-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Banking and financials: Where is the sector headed?

Oct 08, 2021

5 min

4 Rating

Dhaval Gala

Dhaval Gala

The Indian financials sector is well-positioned for a rebound with the Bank Nifty index underperforming in year-to-date period (-700 bps vs. Nifty index), even as there are early signs of credit revival. Today, the listed Indian financials sector largely comprises of lenders – private banks, PSU banks, non-bank financial companies (NBFCs), as well as non-lending financials (NLFs) - life insurance, general insurance, asset management companies, rating agencies, capital market companies. The arrival of fin-tech players in the listed space will enhance the sector play further.

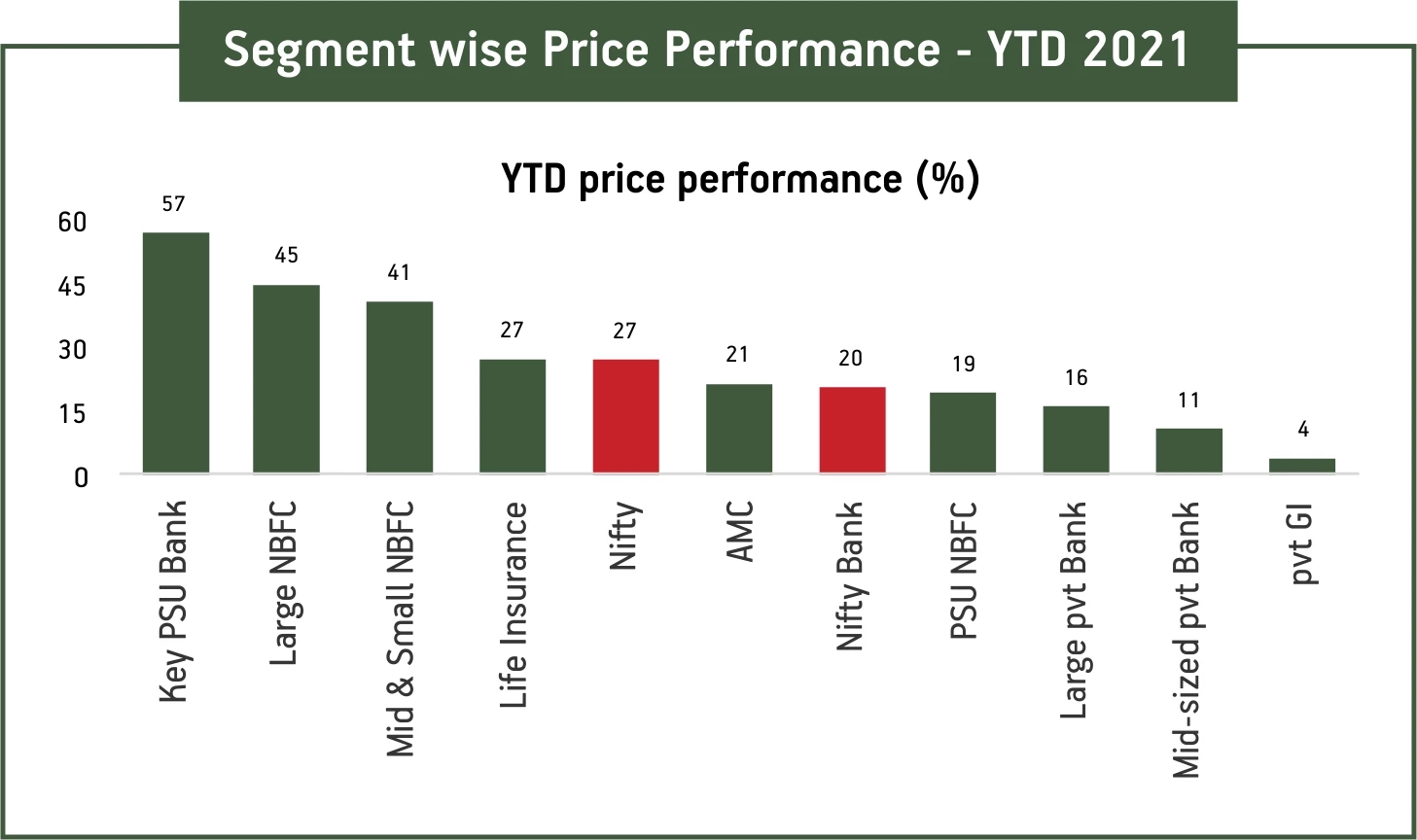

Segment wise Price Performance – YTD 2021

Source: NSE, Research

The reason for the underperformance of financials sector could be COVID-19. Can the rising prominence of fin-techs and possibility of disruption be another reason? More on that later.

