-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Do hybrid funds help tide over market volatility?

Aug 26, 2022

5 Min

4 Rating

Equity investing can often be, nothing short of a whirlwind, roller coaster ride. The NIFTY 50, the market’s headline index is a clear indicator for this. When the pandemic struck, it plummeted more than 1100 points, falling nearly 13%1; recording its worst single day fall in history. Less than two years later, it scaled its all-time high breaching the 18,600 mark2. Yet again today, political tensions and global market pressures are once again creating uncertainty in the stock market.

In spite of this, investors that stay long in equity tend to do well! But do these frequent rises and falls give you mini heart aches each time? Is there any better way to see such volatility through, while still maintaining equity exposure ?

‘Hybrid funds’ are gaining popularity for exactly this! But, do they actually help tide market volatility? And how?

Its equity… but with a Mix!

A hybrid fund is a carved out mutual fund category that, as its name suggests, is ‘hybrid’ in nature i.e.: it invests in a mix of both equity and debt instruments. They essentially aim for a balance of growth and stability by investing in both equity and debt.

SEBI has in fact further classified hybrid funds into 7 categories based on the proportion of equity and debt and their core investment objective.

Also Read - What is Hybrid Fund?

What makes them amenable to market volatility?

Primarily, it is the debt component of hybrid funds that balance the overall risk. Debt instruments invest in fixed income or interest-bearing instruments. These instruments are generally not market linked and do not fluctuate with market fluctuations. Although they do carry interest and credit risk, high rated debt instruments tend to be stable and considerably less volatile than equity.

But is merely investing in debt enough? Hybrid funds have some unique characteristics that truly help them tide over market volatility while maintaining their commitment to equity.

Also Read - What are Equity Mutual Funds?

The volatility management strategy

-

Statically managed

These hybrid funds have a specific asset allocation criterion. Aggressive hybrid funds for example must keep equity allocation between 65 to 80%; a conservative hybrid fund on the other hand keeps equity allocation low, between 10% to 25%.

When market prices fall, so will the market cap of equity allocation. Fund managers must then increase their investment in equity to bring up allocation to the required %. Conversely, when markets rise considerably and allocation goes beyond the maximum %, they must sell equity and bring the allocation % down.

In this way, equity allocation in the fund is guided by the market prices and fund allocation oscillates between debt and equity in response to market changes. This static management strategy tides over volatility and brings a balance to the portfolio, while still getting the growth advantage of equity. -

Dynamically managed - the 'volatility specialists" within hybrid funds

Any doctor can diagnose an illness, but you need a specialist to actually cure it!

In the same way, within the hybrid space there are certain funds that are better suited for and tailored to specifically manage market volatility.

These funds are known as balanced advantage funds or dynamic asset allocation funds. These funds can invest anywhere between 0% to 100% between debt and equity, as per its specific investing objective. Fund managers track market changes and oscillate between debt and equity investments in response to market changes.

They essentially seek out low priced stocks to invest in falling markets and look to book profits and switch to debt when stocks become overvalued in a rising market. This dynamic ‘switch in switch out’ strategy is the key to its volatility management speciality.

Must Read - What is Debt Fund?

