-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

An Early Start Leads the Pack

Jan 30, 2020

3 mins

4 Rating

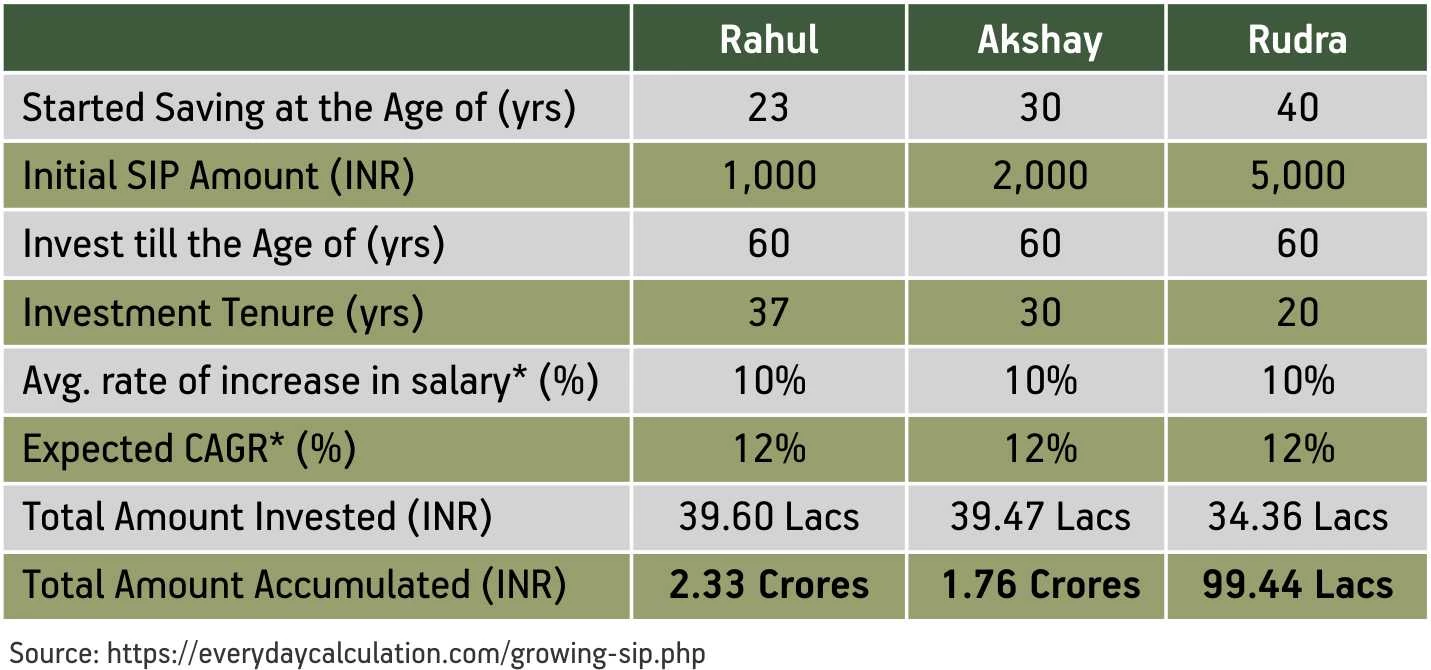

Rahul – The Early Bird

Recently joined his first job at a Pharma company as a Management Trainee. Like most of his friends, Rahul has made a long list to splurge his first salary of INR 25,000 – gifts for his family, a new smart watch and so on.

On the insistence of his father, he starts an SIP of an amount equivalent to his one day’s salary as a gift to his father. His father also asks him to continue this ritual of saving his one day’s salary every month for the next 37years till he turns 60.

Akshay – The Procrastinator

A 30-year old advertising professional working at a managerial position. He currently draws Rs. 50,000 salary per month. Busy with work, finance is boring, no money etc. were few reasons for his procrastination.

Recently he met a financial planner in his office during an event who introduced him to world of investments. He has now started a monthly SIP with an amount equal to his one day’s salary as advised by his planner.

Rudra – The Late Riser

Working in the financial services sector and recently got promoted as a Vice President. On his 40th birthday, together with his wife, he decided to start investing as they will be approaching retirement in a couple of decades.

Since he already has huge fixed monthly expenses in form of EMIs, Kids school fees etc., Rudra decided to start saving an amount equivalent to his one day’s salary every month in equity mutual funds via SIP towards his retirement goal.

The above table is for illustration purpose only. *The rate of increase in salary and CAGR have been assumed for the ease of calculation. Please note these two figures have been kept same for all of them to see how power of compounding works over longer periods of time keeping everything else same.

As you can gauge from the above table, Rahul started with the smallest investment amount, yet he accumulated the most at the end. For Akshay and Rudra, delaying the investing decision by few years led to huge shortfall in the wealth accumulated at the end. This is the power of starting early and staying invested for long term in equities through the thick and thin of markets.

As the saying goes, early birds eat the worms, investments can also grow enormously if started early in life and given ample time to grow.

Start early to make the most!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000