In a sector that is constantly in a state of transformation (new emerging players, new segments) and has the potential for a secular growth, I believe its current underperformance is an opportunity.

A graphic at the end of the blog will explain how market caps in banking and financials segment have evolved over the years.

First, let’s look back at what has happened recently - 1QFY22 and implications of COVID-19:

-

Banking is a business with long-term drivers tied to economic prosperity, income growth and spending capacity. Bank failures are mostly caused by liquidity issues and poor capital levels. The COVID-19 cycle showed that bank managements have learnt their lessons. We have seen banks raising capital through equity to shore up the capital buffers, without being fixated on the equity price.

-

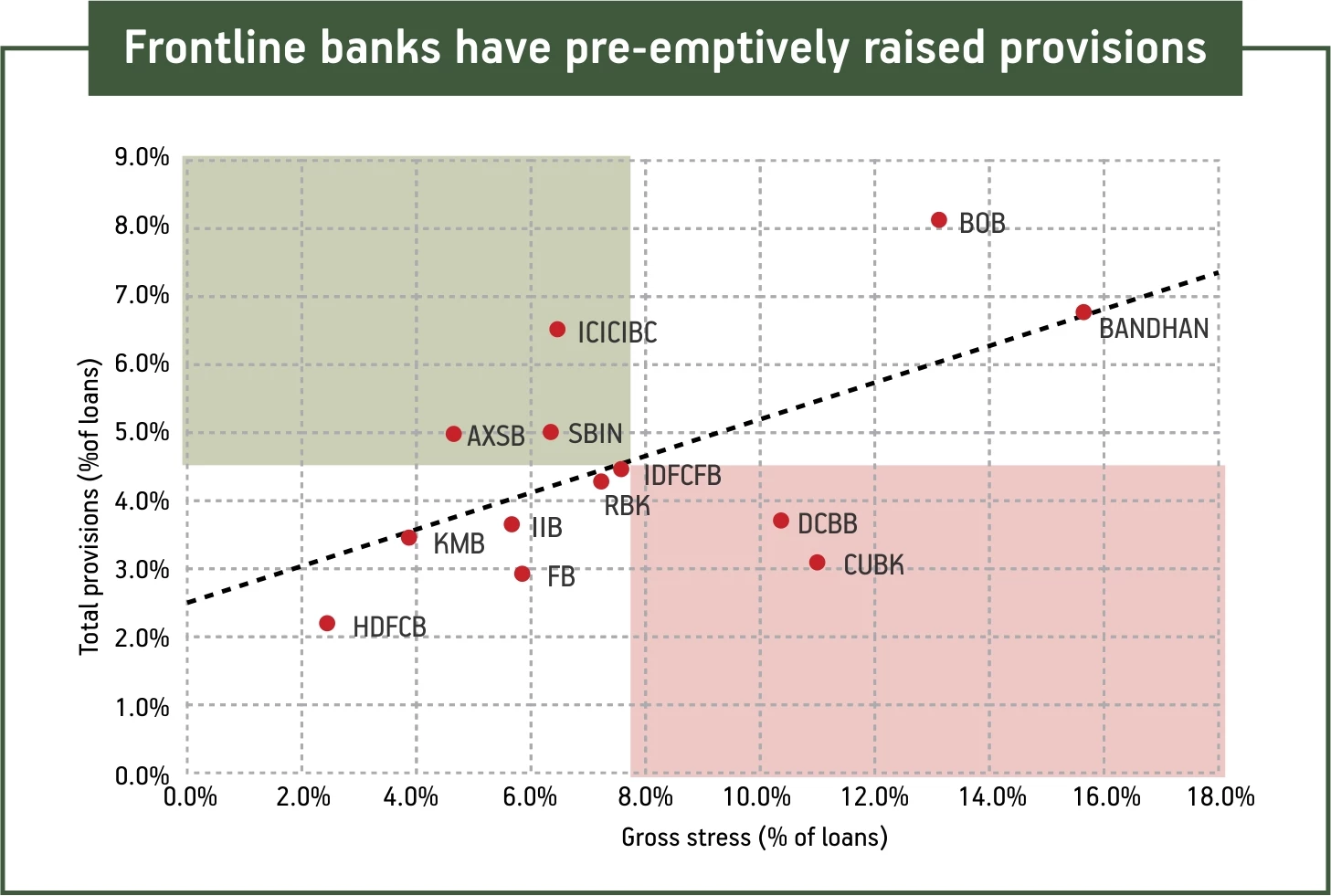

Banks have also transparently and pre-emptively increased provisions without trying to hide the problems. Provision coverage ratio for the banking system is at an all-time high (~69% across). As a result, the expansion in Return on Asset (RoA) has been faster (between 1QFY21 and 1QFY22). On a sequential quarterly basis as well, 1QFY22 fared better than 4QFY21 with aggregate banking system RoA improving to 0.71% from 0.58%. Interestingly, the larger upward shift in RoA was also noticeable in PSU banks, excluding State Bank of India.

