-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Can adversity present an investment opportunity?

Sep 29, 2020

5 Rating

Having crossed the 6-month mark, since a global pandemic hit hard in India, the economy still seems to be reeling under the pressure of its after-effects. The stock market plunged to its lowest levels since 2016 in March 20201, just two months after scaling an all-time high2. Things though have since been looking up for the market, it being on a recovery path post a significant crash. The growth of the economy however continues to be at low levels, having recorded a negative growth in the first quarter of 2020-21, for the first time in 40 years3 – indicating that economic turbulence remains.

Are you still struggling with determining your investment choices through these turbulent times? Many investors being weary, tend to stay away from the market in such uncertain times. But is this a prudent and thought out investment strategy? Or are you missing out on some hidden investment opportunity here?

A famous physicist had once quoted:

Have you considered looking at the current economy and market scenario from a different perspective? Let’s give you a snapshot:

-

2008 financial crisis – opportunity in disguise?

In the classic case of the 2008 financial crisis, stock markets across the world including India plummeted. Several investors may have panicked and sold their investments – but what happened with the investors’ portfolios who sought out an investing opportunity amidst this crash?

It is common knowledge today that a renowned investor made good use of this through his strategic investments post the 2008 financial crisis. If one were to seek out his financial and investing strategy history, you would know that a large part of his success may be attributed to identifying and seizing investment opportunities.

It is such exceptional times that can lead to special opportunities, calling for unique investing strategies.

-

How can you as in investor seek to seize the opportunities?

Uncertainty in the market can arise on account of wide range of factors – substantial regulatory changes, macro-economic disturbances, sectoral and company specific events or global events as is being seen today. The key is to identify whether these events can give rise to any growth opportunity for investors.

For example – a specific tax cut or tax holiday announced may benefit a specific industry or sector, introduction of new technology can work as a disruptor for several industries, or a global pandemic of the scale we see today can considerably change the way businesses across sectors operate presenting a wide range of opportunities.

It is said that – ‘Only a jeweller knows the true worth of a diamond’.

Identifying investment opportunities in turbulent times are probably best done by experts who have the knowledge and experience to be able to identify potential growth propositions and time entry and exit. So how can the layman investor achieve this?

The answer lies with the thematic category of mutual funds, which focus on investing in companies experiencing special situations.

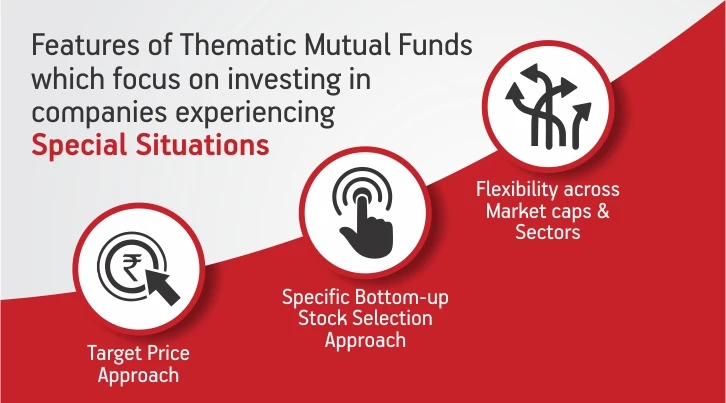

Some of the features of funds following such theme are as follows:

Specific bottom-up stock selection approach

Fund manager expertise and strategy in such funds are directed towards identifying investing opportunities that arise from special circumstances, which have the potential for growth and scalability in the years to come.

Target price approach

A specific target price approach is followed, wherein stocks are sought to be held till they breach an estimated and expected targeted price. This calls for an active portfolio management approach.

Flexibility across market caps and sectors

Such funds tend to have the flexibility to invest in stocks across market caps and different sectors so as to capitalise on opportunities that may present themselves.

Please, click here to know more about a fund that can help you seek investment opportunities in adversity!

Sources:

1. https://en.wikipedia.org/wiki/Stock_market_crashes_in_India#Crashes_of_2020

2. https://www.businesstoday.in/markets/stocks/sensex-hits-all-time-high-nifty-at-12385-bharti-airtel-reliance-industries-hero-motocorp/story/393997.html

3. https://www.financialexpress.com/economy/q1-gdp-live-india-economy-growth-rate-coronavirus-lockdown-first-quarter-agriculture-manufacturing-services/2070263/

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000