-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

All you need to know about eOTM

Dec 23, 2022

3 min

3 Rating

Setting up an Online One Time Mandate (eOTM) is the simplest way to invest in mutual funds in India. It is a process where you allow your bank to deduct money from your bank account and invest that amount in a mutual fund. After the eOTM mandate is set up, the amount is invested without using any payment gateway.

It eliminates the trouble of attaching a cheque or routing the payment through a payment gateway, as well as remembering your debit card or net banking information.

In this blog, we will know all about eOTM.

What is OTM?

OTM is a one-time registration process that allows you to make lumpsum and SIP investments in mutual funds both offline and online with ease.

You allow the registered bank to debit up to a specific maximum amount per day, as per your decision (E.g., up to Rs.50,000 per day) towards investing in the mutual fund by registering the mandate. You can provide this mandate for a set period (for example, five years), or it can remain active until you cancel it.

Benefits of onlineOTM registration in mutual fund

It is simple to register for the OTM online.

It is a one-time process, and once you sign up for the service, you are done.

You can register eOTM for lumpsum and Systematic Investment Plan (SIP).

After OTM registration, you can set up new SIPs within a few days.

The money transfer will be done safely, and there will be no surprises.

There is no limit to how many SIPs you can register under a single OTM. Make sure, however, that the total value of all SIPs stays well within the set restrictions.

An OTM transaction will also not fail because of technical issues. On the other hand, standard online transactions may fail because of payment gateway issues.

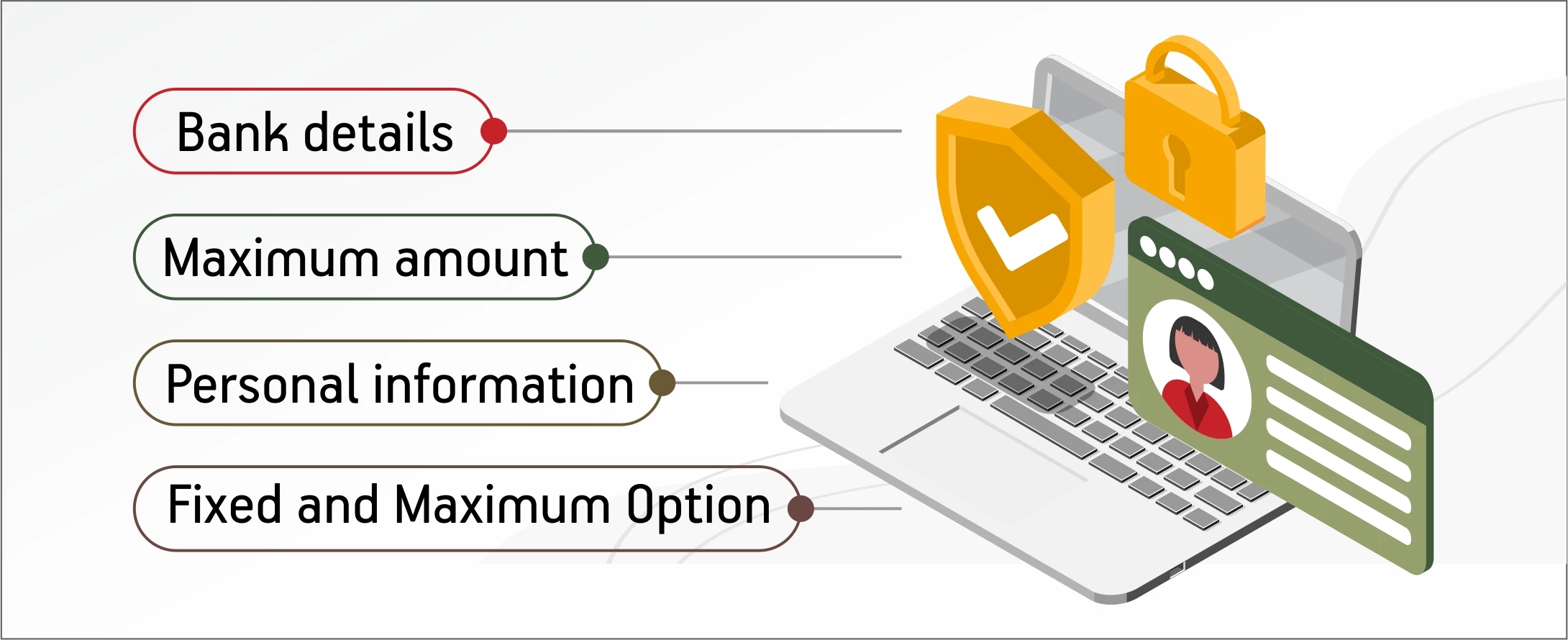

Things to consider during OTM Registration Process

The one time mandate in a mutual fund is simple. Here are some of the aspects that you need to keep in mind before enrolling for eOTM.

Bank details: You need to add your bank account details such as the bank's name and the branch where you hold an account. You'll also need to provide the IFSC code.

Maximum amount: You must choose a maximum amount that the mutual fund can debit from the bank without requiring you to log in to your net banking portal, key in your debit card details or attach new cheques. This amount may be greater than your SIP contribution or lumpsum payment. It is better to have a higher maximum amount as your investments may grow as your income grows with time.

Personal information: This comprises your contact information and the names and signatures of all account holders of the bank account. You must supply the folio number and the debit amount of choice when making an investment.

Fixed and Maximum Option: You can choose between fixed or maximum options when enrolling for the e-OTM process. The fixed option is better suited for SIP investment, while the latter is better suited for lumpsum payments. You should also specify the frequency, such as monthly, quarterly, half-yearly, or as needed. However, it is better to go for the maximum option as you can invest at your convenience.

Click Here to calculate the sip

Conclusion:

One Time Registration(OTM) registration in a mutual fund is a safe process involving your bank and mutual fund. If you want the ease of investing in a mutual fund of your choice without having to go through the same formalities over and over, online OTM may be the best option for you.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000