-

Recovery in corporate asset quality has helped during COVID-19: Corporate asset quality continues to hold up well with little increase in delinquencies through both waves of COVID-19. As profitability has improved in stressed sectors such as metals, power, corporate leverage has reduced.

-

Bank NPAs lower than March-2020 levels: Even as NPAs in retail loan book rose on the back of the two waves of COVID-19, recovery in corporate asset quality has helped bank NPAs to be contained at ~8% vs 8.7% in March-2020. The slippages ratio (percentage of standard loans turning into NPAs) in 1QFY22 was at ~1%, primarily in consumer loan book with large banks again faring better. Smaller private banks and PSUs saw stress in 3-4% of their consumer loan books. Segments such as microfinance loans and commercial vehicle loans were relatively more impacted. At an aggregate level, COVID restructuring is around 2% of loans – not a lot against the backdrop of pandemic.

Large Cap banks have pre-emptively raised provisions

Source: Research, Banks data, Gross stress include GNPL, Restructured loans.

Better growth visibility:

The banking sector is already seeing growth rebound, as reflected in the retail loan growth. Unless there are any major economic impact from the pandemic, this growth should continue in coming quarters. After a long phase of consolidation in credit growth (8% average growth over FY15-21 from 20% average growth in FY05-15), we expect the Indian banking system to start growing its loan portfolios over the next few years, driven by:

(1) growing demand for working capital loans as capacity utilisation improves across industrial plants. We have already seen select capex announcements totaling US$58 billion by various companies in recent months,

(2) government incentives for infrastructure and domestic manufacturing, with the National Infrastructure Pipeline envisaging US$1.5 trillion of spending over the next 5 years,

(3) deepening penetration in retail lending as India still has one of the lowest retail penetration, and

(4) improving risk-appetite due to the reducing cost of credit and strong capital adequacy ratios of banks.Another meaningful growth engine could be digitization and the focus on mobile banking apps. Case in point, is SBI's YONO app, which mobilised US$2.8 billion of personal loans in FY21 and has one of the largest market shares in unsecured lending.

Buy-Now-Pay-Later (BNPL) facility could further drive the growth in unsecured retail loans given (1) BNPL would increase the credit penetration (fin-techs on-board 29% of new-to-credit customers). BNPL Gross Merchandise Value (GMV) could be $35 billion by FY26 and could add upto 50 million customers to the credit base. If executed well, BNPL could add a market cap of US$60 billion- US$70 billion to the financials sector.

What lies ahead?

We think 2HFY22 could see strong momentum in recoveries, credit growth and market share gains, especially for large lenders with well-established distribution networks.

Large lenders continue to gain market share: We expect the private sector banks’ story of market share gains to continue. Over the past five years, PSU banks have lost ~10% of loan market share and ~8.5% share of deposits. We expect banking profitability is set to improve (across Private/PSU banks) as credit costs moderate, digital push improves operating leverage leading to improving loan growth. Select NBFCs – HDFC and Bajaj Finance have also seen significant market share gains.

Non-lending financials (NLF) - a structural growth story, play on financial savings: There have been multiple listings in the NLF segment over the past five years. It has evolved into a large sector within financials, with market cap of over US$80 billion. The segment consists of life insurance, general insurance, asset management companies, broking and capital market companies. This segment has emerged as a space that offers a great combination of growth and certainty at reasonable valuations. In the life insurance space, Indian life insurance companies have demonstrated lowest sensitivity of Embedded Value (EV) & Value of New Business (VNB) to interest rates when compared to global life insurance companies. Moreover, the quality of their investment portfolio has held through thick-and-thin of asset quality cycles in India. This has helped in ensuring that investors see them as solid avenues to manage long-term savings and seek protection. In general insurance, ICICI Lombard / Bajaj Finserv has also delivered steady growth and profitability. The asset management and capital market space has also delivered steady growth and offer play on financialisation of savings in India and scope for shift in savings from traditional modes like bank deposits to capital market-linked products like equity, mutual funds, etc. This segment is not only favourably poised in the current environment amid capital market buoyancy and inflows into funds, but also the long-term outlook is robust.

