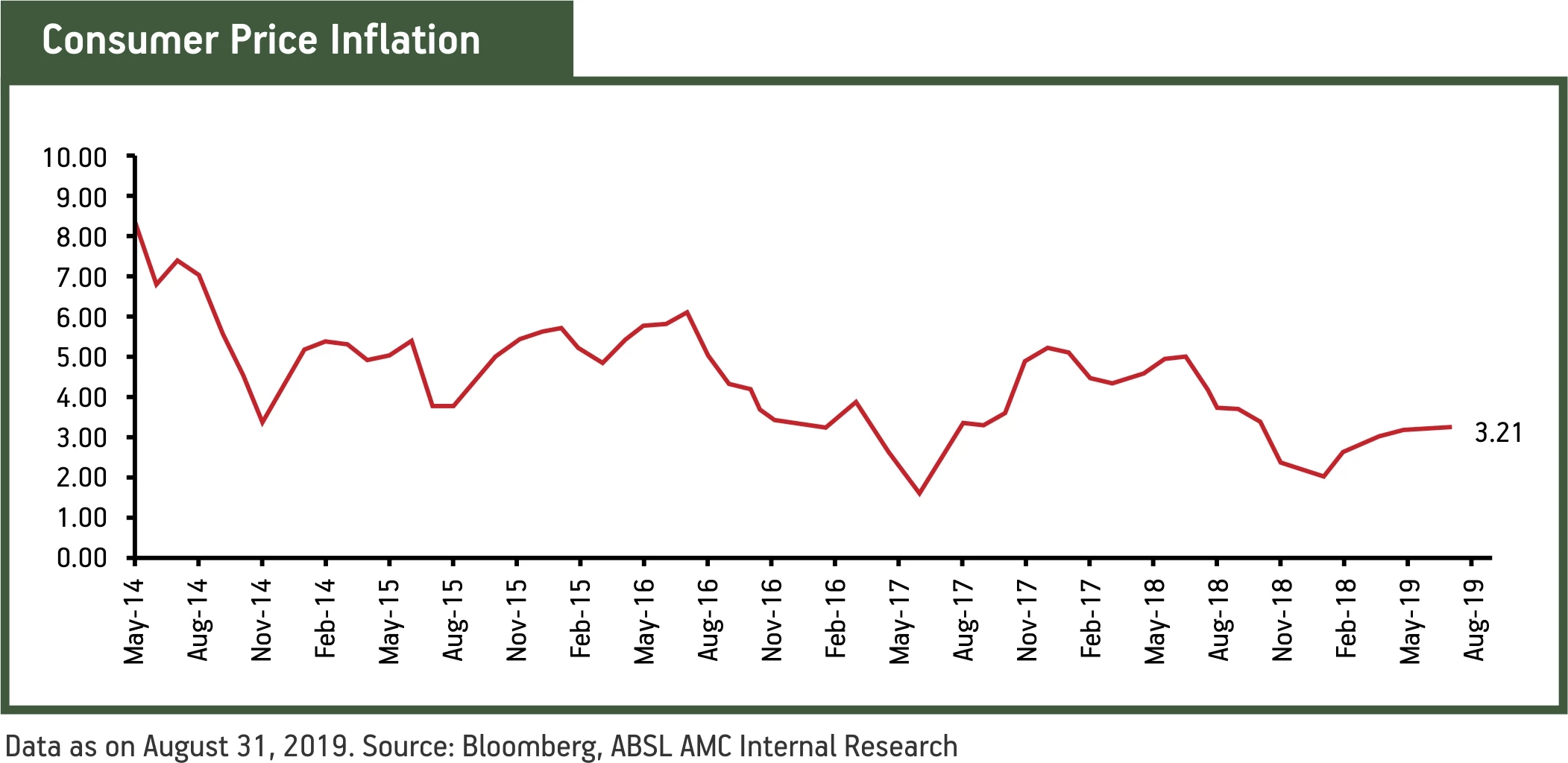

1. Possibility of uptick in inflation positive for short-term yields

Data indicates that inflation is slowly inching up. Food inflation rose to 2.99% in August 2019. Adding to the inflationary pressure are high crude oil prices.

