-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

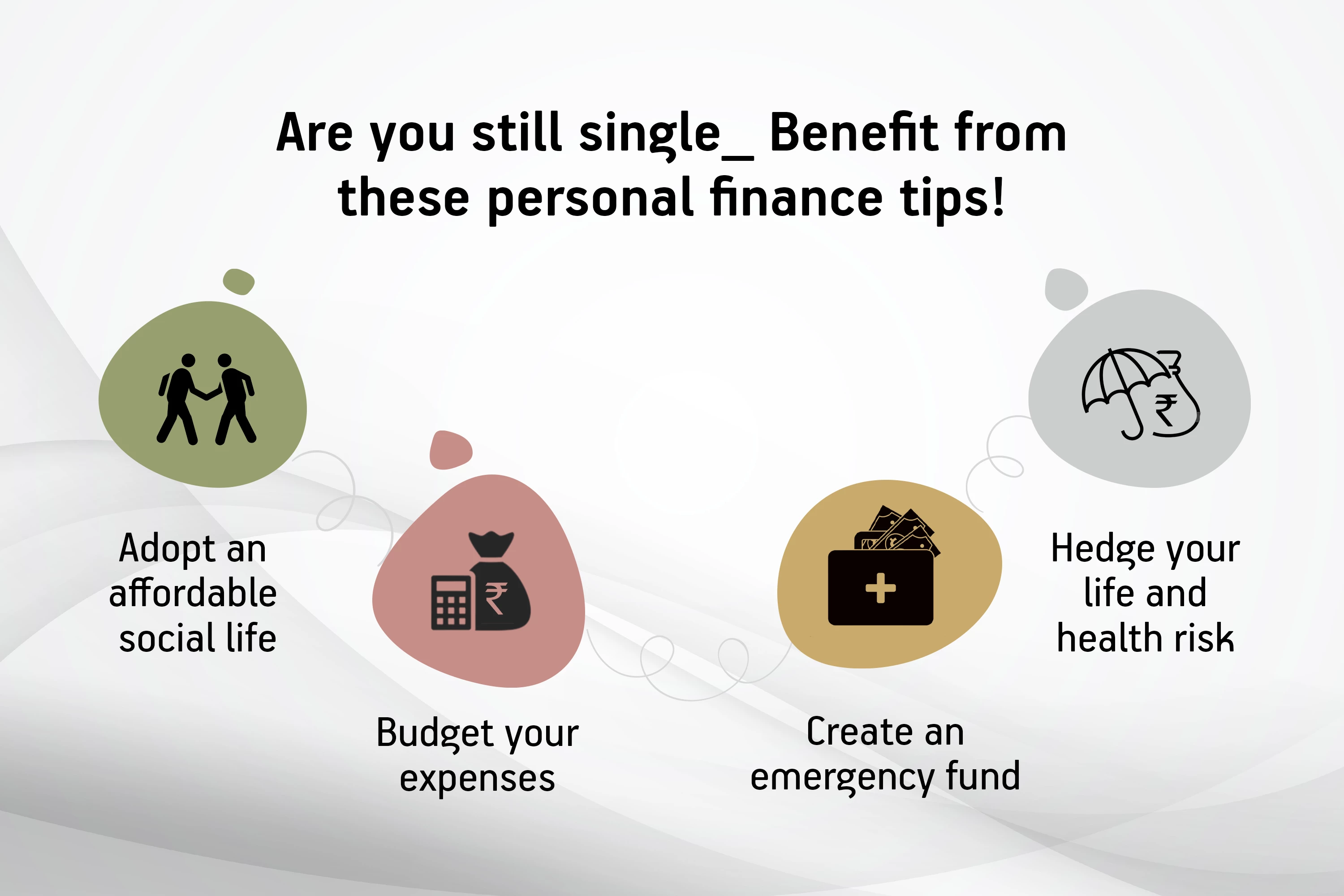

Are you still single_ Benefit from these personal finance tips!

Sep 15, 2022

5 min

4 Rating

While you are single, personal financial planning is probably the last thing on your mind. It may seem like investing is a futile effort. Partying hard, date nights, watch and chill and takeout dinners are probably the norms. However, as you step into the world of financial independence, it is important to be responsible for your finances. These per-sonal finance tips can go a long way in inculcating healthy money habits that enable you to manage your money effi-ciently.

Adopt an affordable social life:

Often singledom thrives on social life. This could make you fall easily into the trap of expensive dinners and drinks. Choose your company wisely and budget you’re spending on such outings. Look for deeper friend-ships which will last a lifetime. While it is important to have fun, it should not become a bane and lead you into a debt trap in the future.

Budget your expenses:

The easiest way to reduce your spending is to be aware of the items you spend your money on. Often, cut-ting back on your expenses sends people into a frenzy. They may view this as a way in which life would rad-ically change. However, budgeting your expenses will only curtail your impulsive spending and put a tab on the subscriptions you have overlooked over time. These savings can be conveniently routed towards in-vestments which will help you build a sizable corpus over the long haul.

Create an emergency fund:

Being hale and hearty and with your recent financial freedom, emergency does not seem to find a place in your agenda. However, in this era of youngsters developing medical conditions, lifestyle illnesses and los-ing jobs at the drop of a hat, it calls for an emergency fund. This rainy day fund should hold about 3-6 months of funds to cater to your household /lifestyle expenses. This could come in handy for any form of loss of monthly income. However, this has to be individually assessed to understand the exact require-ment. You also need to accommodate scenarios of reduced income, which became quite the norm during the recent pandemic.

Hedge your life and health risk:

Even though you may be offered group insurance by your employer, assessing the quantum of life cover needed for yourself is important. This should be a function of your current health condition, the number of dependents and their goals. The pandemic taught us an important lesson: assess the coverage and ensure that it caters to unforeseen health conditions and price escalations that we saw in the past. Buying ade-quate life insurance and health insurance is a very important aspect of personal financial planning that you should not ignore.

Also understand : What is Hybrid Fund?

Implement these personal finance tips to initiate your journey to successful investing life while you are still single. This will be your stepping stone for a comprehensive personal financial planning journey that you will embark on in the future.

Click Here to know more about the mutual funds

Also Read:

What is Mutual Fund

What is SIP?

What is Equity SIP?

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000