Emergence of fintech – new frontier? The stock market is likely to see new listings like Paytm (One 97 Communications), PolicyBazaar (PB Fintech), MobiKwik (One Mobikwik Systems) in the coming quarter. There has been massive private capital chasing Indian fintechs. The Indian fintech landscape comprises of four categories: cards & payments, lending, investing / personal finance and others (neo-banks, insurtechs, etc.). Our reading of the fintech space is that of players competing in a red ocean, with only a handful likely to do well, which are operating in select niches. Both scale and profitability remain issues in the fintech space - while payment fintechs have scaled substantially, profitability remains an issue. Lending fintechs are relatively more profitable, but then scale remains elusive there. In the Indian context, no fintech player has so far managed to build a fintech business of both scale and profitability across verticals. So, we will only know the true winners in this space over the course of time, but surely collaborations will be the answer and large lenders may ultimately come out as joint winners.

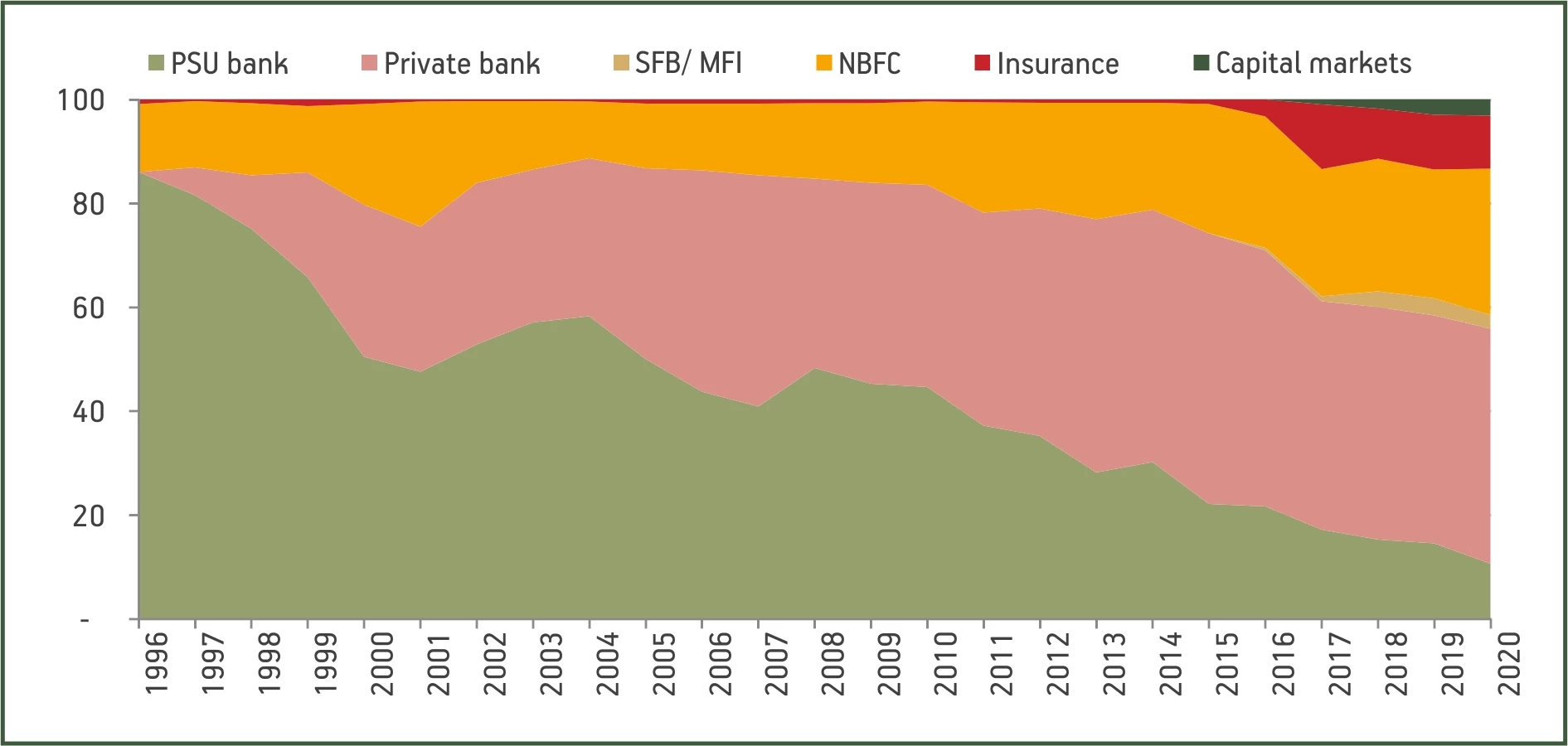

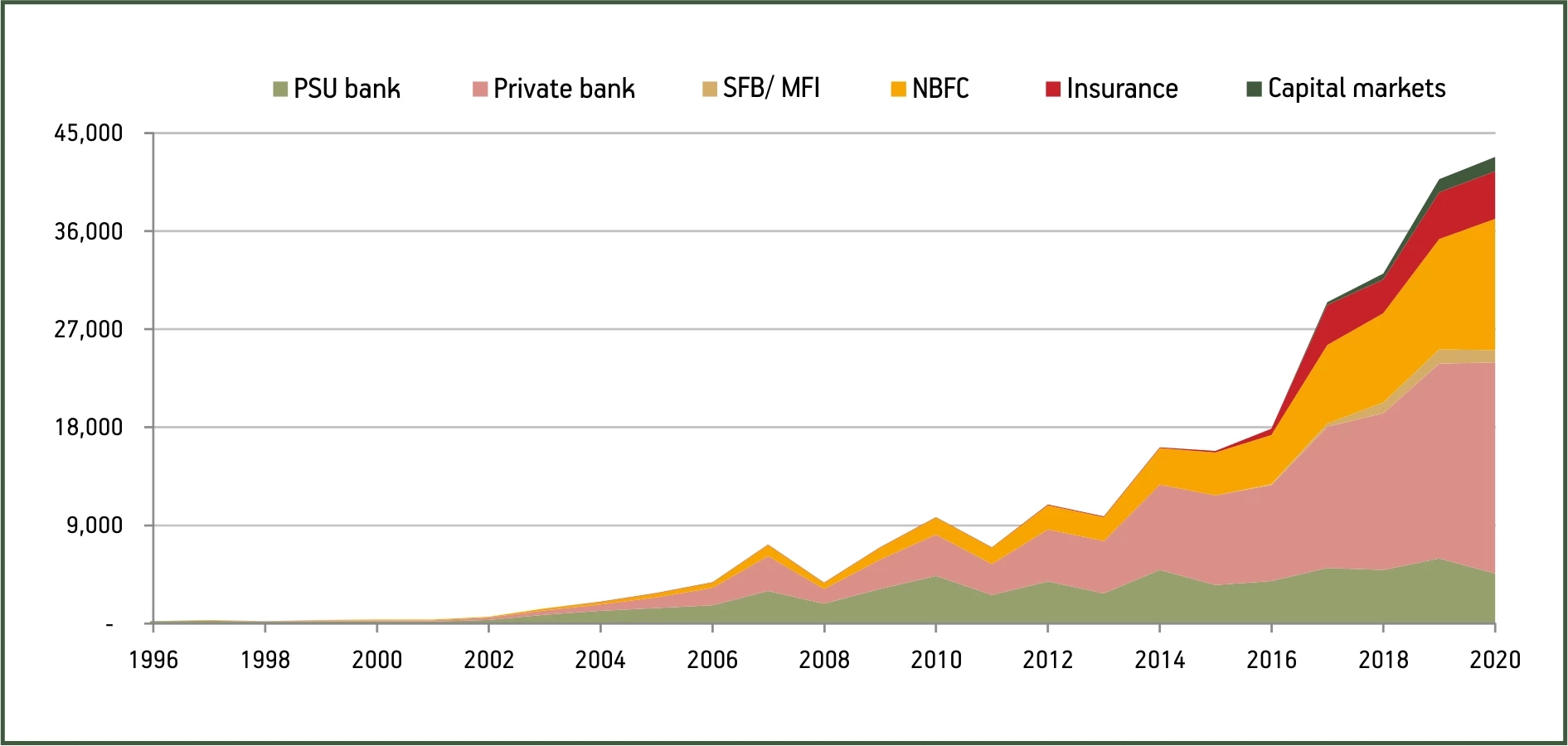

A look at how market caps of Indian financial sector has evolved over the years:

A look at market capitalisation movement over the years has shown a declining trend in the share of lenders (especially PSU Banks). We have seen a rise in the share of Private Banks, NBFCs followed by NLFs in the overall market capitalisation pie. These are still early days as large lines of business of existing players are getting challenged by a combination of small, as well as large fintech players globally. We expect a similar trend in India, though earnings growth outlook for large lenders / NLFs is still quite strong, which implies that their role would still be very much relevant.

Private bank, select NBFCs and insurance companies have seen maximum market cap expansion

Market cap of BFSI segments in India, December calendar year-ends (%)

We see broad expansion of market cap for all segments barring PSU Banks (Rs bn)

The views and opinions expressed are those of Dhaval Gala, Fund Manager and do not necessarily reflect the views of Aditya Birla Sun Life AMC Ltd (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”). The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000