-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Decrypting Small & Mid Cap funds and What they can do for you?

Aug 31, 2019

5 mins

5 Rating

With the stock market having reacted positively to the election results, you may have noticed an increased buzz around investing in the ‘small and mid cap’ segment. So, what exactly is ‘small and mid cap’ and how can it impact you? Let’s look at this more closely with a complete low down on small and mid cap funds.

What are Small & Mid Caps?

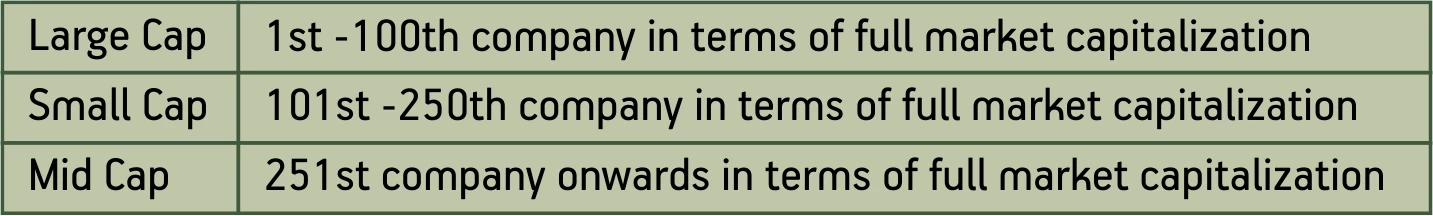

First things first, let’s understand what small and mid-cap companies are. As per Securities and Exchange Board of India (SEBI)1 circular1 dated 6th October’17, definition of large cap, mid cap and small cap are as follows:

Association of Mutual Funds in India (AMFI) releases an updated list2 bifurcating the listed companies into the above categories every 6 months.

How do such funds work?

Small and mid cap funds are mutual funds that diversify majority of its investible capital in stocks of small and mid-cap companies.

Fund managers consider the sector outlook, specific finances of the individual mid and small cap companies as well as the strength and stability of the promoter group or top management, while determining the fund allocation.

Are these funds for you?

Like any investment planning, choosing the right fund for you is guided by your investment goals. Generally, investors looking for low risk returns tend to opt for large cap schemes. If you are a proactive investor looking to earn more than average return and have a relatively higher risk appetite you can look to capitalise on small and midcap funds.

The key to gain from small and mid caps is to stay invested for a long term. In such cases the purported risk associated with small and mid caps may be insulated.

Identifying the correct small and mid cap companies requires an in-depth study of the company as well as of its sector. If you do not have the adequate time and expertise to research and capitalise on the opportunities of investing in small and midcap companies, then these funds can be the go-to funds for you.

Preferred time horizon

As small and mid cap companies are generally younger, emerging companies they have potential for reasonable return but may also be more subject to volatility when the market isn’t performing well. So, staying invested for a longer horizon of more than 5 years should be preferred to generate reasonable returns.

When should you invest in such type of funds?

As such funds tend to perform better over a long term, investors can use these funds to fund their mid to long term goals such as saving for a house, your retirement or for your children’s higher education.

Additionally, as these funds can be higher return higher risk investments, they can be opted for to diversify your portfolio especially if your portfolio already has large cap funds and lower return investments such as debt funds.

How does one evaluate these types of funds before investing?

-

Fund’s track record

Compare the fund’s performance with its benchmark index and you may opt for those which outperform the index over your time horizon.

-

Performance in different market conditions

You may look for funds which have taken a lesser hit in a bearish market and a higher growth in a bullish market.

-

Take a closer look

Take a closer look at what specific mix of small and midcap companies the funds have invested their capital in. You can choose funds which have invested in companies which have lower sector vulnerability in the prevalent economy conditions. Choose companies which have strong and reliable top management and good corporate governance features.

-

Look at rankings given by credible rating agencies

Established credit rating agencies such as CRISIL assign rank categories to mutual funds each quarter. These agencies assign these ratings after extensive study of the funds’ performance and continuously monitor these funds. Select funds which have been ranked well by such agencies

-

Prefer experienced fund manager with proven track record

The success of such funds depends on the expertise of fund managers to study and understand the market and time entry and exit of stocks effectively. Assess the performance track record of the fund manager as well.

The small and mid cap segment that has growth potential is emerging as another segment for equity investments. Identify your risk appetite and determine the % to allocate to these funds to get greater diversification in your investment portfolio. Remember, be patient and remain in these funds for the long haul to increase your chances of reaping quantum benefits.

Source:

2https://www.amfiindia.com/research-information/other-data/categorization-of-stocks

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000