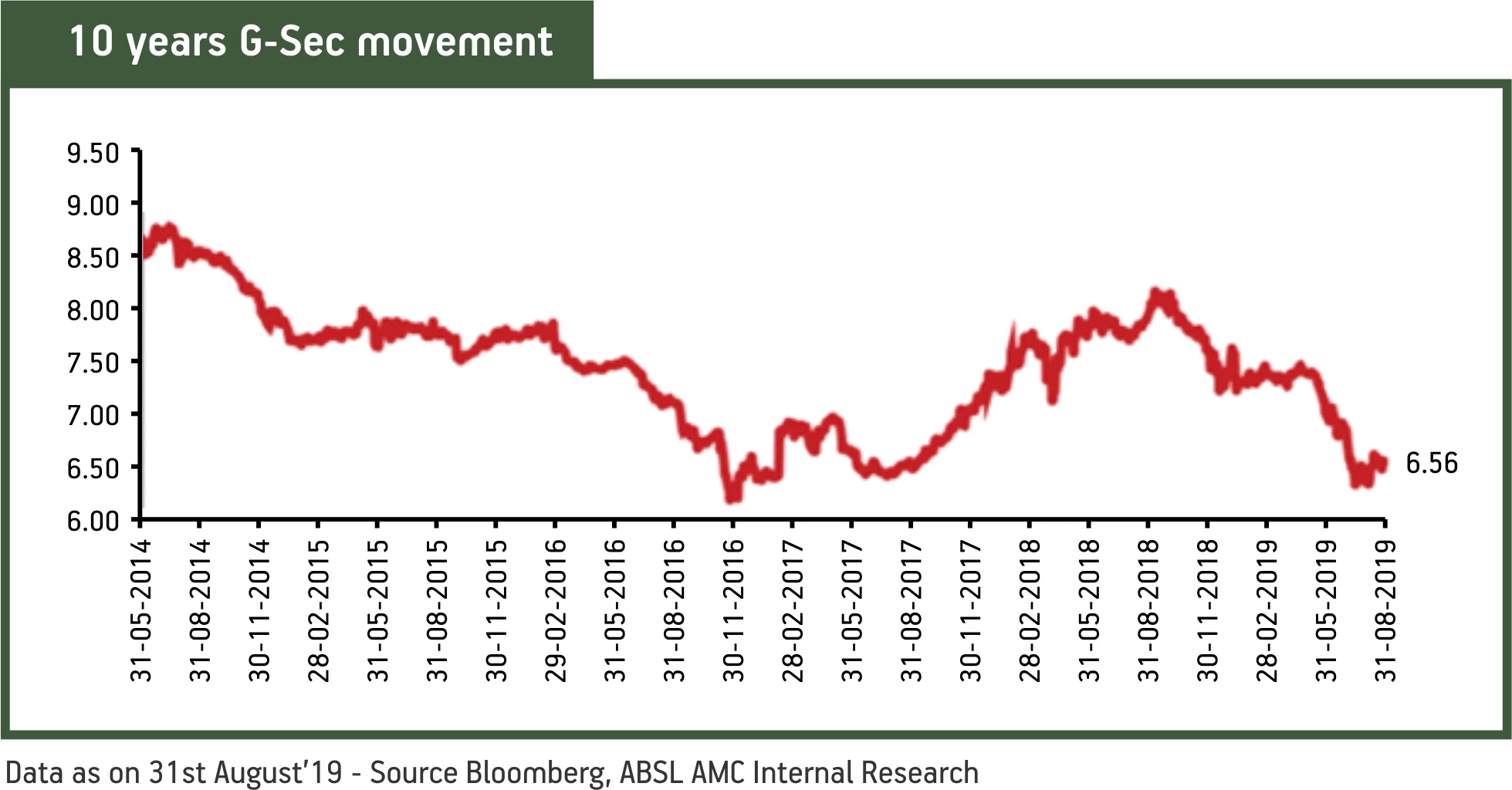

2. Macro-economic factors indicate it is time to lock –in the yields

Despite 4-consecutive rate cuts by RBI, the 10-year G-sec levels have remained elevated. This may change if RBI continues to cut repo rate in the year ahead to support slowing growth. Consequently, we could see downward pressure on the yield curve.

Moreover, data shows that real rates have peaked and are already declining. If inflation rises and repo rate continues to drop, it would lead to a rapid decline in real rates.

A quick overview of Aditya Birla Sun Life Corporate Bond Fund:

Positioning

- Predominantly follows accrual strategy with the endeavour to generate regular income

- Majority of the portfolio (80%+) is invested in AA+ and equivalent corporate bonds to ensure safety

Key features

- Invests in a mix of short to medium term corporate bonds and money market instruments

- Seeks to maintain a high credit quality and low risk portfolio

- Better tax efficiency compared to traditional products if investment held for more than 3 years as debt mutual funds have indexation benefit on long term capital gains

Who can invest in this fund?

- Suitable for conservative investors with an investment horizon of 1 year or more

- A good investment avenue to park short term lumpsum amount received such as annual bonus and PF

- Retired investors can invest their savings in this fund and start a systematic withdrawal plan (SWP) to meet their monthly expenses

For more information on the scheme, please refer Scheme Information Document/Key Information Memorandum of this scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000