-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Global vs Domestic Multi-Asset Allocation Funds: Ultimate Guide, Key Differences, and Investment Options

Jun 12, 2025

5 min

0 Rating

Not all mutual funds are created equal, and this year's market tells this clear story. This year, global mutual funds outperformed their domestic counterparts. So, where should your money go? What differentiates domestic multi-asset allocation funds from global funds, and are they worth the switch? This guide answers all these questions for you, so read on to compare and make your choice.

What is a Multi-Asset Allocation Fund?

Before we dive into the difference between global and domestic multi-asset allocation funds, let’s begin by understanding what a multi-asset allocation fund is.

A Multi-Asset Allocation Fund is a type of mutual fund that invests in a mix of different asset classes. So, provide investors with a single investment that combines equities (stocks), real estate, debt (bonds), commodities, and even gold or cash. These funds aim to diversify an investment portfolio and reduce risk by spreading investments across various asset classes with different risk-reward profiles. Therefore, multi-asset allocation fund returns are risk-adjusted. They serve the purpose of diversification, risk management, and stable returns in one go.

Their two categories include global and domestic multi-asset allocation funds.

What is the Global Multi-Asset Allocation Fund?

Global Multi Asset Allocation Funds allow investors to tap into opportunities outside India by investing in companies across developed and emerging markets. They are ideal for investors seeking long-term growth while minimising dependence on the economic performance of a single region.

What is the Domestic Multi-Asset Allocation Fund?

A domestic multi-asset allocation fund is a mutual fund that spreads investment across various asset classes such as Indian stocks, bonds and sometimes Gold ETFs. The fund manager makes allocation decisions based on market performance. They help reduce volatility and improve long-term returns. They are ideal for investors who prefer home market exposure without tracking multiple investments. They offer a simple managed route while balancing risk and opportunity.

Key Differences between Global Mutual Funds and Domestic Multi-Asset Allocation Funds

The following table depicts the key differences between global mutual funds and domestic multi-asset allocation funds:

Point of Difference |

Global Multi-Asset Allocation Funds |

Domestic Multi-Asset Allocation Funds |

Investment Geography |

Across the world (including India) |

Only within India |

Exposure Type |

Global companies |

Indian companies only |

Currency Risk |

Yes, due to foreign exchange fluctuations |

No currency risk |

Diversification |

Higher geographical diversification |

Limited to the Indian economy |

Political Risk |

Affected by global events |

Affected by Indian policies |

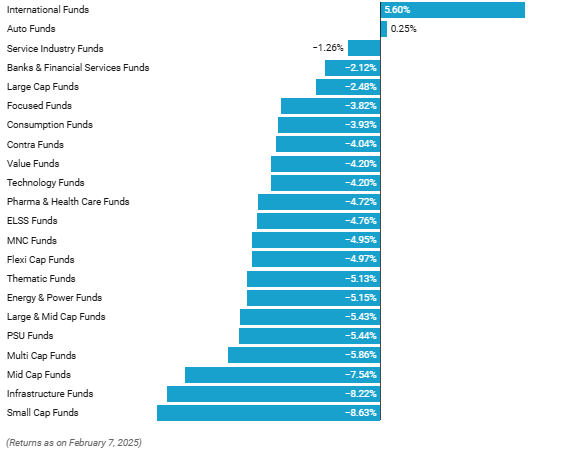

Performance in 2025 |

Average return ~5.60% so far |

Mostly negative returns in all categories |

FII Influence |

High influence, especially from the US & China |

Limited FII impact |

Sector Spread |

Broader global sector exposure |

Indian sector exposure only |

Investment Strategy |

Globally diversified |

India-focused |

Volatility |

Sensitive to global economic shifts |

Sensitive to Indian market fluctuations |

Fund Accessibility |

Available via select AMCS |

Widely available |

Regulatory Jurisdiction |

Follows Indian SEBI + overseas regulations |

Follows SEBI guidelines |

Suitable For |

Investors seeking global diversification |

Investors focused on India's growth |

|

|

|

Global vs Domestic Multi-Asset Funds: Which is the Better Investment Option?

Source: The Economic Times

Although global funds have recently outperformed domestic ones, this momentum may not last. Amid recent global rallies, experts advise caution when it comes to international mutual funds. Experts warn these gains are driven more by temporary capital inflows than actual improvement in the economy itself.

On the other hand, India’s long-term economic outlook remains promising. Domestic mutual funds are in a better position for sustainable wealth creation, despite short-term dips in categories like large-cap and service sector funds. This continues to show resilience given the uncertainty in global markets.

In the last six months, foreign institutional investors have shifted focus to economies like China and the US, triggering a rally in global mutual funds. However, experts suggest this gain is driven more by short-term sentiment and liquidity than by sustainable growth. Meanwhile, India remains economically strong, with the IMF projecting a 6.5 to 7% GDP growth rate. Domestic mutual funds are a more dependable investment option in 2025.

Wrapping Up

Considering all the factors stated above, global mutual funds may not be the best investment choice for most, as they have underperformed recently. Experts suggest that they must constitute not more than 5% of an investor's portfolio. Allocation of 5% to global funds can offer some diversification benefits, but domestic diversified multi-asset allocation funds are a better long-term investment strategy. These funds not only offer sector diversification but also align well with India’s growth trajectory. This makes them a safer, more rewarding bet for investors seeking to build wealth and generate better returns over time .

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000