-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABC Solution

Loans

Insurance

Aditya Birla Sun Life AMC Limited

Aditya Birla Sun Life AMC Limited

Enter your details to visit our Metaverse

Enter valid first name

Enter valid last name

Enter valid email

+91

Enter valid mobile number

Enter valid otp detail

Select internet speed

Select privacy policy

Form Error

- Personal

-

Corporates

-

-

Advisors

-

Protecting

Financing

Advising

-

- Careers

- Mutual funds

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

1-800-270-7000 within india | +91-080-45860777 outside india | care.mutualfunds@adityabirlacapital.com -

- Downloads

- Learnings

- About Us

- Calculator

- Shareholders

-

Our Products

-

Our Funds

- All Funds

- Our Unique Solutions

- Our High Return Funds

- Aditya Birla Sun Life PSU Equity Fund

- Aditya Birla Sun Life Nifty Smallcap 50 Index Fund

- Aditya Birla Sun Life Pure Value Fund

- Aditya Birla Sun Life Infrastructure Fund

- Aditya Birla Sun Life Pharma and Healthcare Fund

- Aditya Birla Sun Life Small Cap Fund

- Aditya Birla Sun Life Midcap Fund

-

Solutions & Categories

-

-

Self Care

-

Self-Service

-

Find Information

-

Ways To Transact

Contact Us

-

-

Downloads

-

Learnings

-

About Us

-

Calculator

- Shareholders

Aditya Birla Sun Life AMC Limited

Asset Allocation – The Investing Mantra in Today’s Time!

May 29, 2020

| Views 10489

Devising an investment strategy is a perennial issue for most investors. We are going through uncertain times, making formulating an effective investment strategy an even bigger challenge. The fundamental objective of investing is to maximise return with the minimum possible risk.

Diversification in investing is one of the established means aimed at reducing investing risks while aiming to earn returns; asset allocation is essentially diversification at a macro level.

Asset allocation – an evergreen investing mantra!

Asset allocation involves achieving a combination of asset classes in an investment portfolio aiming to balance investor’s return expectation with risk appetite. Investors differ in their investing strategy and goals and thus their asset allocation also differs. A retired senior citizen for example is likely to be a more conservative investor and will look for a higher proportion of debt in his asset allocation, whereas a young professional may look for a more dynamic investing style with a higher allocation towards equity.

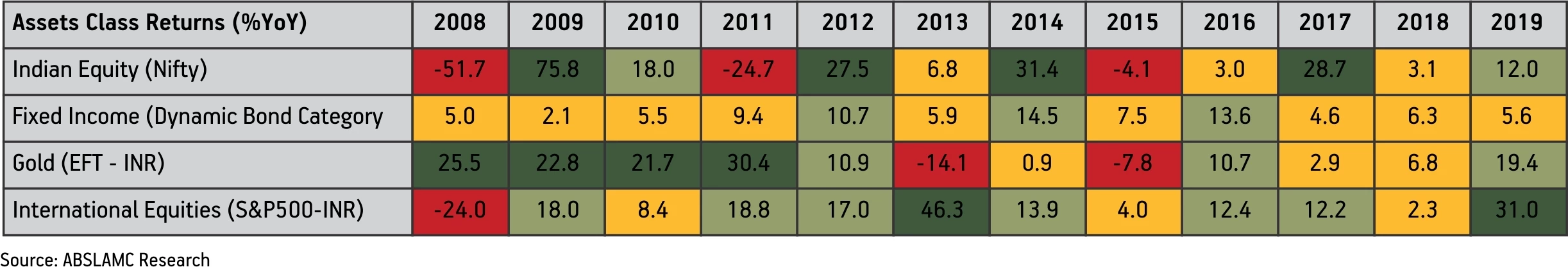

Different asset classes offer different return cycles at different periods of time, so asset allocation seeks to benefit from different return cycles of different asset classes.

A quick look at the snapshot of returns earned by various asset classes over the last 10+ years demonstrates how different assets can complement each other i.e.: when one asset class is severely underperforming another asset class may overperform resulting in a balance in the overall portfolio return.

…. and an evergreen challenge as well!

While asset allocation seems to be the investing mantra today - is an efficient asset allocation easy to achieve? Well, there is no ‘one size fits all’ when it comes to asset allocation – neither to all investors nor across all investing cycles. What constitutes the correct mix depends on many variables – investor age, financial position, goals, risk appetite and many more.

So, how does an individual investor, especially a novice investor carry out an extensive research across asset classes to zero in on the correct mix? Especially when asset allocation, comes with its fair share of challenges:

Assessing co-relation of asset class to market cycles

Assessing tax implications of different asset classes in your portfolio

The need for constant review and rebalancing, to take prudent switch in and switch out decisions

Is there any investment avenue to ease this challenge?

A Fund of funds (FoF) is one such investment solution that can lead the way to an effective asset allocation. One such FoF that focusses on asset allocation is Aditya Birla Sun Life Asset Allocator Multi Manager FoF Scheme - an open ended fund of fund scheme investing predominantly in equity schemes, Exchange Traded Funds (ETFs) & debt schemes.

