-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Are you planning to liquidate your mutual funds? Here’s what you need to know

Jul 21, 2022

3 Min

4 Rating

Investing in mutual funds is one of the most favourite topics, however, redemption gets less attention. It is important to remember that redemption or selling of mutual funds occurs with equal frequency. Mutual fund redemption can be a tricky business, you will have to ascertain if the time is right or not. Here we intend to talk about the aspects that you should be aware of before you liquidate or sell your mutual fund holdings.

Market phase:

The most important factor is mutual fund redemption time. The value of your mutual fund holding will change every day and depends on the phase of the market. If the markets are at troughs, it may be advised that you hold on to your position for longer before a turnaround happens. To avoid such a situation, you can start transferring your investment to a safer avenue in a staggered manner a year before your actual money requirement. This can be done with the help of Systematic Transfer Plan or Systematic Withdrawal Plan.

Cut-off time for mutual fund redemption:

There is another connotation to the mutual fund redemption time, it is the cut-off timing for investing and redemption of mutual funds. This restriction decides the NAV at which the mutual fund redemption on your holding will be carried out. Liquid, debt and equity funds all of the funds have different timings. You must check the cut-off timings for the mutual fund redemption that you have initiated.

Mutual fund redemption days:

While the open-ended funds can be redeemed anytime during the year, a close-ended scheme such as ELSS has a lockin of 3 years. You will be unable to redeem it until the lock-in is over. There are other funds which are close-ended with specific windows which are indicative of mutual fund redemption days. Read through the scheme details to understand such clauses and process your mutual fund redemption at the right window.

Mutual fund redemption request:

You can initiate the mutual fund redemption process either by submitting a physical request in the form of a mutual fund redemption request form with the fund house. Alternatively, the mutual fund redemption online mode could be used wherein you can use your Demat to proceed with your redemption which happens merely with a click of the button.

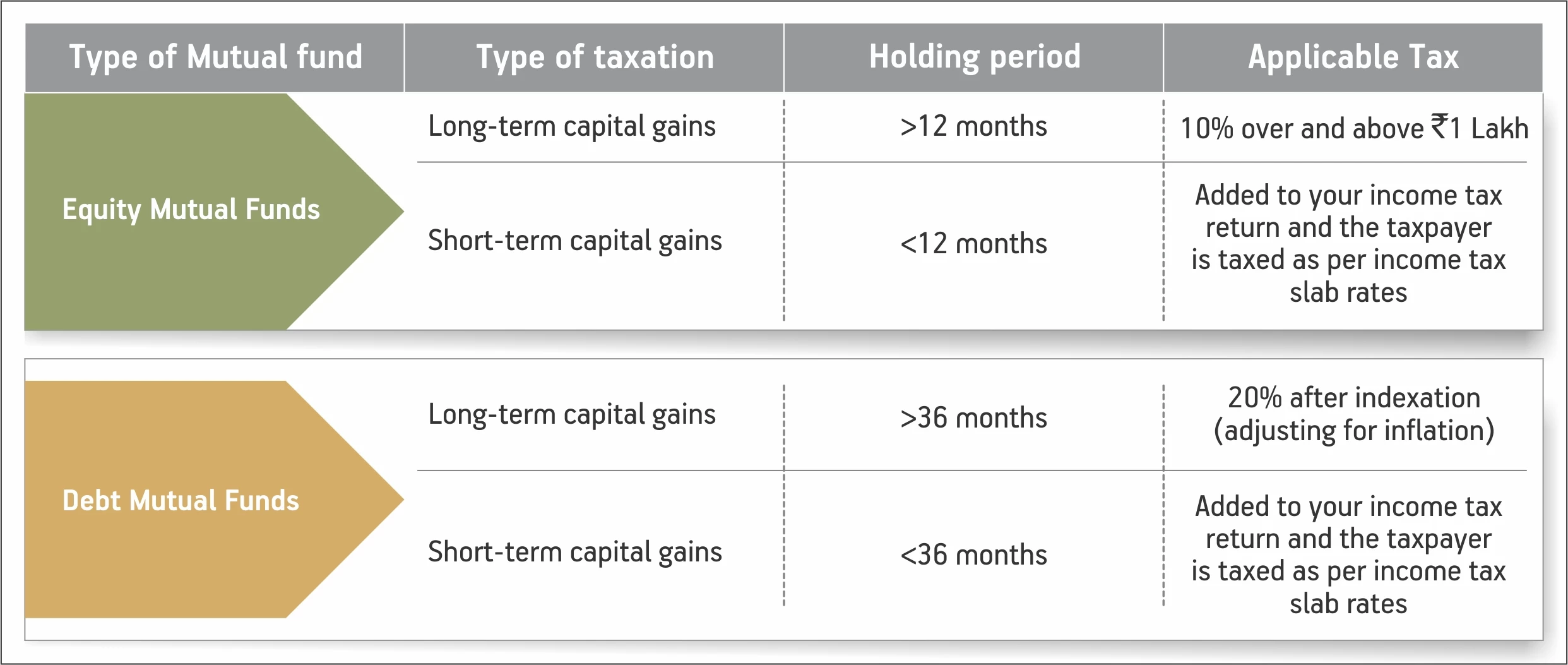

Taxability on redemption:

The returns that you earn from mutual fund redemption are subject to taxation under the capital gains head. The tax treatment for debt mutual funds and equity mutual funds is different. Remember to assess the taxability whilst you initiate your mutual fund redemption process.

Click Here to know What is ITR?

Mutual fund redemptions can be stressful if you do know the nuances. This note will help you gather enough ideas to ensure that your mutual fund redemption happens seamlessly and in terms favourable to you.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000