-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

ETFs Explained: Diversify Your Investments with Exchange-Traded Funds

Aug 08, 2024

5 min

4 Rating

You have been investing for quite some time, studying the market and the various investment instruments. It is time to explore new avenues and asset classes, go niche with your investments, and plan investing strategies. You may be confident about a particular sector but are confused about which stock to buy. Or you may want to get exposure to the US markets, but the process of investing overseas is giving you cold feet. While mutual funds allow you to invest in an entire index or a commodity, they may not be tradable on your demat account.

Exchange-traded funds, popularly known as ETFs, bridge the gap between individual stocks and mutual funds, giving investors an alternative to execute their investment strategies while enjoying the diversification of a mutual fund.

Also Read- What is ETF?

How ETFs work and what they mean to your portfolio

The investment market has several indices built on some basic classification. For instance, the NIFTY 50 Index is a list of the top 50 stocks by market cap trading on the NSE. These indices are reviewed every quarter, and the stocks that do not meet the criteria are replaced by the ones that do. Like Nifty 50, there are many sector-specific, commodity, and international market indexes.

The ETF tracks a particular index and invests your money in the assets inside that index with the same weightage. It removes any human bias, and you replicate the returns generated by that index. You can buy and sell ETFs on your demat account. You can look at ETF investing as buying a small portion of a portfolio designed to replicate the performance of the underlying index.

How do you diversify your investments using ETFs?

Speaking of portfolios, a good practice is to have a diversified portfolio comprising uncorrelated assets. Why so? Because the market is unpredictable as multiple factors influence the market. The best way to thrive in an unpredictable market is to be prepared for any possibilities. Such diversification will reduce the risk of a downside, and you won’t miss any growth opportunity in a particular asset class or sector.

An ETF can help you achieve this diversification by investing in different types of ETFs offered by Aditya Birla Sun Life Mutual Fund. There are sector ETFs, commodity ETFs, large or small-cap ETFs, and investing strategy ETFs.

You can build a well-diversified portfolio using ETF.

1. Asset Level Diversification

The first step is to allocate a ratio to each asset class. Suppose you select 60:20:20 for equity, debt, and commodities. You can invest in equity ETFs, bond ETFs, and gold or silver ETFs. This is especially true for commodity ETFs, as they make it easy to invest in gold or silver without worrying about purity or storage. If you are unsure of your asset allocation, you could consider investing in Aditya Birla Sun Life Multi-Index Fund of Funds that invests in units of ETFs and Index Funds in varying combinations. It can give you an exposure to all assets. Consider it like a food platter that has a little of every dish.

2. Equity: Sector Level Diversification

Within your equity space, you could diversify across specific sectors or segments of the economy you are bullish on. There are sector-specific ETFs like the Nifty IT index or Nifty BFSI index. There are also segment-specific ETFs like the Nifty PSE ETF. It invests in top public sector enterprises across multiple sectors like power, capital goods and oil & gas. Such ETFs give you exposure to multiple sectors and a growth trend.

3. Equity: Market Capitalization Diversification

Within equity, you can also invest in ETFs that track large, medium, or small-cap stocks. Each of these market caps has different risks and returns. The Nifty 50 Index tracks the top 50 large-cap stocks, while the Nifty Next 50 ETF tracks mid-cap stocks. The ETFs can help you balance risk and reward, especially in high-risk small-cap stocks.

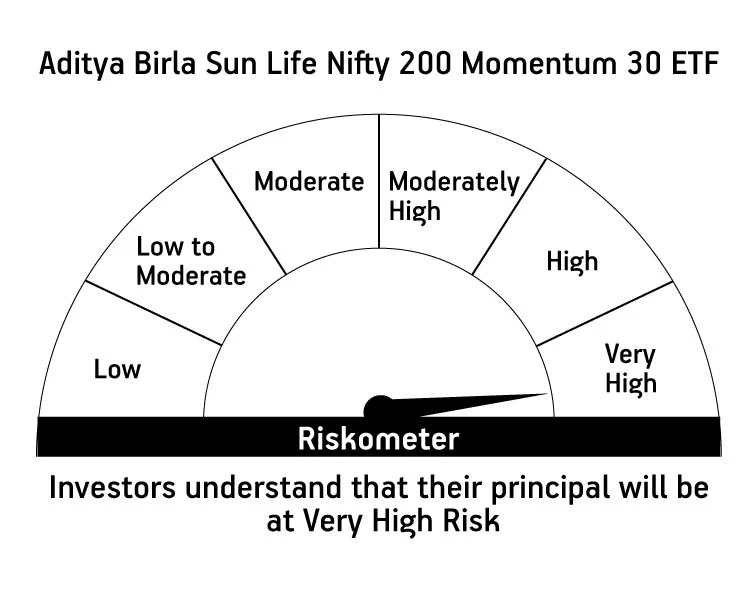

4. Investment Strategy Diversification

Another level of diversification could be different investing strategies like value, growth, quality or momentum strategies. While you may understand these strategies well, it becomes difficult to implement them. Aditya Birla Sun Life Nifty 200 Momentum 30 ETF uses momentum-based factor investing to capitalize on market trends where there is high momentum. This strategy is designed to create wealth in the long term.