The numbers speak

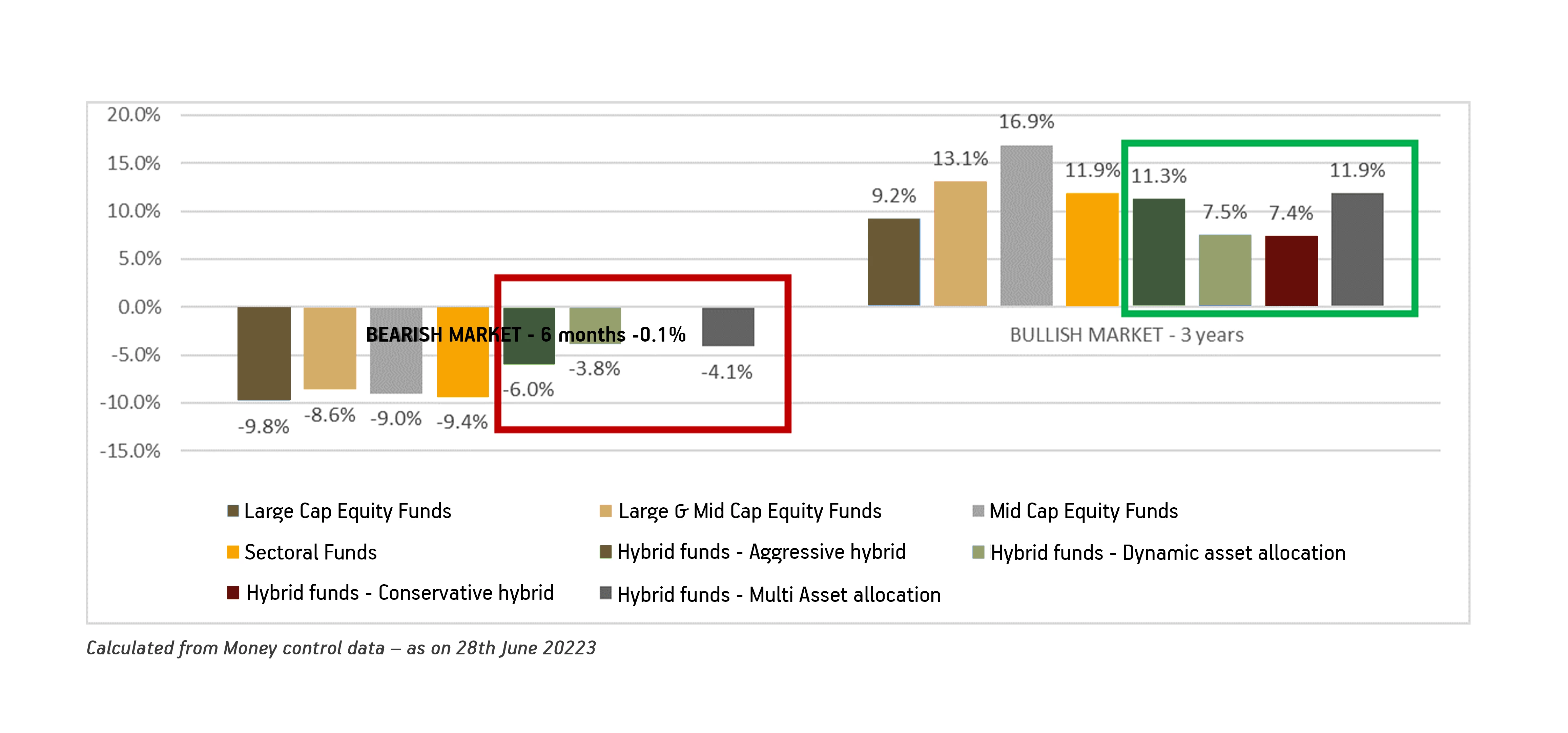

A quick look at performance numbers of fund categories demonstrate this volatility-absorbing strength of hybrid funds.

In a bearish market of falling prices, hybrid funds have fallen considerably less than most other equity fund categories – while still delivering returns in bullish markets!

Past performance may or may not be sustained in the future. The above returns do not guarantee future returns. Please reach out to your financial advisor for making any investment decision.

Go Hybrid!

So, if you are looking for a mix of capital growth of equity and income stability of debt to better tide through volatile times then hybrid mutual funds are for you.

Looking to continue to remain strong in equity then opt for aggressive hybrid funds that keep their equity at minimum 65% allocation. If you are a more conservative investor then conservative hybrid or equity savings funds are more suited.

If a dynamic asset management strategy is more to your liking, then dynamic asset allocation/balanced advantage funds are your best bet.

No matter which one you choose, opting for hybrid mutual fund schemes can give your portfolio an inbuilt volatility defence mechanism; reducing your stress in market stressful times!

Sources:

1. https://en.wikipedia.org/wiki/NIFTY_50

2. https://www.india.com/business/share-market-today-stock-market-news-sensex-hits-all-time-high-nifty-50-crosses-18600-top-performing-shares-5059820/

3. https://www.moneycontrol.com/mutual-funds/performance-tracker/all-categories

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000