-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Early trend spotting could become your market navigator

Aug 09, 2021

3min

5 Rating

By Vishal Gajwani, Head – Alternate Assets Equity Investments

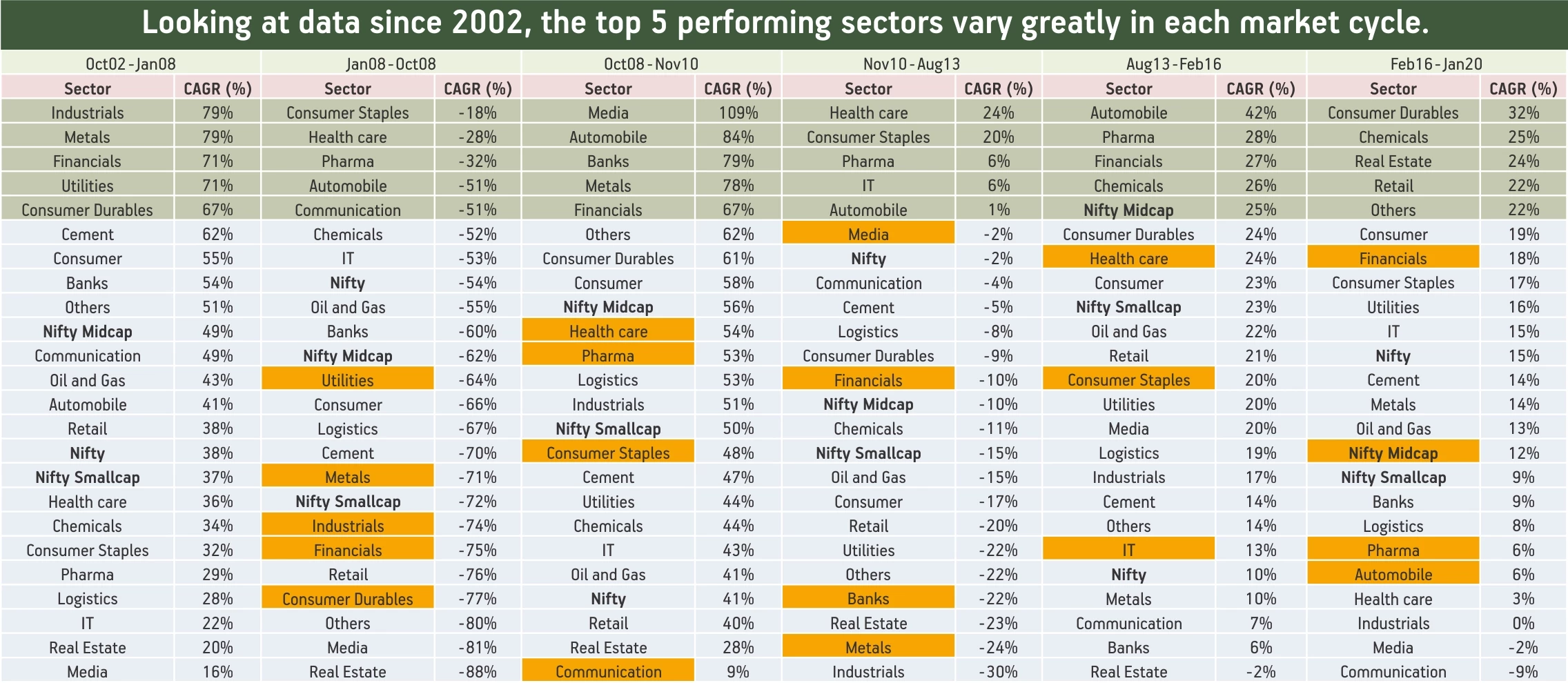

Every decade presents a set of new trends and rarely ever in the past have top performing industries of a particular cycle repeated the same feat in the subsequent cycle. The variation in returns among the best and worst performing industries during a cycle is too large, again underscoring the importance of picking the themes and trends correctly. Looking at the past market data, one can decipher the interplay of various macro and micro factors coming together to create a market cycle that favours a set of industries. Our recently launched Trendspotting Report by the Alternate Assets Equity Investments team at Aditya Birla Sun Life AMC Limited showcases the same. The study analyses the big trends that have played out over the last couple of decades, and have identified the key enablers of any big structural trend. It brings to fore some of the key market insights and dynamics at play, which we believe will help you in making better investment decisions.

