-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Why Quant Investing is Beneficial: Know the Key Advantages

Jun 14, 2024

5 min

4 Rating

Every investor wishes to ride above the market trend and bank on better returns. This surreal dream may bring temporary joy, but any investor who knows very well the market’s unpredictable behavior would advise otherwise. Leaving investment decisions to human sentiments all the time can literally prove disastrous, as real-time market performance totally ignores the emotional psyche.

So, is staying ahead of the curve even possible? With Quant investing, there is a possibility!

Artificial intelligence is playing a leading role in revamping the entire technological landscape. Already capturing the mutual fund industry, we see an optimistic usage of quant investing, giving a little break to all traditional investing methods.

What is Quant Investing?

Quant investing, also called as quantitative investing, is an investment approach relying heavily on artificial intelligence and machine learning. This investment method uses quantitative, advanced models that identify market patterns to make investment decisions. With the huge amounts of data that a human mind finds difficult to comprehend, quant investing quickly manages them.

Benefits of Quant Investing

Data-driven decisions

Quant investing promises to make investment decisions without the cloud of emotions. This human bias can lead to second-guessing or impulsive decisions, which may or may not ruin the opportunity to capitalize on a market trend. Quant investing overlooks this bias by relying on hard data, bringing clarity and objectivity to its decision-making.

Consistency and discipline

Human behavior is a series of unpredictable choices. It is possible that the investor may change his or her investment strategy as per market trends, leaving a questionable outcome. Although the market is notoriously unpredictable, quant investing sets pre-defined rules like disciplined exits that entail no more impulsive reactions to short-term volatilities. As a result, you will see a consistent investment approach that can potentially prove better in the long run.

Mastering risk management

Market risks are difficult to gauge, thanks to market volatility! Quant investing isn’t here to play games; its advanced mathematical models constantly monitor market behavior, suspecting any sudden or sharp change. These predictive models provide substantial data about the potential market risks that can help in mitigating them.

Re-balancing the portfolio

Investors torture themselves over the asset re-allocation during the unpredictable market conditions. This might leave a loose end for mistakes, causing potentially damaging side effects. Quantitative models possess the capability to quickly recalibrate themselves to capture new market opportunities. These models can frequently rebalance the portfolio during real-time market performance.

Theoretical testing

Using quant investing, you can study how the investment strategy would have performed under different market conditions. This evaluation provides a rear view analysis of past data that helps forecast the future market behaviour. This also evaluates the fund’s potential effectiveness during different market conditions.

Reliability and transparency

The quantitative models employ investment strategies based on factors like trading volumes, volatilities, historical prices, etc. to capitalize on potential market opportunities. All these strategies are easily viewed and analyzed by the fund manager overlooking the fund. Hence, you know what strategies are implemented.

Aditya Birla Sun Life Quant Fund: an investment offering for your long-term goals

Aditya Birla Sun Life Quant Fund offers the perfect blend of technology and human wisdom. It uses a disciplined quant investing model and a factor investing strategy, investing across various market sectors. Its investment in equities and equities-related instruments is based on the quant model.

The fund manager uses his expertise to identify the potential top 75 stocks from the top 15+ mutual fund houses. The fund manager chooses the stocks based on factors like a 5-year track record, momentum, sell-side revision composite, and low volatility.

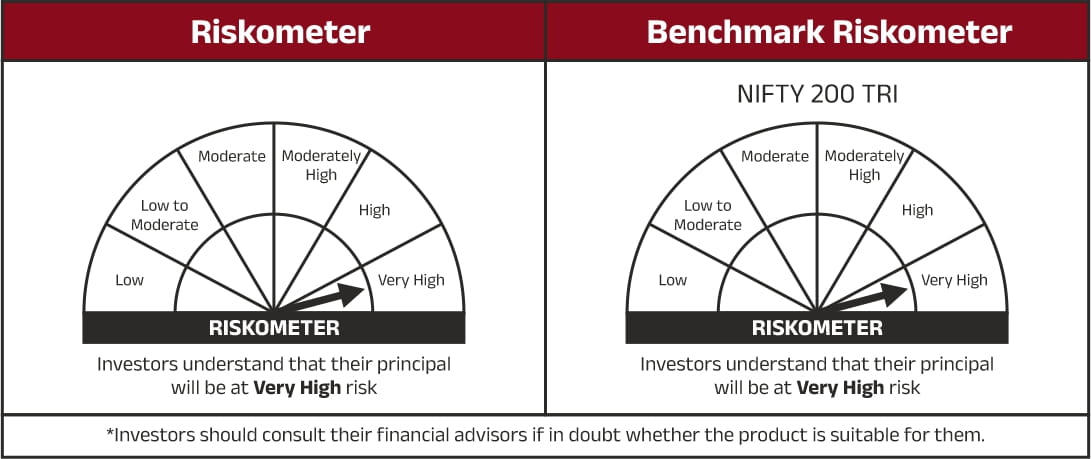

Investing in Aditya Birla Sun Life Quant Fund will give you benefits like long-term capital growth potential, low entry points (investments as low as Rs. 500), etc.

Conclusion

The reign of quant investing has just begun due to AI gaining traction in recent times. There’s still a long way to capture the full potential of quant investing, but what this investment approach currently gives is more than enough for investors who wish to utilize this latest offering. Quant investing may enthuse investors with its benefits, but whether this investment approach is good for your financial goals should be evaluated after careful consideration.

Note: Aditya Birla Sun Life AMC Limited/Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments. There is no assurance that the investment objective of the Scheme will be achieved. This is just for information purposes, and it does not recommend investing in mutual fund scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000