-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Darkest times may have the potential to offer the Brightest Opportunity

Apr 28, 2020

5mins

5 Rating

Higher the risk, higher the opportunity!

Stock markets tend to follow the above ideology more often than any other industry. The current abysmal market movements have left investors with pain, frustration, and anxiety. A negative sentiment prevails on D Street as major indices go into a tailspin.

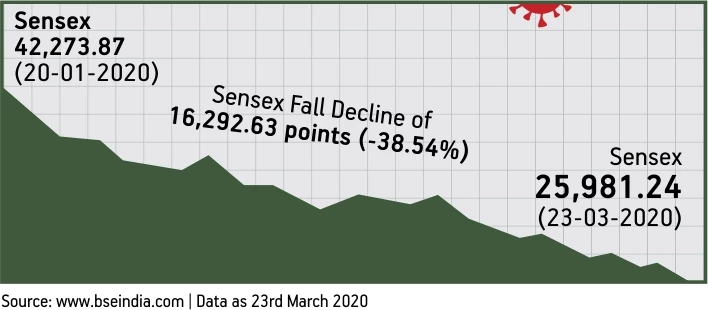

The past couple of weeks have been challenging for the Indian equities as they have witnessed a massive correction from their recent highs. Sensex has had one of its toughest fortnights in a long time.

While most may fear the short-term turbulence, especially with the falling oil prices and fear induced by the COVID-19 outbreak, there might be a silver lining for the Indian stocks with the current valuations. Let’s find out more about the silver lining amid the negative market sentiments.

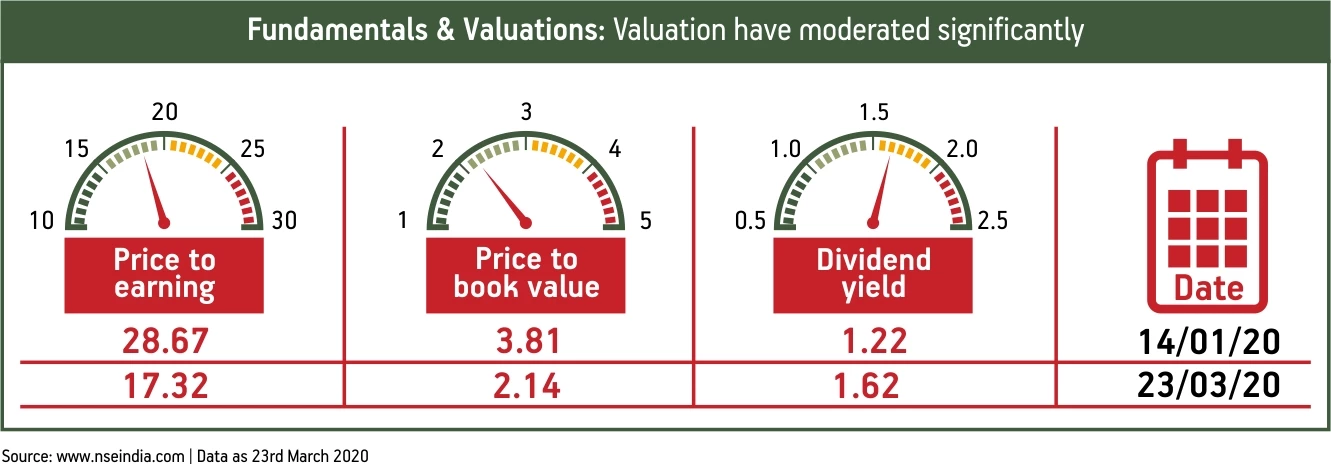

Fundamentals and valuations

Stock valuations have been a topic of worry among financial experts in the past couple of months. However, the ongoing correction has steered experts away from any doubts regarding valuations in the last month itself. On account of improved corporate earnings going forward, valuations are likely to get pre rated in the coming months.

A drop in oil prices

The falling oil prices may work in favour of the Indian economy. Lower oil prices will allow India to improve its trade and fiscal deficit ratios in the near future. By some estimates, India may have additional annual savings* if these oil prices are sustained for the foreseeable future.

Windfall for India

The ongoing Coronavirus outbreak could hamper manufacturing units in China, thereby presenting an opportunity for the Indian manufacturing sector to position itself as a leader in the global manufacturing industry. It could be an opportune time for Indian manufacturers to make their mark on the global supply chain.

