-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Set It and Forget It: Let an Asset Allocator Fund Do Your Investment Thinking for You

Jan 17, 2025

5 min

4 Rating

Investing in financial markets is like navigating a constantly shifting landscape. Prices rise, fall, and sometimes stall, creating a rhythm that’s challenging to predict. For those aiming to make the most of these movements, managing investments can feel like a full-time job. Between monitoring market trends, rebalancing portfolios, and managing risks, it’s a lot to handle.

We present infrastructure index funds, an investment option that can capitalize on this growth potential. These funds offer an accessible way for investors who want to be on this growth journey of India’s economic transformation.

What if you could enjoy the benefits of market growth without having to watch every tick on the screen?

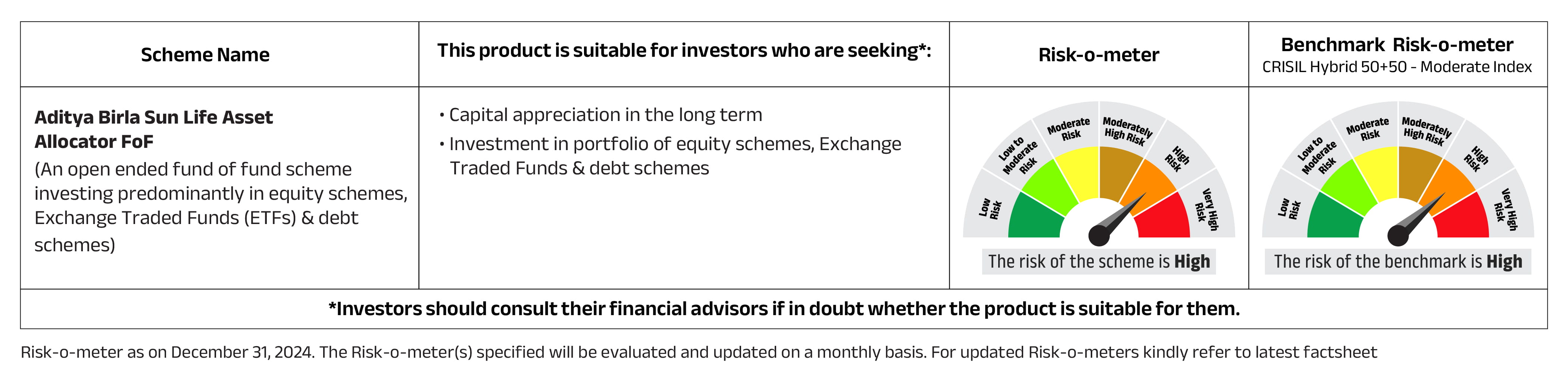

That’s where smart investors shine—they set their portfolios in motion and let their investments do the thinking for them. The Aditya Birla Sun Life Asset Allocator FoF offers an innovative way to automate and optimize your investment journey. By diversifying across asset classes such as equity, debt, and commodities, this fund does the hard work of balancing your portfolio for you.

Let’s dive into how this fund works and why it’s a great addition to your financial strategy.

What Is an Asset Allocator Fund of Fund?

An Asset Allocator Fund of Fund is designed to simplify and streamline your investments. Rather than investing in individual stocks or funds, an Asset Allocator Fund of Fund pools your money and allocates it across a mix of mutual funds, Exchange Traded Funds (ETFs), and other asset classes like equity and debt.

The Aditya Birla Sun Life Asset Allocator FoF takes this one step further by optimizing your portfolio based on market conditions. The fund manager aims to continuously adjusts allocations to ensure your investments are aligned with assets that show strong growth potential.

How Does the Fund Think and Operate?

Curious about how this fund works behind the scenes? Here’s the breakdown:

Dynamic Asset Allocation:

The fund manager evaluates market conditions to determine the optimal mix of asset classes—equity, debt, and commodities like gold and silver. For example:

During a bull market, equity exposure may increase to capitalize on growth opportunities.

During market downturns, allocations might shift toward debt or commodities, which act as a hedge against volatility.

Incorporating Gold and Silver for Stability:

Gold and silver have historically served as safe havens during periods of market volatility or inflation. By including commodities, the fund provides an added layer of diversification, helping your portfolio withstand any slowdowns in equity market.

Commodities also benefit from global demand-supply dynamics, making them a good investment alongside traditional asset classes.

Diverse Exposure to Mutual Funds and ETFs

The fund invests in a combination of:

Equity mutual funds: These include large-cap, mid-cap, small-cap, and thematic funds, each offering a unique investment style.

Exchange Traded Funds (ETFs): These passive instruments mirror the performance of underlying indices or assets.

Debt schemes: These can add stability to the portfolio by balancing the risks associated with equity investments.

Multiple Investing Styles

This fund doesn’t rely on a single strategy. It incorporates active and passive investing approaches:

Active investing: Actively managed equity mutual funds aim to outperform the market by identifying growth opportunities.

Passive investing: ETFs track indices or asset prices, offering a low-cost way to match market performance.

With such a diversified approach, your portfolio benefits from multiple strategies working together, reducing risk and enhancing the potential for long-term returns.

The Beauty of the “Set-It-and-Forget-It” Strategy

Investing for the long term is about letting your money work for you. Constantly monitoring market trends and adjusting your investments can be exhausting. Instead, an Asset Allocator FoF lets you automate diversification and take the guesswork out of investing.

When you combine this strategy with a Systematic Investment Plan (SIP), you ensure regular contributions to your portfolio across all market cycles. This approach not only helps mitigate the impact of market volatility but also promotes disciplined investing.

The Aditya Birla Sun Life Asset Allocator FoF is particularly suited for long-term goals, such as retirement or wealth creation over 10-15 years. By blending dynamic asset allocation with the convenience of SIPs, this fund helps you combine the efforts of different asset classes in long term wealth creation.

Why This Fund Makes Sense for Your Portfolio?

While no single fund can replace a well-diversified portfolio, the Aditya Birla Sun Life Asset Allocator FoF could be a good start towards diversification. It automates your exposure to multiple asset classes, making it ideal for investors who:

Seek long-term capital appreciation.

Want to minimize the complexity of managing diverse investments.

Are looking for an investment solution that automatically adjusts to the market movement.

Think of it as a starter platter at a restaurant. Instead of picking individual dishes, you get a little of everything—a taste of different asset classes, styles, and strategies. This includes equity, debt, and commodities like gold and silver. Once you understand your preferences and risk appetite, you can customize your financial journey by adding more focused investments to your portfolio.

Your Next Step: Automate and Relax

The Aditya Birla Sun Life Asset Allocator FoF simplifies investing by offering a solution for diversification and growth. Its dynamic allocation across equity, debt, and commodities like gold and silver ensures your money is always working for you, no matter the market conditions.

Ready to set it and forget it? Start a long-term SIP in this fund today and enjoy the peace of mind of smart investing.

With this fund in your portfolio, you can focus on living your life while your investments grow. After all, the best investments are those that let you enjoy the journey, not just the destination.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000