-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

Did you say high returns with moderately high risks?

Apr 10, 2018

4 mins

5 Rating

Have you ever ridden a bicycle? Do you know what is most important for that? Balance. Same goes for life and all other aspects in it. Even investments.

In the financial world, the balance is always between risk and returns. Too much risk is, well, risky. And too much safety would mean you compromise on returns. Every investor is, thus, after their own Holy Grail, that which safeguards their money but also gives potential returns.

Balanced Funds one of the investment option

Thankfully, the search need not be long-winded. The invisible market force has ensured you get a ready solution, one that offers potentialreturns and decent capital appreciation in the long term, minus the big risk factor, since usually the risk involved is moderately high. The answer is: ABalanced Fund.

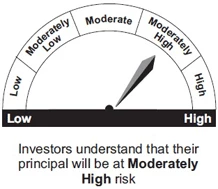

Moderately high risk& seeks maximum returns

As you may know already, Balanced Funds are Hybrid Mutual Funds suitable for investors with a moderately high risk profile. These Funds invest in a good portfolio mix of Debt and Equity assetsthat aims to minimize risk and maximize your potential returns.Aditya Birla Sun Life Balanced ’95 is an open ended balanced schemethat could be considered for investment in balanced funds. You may consult your financial advisor and based on your risk appetite you can invest in the scheme.

Ideal Portfolio Allocation

Usually, 50-75% of the Fund’s money is allocated to stocks ie equity and equity related instruments and the rest is usually invested in Money market and other Debt assets. This mean you probably get a well-diversified portfolio with the right mix of stocks and bonds. The focus here is on maximizing growth while simultaneously aiming to reduce the risk. Market volatility takes a back seat.

Equity v/s Debt

Historically speaking, the Equity and Debt markets are inversely related. Meaning, when Equity is booming, Debt does not. And Debt markets boom when the stock markets are going through a lull period.

With Balanced Funds you tend to get the best of both worlds. So when Equity assets fall in value, the Debt assets in the Fund’s portfolio usually rise in value to give you decent returns. This way, you get potential returns irrespective of whether the markets are doing well or not.

So what next?

If you ever find yourself wondering about mutual funds in the market which you can just set-up and forget, then you have an answer. Pick up a Balanced Fund to get long-term capital growth with lower risks. The optimal balance of equity and debt ensures that a fall in one category is made up with the rise in another. So start a Systematic Investment Plan (SIP) in any of the balanced funds, you may consider Aditya Birla Sun Life Balanced ’95, and aim to let it grow over time and finally reap the wholesome probable benefits when you need.

Aditya Birla Sun Life Balanced '95 Fund

(An Open Ended Balanced Scheme)

This product is suitable for investors who are seeking*

- Long term capital growth and income

- Investment predominantly in equity and equity-related securities as well as debt and money market instruments

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000