Looking at data since 2002, the top 5 performing sectors vary greatly in each market cycle.

Source: ABSLAMC Research

*Past performance may or may not be sustained in future.

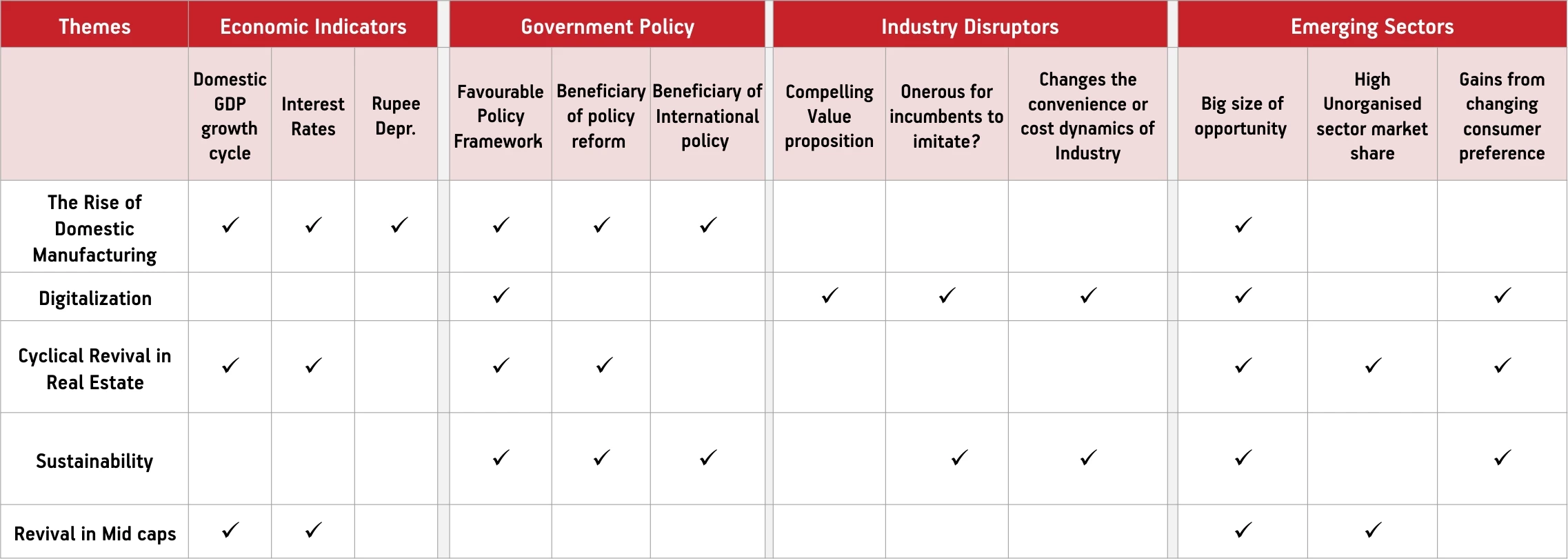

A confluence of factors drive trends

The factors could be many - from the phase of economic cycle, change in government focus, to emergence of industry disruptors that create a conducive environment for outperformance of particular sectors. In terms of economic cycles, factors like domestic and global GDP growth, interest rates, rupee depreciation etc. guide the trend while any big reforms from the government to shape the economy further provides a growth push to particular segments in the economy.

Here’s a look at trends of the future

Rise of domestic manufacturing

The contribution of manufacturing to India’s GDP has been 14-15% for several decades which is about to change now with a slew of government initiatives like Atmanirbhar Bharat & Vocal for Local to increase the manufacturing share to 25% of GDP. Major policies have been announced by the government such as cut in corporate tax rate to 25.2% and 17% rate for Greenfield projects until FY23, increase in import duty on various products and components and PLI scheme with an outlay of INR 2 lakh cr across 13 sectors. The major sectors likely to benefit from the manufacturing theme are Pharmaceuticals & Chemicals, Defense, Consumer Electricals & Durables, Auto & Auto ancillaries, and Capital goods.