Aditya Birla Sun Life Asset Allocator Multi Manager FoF Scheme invests in different mutual fund schemes that invest across asset classes. This scheme invests primarily across 4 asset classes – Domestic & International equity with an aim to achieve growth and capital appreciation and Debt & Gold ETFs with an aim to provide stability and liquidity to the fund.

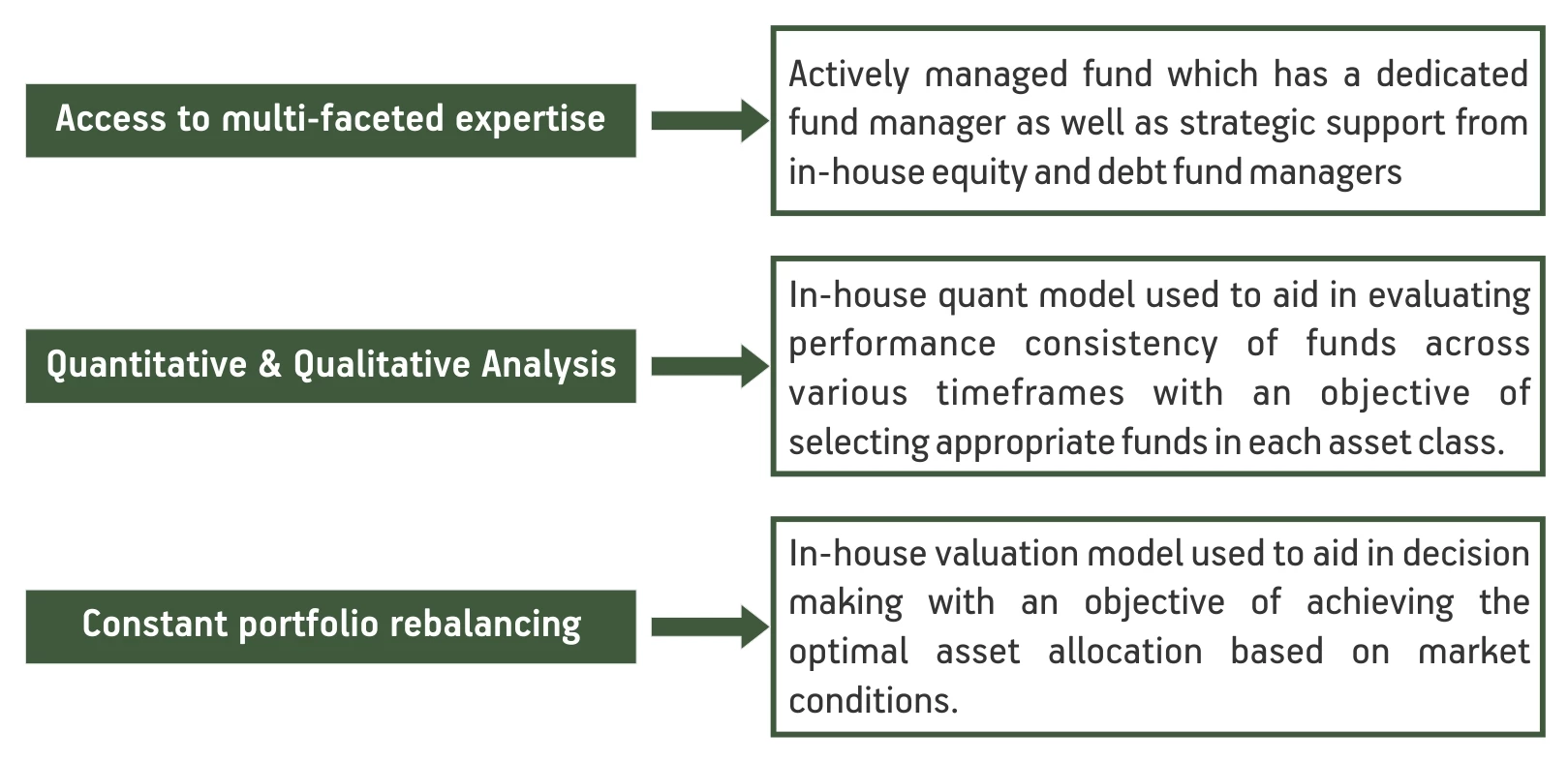

How does Aditya Birla Sun Life Asset Allocator Multi Manager FoF Scheme drive its asset allocation strategy?

To conclude, Aditya Birla Sun Life Asset Allocator Multi Manager FoF Scheme allows investors to tap into a diversified portfolio of schemes with different underlying assets with an aim to earn reasonable risk adjusted returns by taking advantage of negative correlation between various asset classes.

Hence, from a small start to a large corpus, SIP or lumpsum, the Aditya Birla Sun Life Asset Allocator Multi Manager FoF Scheme can be one of the options in the quest for efficient asset allocation!

Note: Investors are bearing the recurring expenses of the Scheme, in addition to the expenses of other schemes in which the Fund of Funds Scheme makes investments.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Rate this

Rate this Article

Our Experts

Our Experts

Tools and Calculator

Tools and Calculator

RSS News Feed

RSS News Feed

Archives

Archives

Close

Hover to Zoom

1800-270-7000

1800-270-7000

Thank You

Message will change according to your requirement.