Multiple people may have the same financial goal, but their approach to reaching their goal is different. Each person chooses his/her path based on their knowledge, risk-taking ability, and comfort. Similarly, in your investment journey, you determine your path. Aditya Birla Sun Life Mutual Funds offers a range of ETFs and mutual funds schemes that can act as your means to help you reach your financial destination.

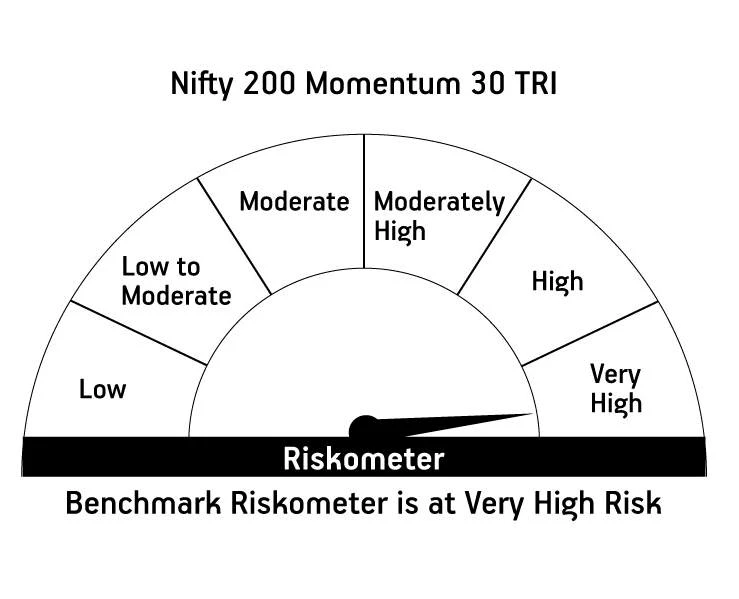

| ABSL Nifty 200 Momentum 30 ETF | ||

| (An open ended exchange traded fund tracking Nifty 200 Momentum 30 TRI) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

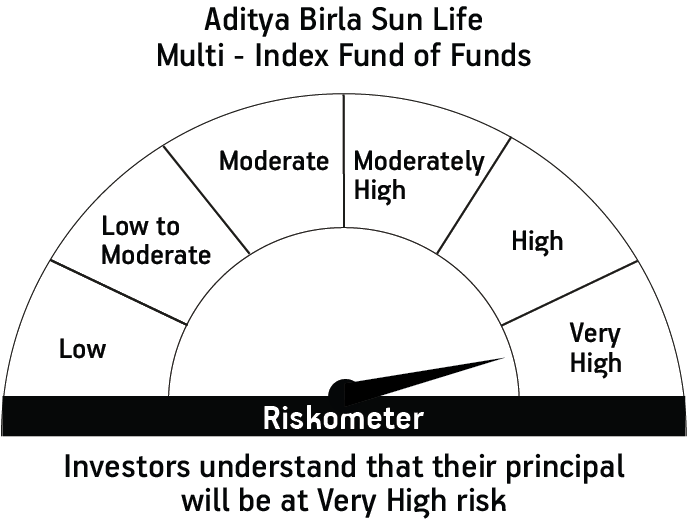

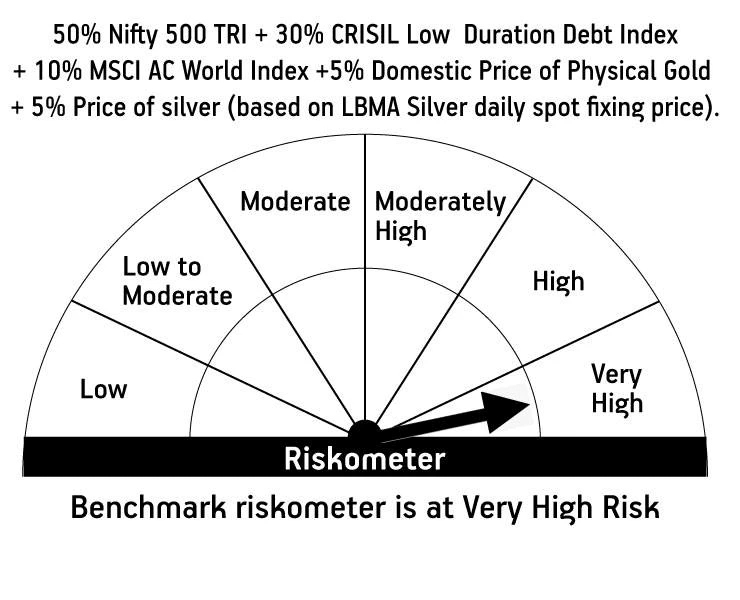

| ABSL Multi - Index Fund of Funds | ||

| (An open-ended fund of funds scheme investing in Exchange Traded Funds and Index Funds) | ||

This product is suitable for investors who are seeking |

||

|

|

|

|

||

| *Investors should consult their financial advisers if in doubt whether the product is suitable for them | ||

Note: Aditya Birla Sun Life AMC Limited /Aditya Birla Sun Life Mutual Fund is not guaranteeing/offering/communicating any indicative yield/returns on investments.

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000