Digitalization

CoVID-19 outbreak has underscored the importance of digital adoption as individuals, businesses and government move their operations online. The pandemic has exposed a clear digital divide with companies invested in digital operating models faring much better than those which had not. This accelerated underlying trends of adoption of digital technologies by few years and that these changes could last over longer horizon. Digitalization in India is largely to be led by low cost of data (owing to Jio) coupled with affordable smartphones, government initiatives like Aadhar, digital tax platforms like GST and increasing digital adoption by private sector. Digital capabilities have boosted the revenue of major Indian IT services providers and are increasingly becoming sizable. Mega technology trends to look out for in the next decade are - Cloud led services, implementation of chat-bots, AI- based automation, Software As a Service (SAAS) to drive growth for software products firms (pure-play firms) and system integrators over next decade due to flexibility and cost efficiency.

Cyclical revival in real estate

The recovery in the sector has surprised positively. Unsold inventory has sharply dropped since 1QCY20 given fewer launches and better sales. Property prices have largely remained flat in the last 8 years. Given that the difference between tax adjusted home loan rate and rental yield has fallen, one could prefer buying a house. We feel COVID-19 induced “work from home” trend, reduced stamp duty in certain States, Industry consolidation induced by RERA, Low interest rates are some of the structural factors the real estate segment hinges on. In addition, housing has a huge multiplier effect on the economy, which means a wide choice of investment opportunities. Few segments that could benefit from the real estate upcycle include early and mid-cycle proxies such as cement, steel, pipes and electrical fittings. Also, late cycle proxies such as paints, tiles, sanitaryware, plywood and consumer durables are beneficiaries of likely completion in currently unsold/ partially constructed inventory.

Sustainability

Amid the rising concerns over global warming and increasing environmental risks, the focus of government and companies has shifted to more sustainable ways of doing business rather than simply chasing growth. This shift in outlook has created many fresh set of opportunities by way of Green fuel (ethanol), green mobility (electric vehicles), green energy (wind, solar, hydro), clean technology and health. All these segments are increasingly getting support from both the government and the end-consumers. Government has been incentivising the shift towards Hybrid vehicles & EVs by announcing the FAME subsidy programme and has also tightened the emission norms (BSVI). To promote green fuel, government has increased the target of ethanol blending in petrol to 20% by 2030 and has also increased CNG retail outlets to ensure usage of CNG. Additionally, larger chemical companies are investing in waste water treatment plants for long term sustainability. Many companies have increased their nutrition offerings and are offering solutions for active lifestyle.

Revival in mid and smallcaps

Mid and Small caps after 3 years of underperformance have started outperforming large caps, led by reasonable starting valuation, economic recovery, and lower interest rates. Multiple factors are at play to support the outperformance of mid and smallcap vs largecaps in the medium term. Smaller companies have higher growth potential as they have their own niche, higher entrepreneurial spirit, higher risk/reward ratio and higher participation in emerging sectors like chemicals, digital platforms, healthcare etc. For category leaders in mid & smallcap space, this is an opportunity of the decade to further entrench their dominance and accelerate market share gains, as unorganized competition suffer. Moreover, easing of monetary policy could revive real estate sector, which is a big growth driver for certain sectors dominated by small and mid-cap companies and could lead to an earnings upgrade cycle. For eg. Building materials, etc. Nifty Mid CAP EPS growth expected to be stronger vs. Large Cap Index led by gains from operating and financial leverage.

The trends that we have highlighted above are long term structural trends, wherein we expect these catalysts to play out over the next 3 to 5 years. Given that the factors leading to these trends are structural in nature like changing demographics, or permanent change in consumer preferences, we believe these are multi-year stories which have strong fundamental underpinnings. Having said that, one needs to use right judgement in assessing fair value of businesses benefiting from these trends to arrive at potential upside and also be cognizant of the fact that the path to value creation could be volatile.

Read detailed trendspotting analysis here:-

This should not be construed as an investment advice. Investments in securities are subject to market risks. Past performance may or may not be sustained in future.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000