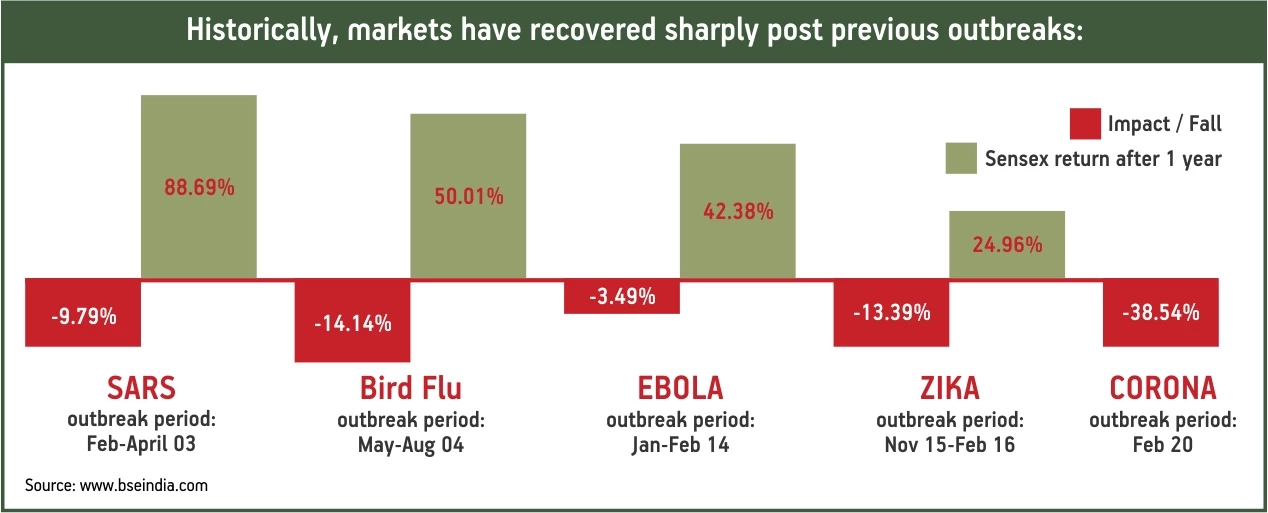

Stock markets have beheld worse times

While the ongoing Coronavirus pandemic may appear out of control, the stocks markets have been through worse periods, such as SARS in 2003 and MERS in 2012. We must note that the world may seem a bit chaotic in its response, but these circumstances are temporary, and the situation will improve in the near future.

Central Bank measures

Central banks across the world have been active in their response against the current slowdown through measures such as lower interest rates and injecting sufficient liquidity in the global banking system. One must note that this could be the stimuli streak the global economy has ever noticed from central banks.

The Reserve Bank of India (RBI) has followed the lead of other central banks in handling the current sluggish economy. In addition to the various steps RBI has taken to maintain adequate liquidity within the banking system, the Indian central bank is likely to extend similar rate cuts as that of its global peers. These steps will not only boost liquidity, but they will also aid India’s economic growth, which will, in turn, complement India’s strong fundamentals.

Measures for quick economic recovery by governments (Worldwide)

Governments across the globe have taken multiple steps to spur economic recovery and improve market sentiment. The Indian government has maintained pace with other nations by putting together COVID-19 Economic Recovery Task Force. The finance minister of India will lead this task force and listen to all the majority stakeholders for creating a strategy to counter the impact of COVID-19 on our economy.

Historical data reveals a sharp recovery post outbreak

There is no questioning the existing negative sentiment because of the coronavirus outbreak, but a look at historical data reveals it to be a temporary setback. The market has witnessed sharp corrections with historical virus outbreaks only to recover the losses shortly. Each time the market has noticed a large correction, it has come back even stronger.

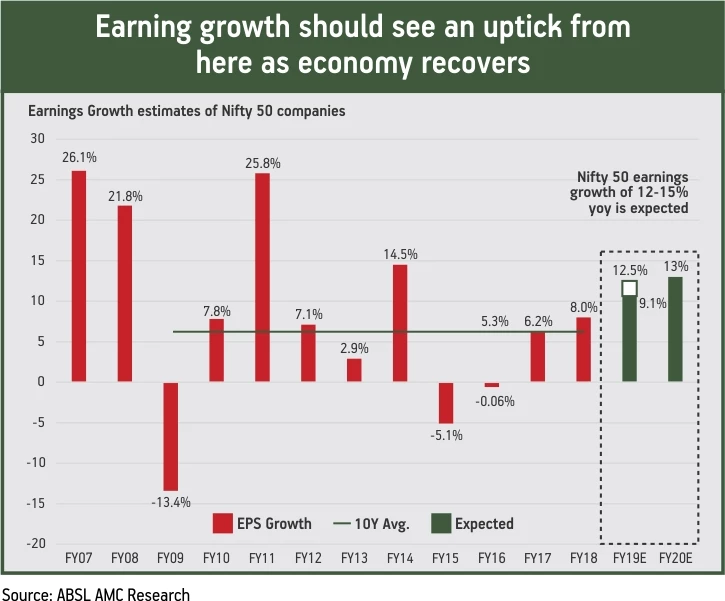

We should consider the one-year forward returns and three-year forward returns since 2001 as opportunities that helped investors create long-term wealth. It is critical to note that a drop in the stock markets over the last two months may have created an opportunity to invest in equities at reasonable valuations.

For long-term investors, you can consider investing in large-cap and multi-cap funds like Aditya Birla Sun Life Equity Fund, Aditya Birla Sun Life Large Cap Fund, Aditya Birla Sun Life Focused Equity Fund, Aditya Birla Sun Life Large & Mid Cap Fund. These funds may have the potential to offer reasonable returns in the given market conditions.

As a long-term investor, this may just be the time you were waiting for to make investments. In the words of a famous investor, you should be greedy when others are fearful and fearful when others are greedy.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000