-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Cut your taxes while growing your money: The power of ELSS Funds

Jan 23, 2025

10 min

4 Rating

Planning your investments without considering taxes is like trying to fill a bucket without plugging the leaks—it can be inefficient and can diminish your overall gains. For instance, while you may aim to build a ₹1 crore portfolio over time, not factoring in taxes can significantly impact your investment returns.

Taxes can reduce the gap between your gross returns and what you actually take home. A well-structured, tax-efficient portfolio ensures that you maximize your returns while minimizing unnecessary outflows. One of the smartest tools to achieve this is an Equity-Linked Savings Scheme (ELSS) — a fund that combines equity-driven growth potential with tax-saving benefits.

Let’s explore how ELSS funds can help reduce your tax liability and create wealth over the long term.

How ELSS funds cut taxes?

For many investors, the primary draw of ELSS funds is the deduction of up to ₹1,50,000 under Section 80C of the Income Tax Act under old regime. While this is a significant advantage, there’s more to ELSS than just a tax deduction.

Tax Deduction Under Section 80C in old regime

ELSS allows you to claim a deduction of up to ₹1,50,000, which can reduce your taxable income. For someone in the highest tax bracket, this deduction translates to annual tax savings of up to ₹46,800. What makes ELSS particularly tax efficient is its short lock-in period of just three years, compared to five or more years for other 80C options like tax-saving fixed deposits or Public Provident Fund (PPF).

Tax-Efficient Long-Term Capital Gains (LTCG)

The tax advantages of ELSS don’t stop at the deduction. Since ELSS funds primarily invest in equity (at least 60%), they are taxed like equity instruments:

After the mandatory three-year lock-in, any long-term capital gains (LTCG) of up to ₹1 lakh per financial year are completely tax-free.

If your gains exceed ₹1 lakh, the excess is taxed at just 10%.

How ELSS funds grow your money

Here’s a revised version of your blog with a more subtle and general tone regarding taxes:

Cut Your Taxes While Growing Your Wealth: The Power of ELSS Funds

Planning your investments without considering taxes is like trying to fill a bucket without plugging the leaks—it can be inefficient and can diminish your overall gains. For instance, while you may aim to build a ₹1 crore portfolio over time, not factoring in taxes can significantly impact your investment returns.

Taxes can reduce the gap between your gross returns and what you actually take home. A well-structured, tax-efficient portfolio ensures that you maximize your returns while minimizing unnecessary outflows. One of the smartest tools to achieve this is an Equity-Linked Savings Scheme (ELSS)—a fund that combines equity-driven growth potential with tax-saving benefits.

Let’s explore how ELSS funds can help reduce your tax liability and create wealth over the long term.

How ELSS Funds Cut Taxes

For many investors, the primary draw of ELSS funds is the deduction of up to ₹1,50,000 under Section 80C under Old Regime of the Income Tax Act. While this is a significant advantage, there’s more to ELSS than just a tax deduction.

Tax Deduction Under Section 80C in Old Regime

ELSS allows you to claim a deduction of up to ₹1,50,000, which can reduce your taxable income. For someone in the highest tax bracket, this deduction translates to annual tax savings of up to ₹46,800. What makes ELSS particularly important in tax planning is its short lock-in period of just three years, compared to five or more years for other 80C options like tax-saving fixed deposits or Public Provident Fund (PPF).

Tax-Efficient Long-Term Capital Gains (LTCG)

The tax advantages of ELSS don’t stop at the deduction. Since ELSS funds primarily invest in equity (at least 60%), they are taxed like equity instruments:

After the mandatory three-year lock-in, any long-term capital gains (LTCG) of up to ₹1 lakh per financial year are completely tax-free.

If your gains exceed ₹1 lakh, the excess is taxed at just 10%.

For example, if you earn ₹1,50,000 as returns from your ELSS investment, only ₹50,000 (the amount above ₹1 lakh) is taxable. At a 10% tax rate, this amounts to ₹5,000—much lower than the tax on other investments in higher tax brackets. This dual advantage—tax savings under Section 80C and favorable LTCG taxation—makes ELSS one of the most tax-efficient ways to grow your wealth.

How ELSS Funds Grow Your Wealth?

Beyond the tax benefits, ELSS is a powerful tool for long-term wealth creation, thanks to its equity-focused approach.

The Equity Advantage

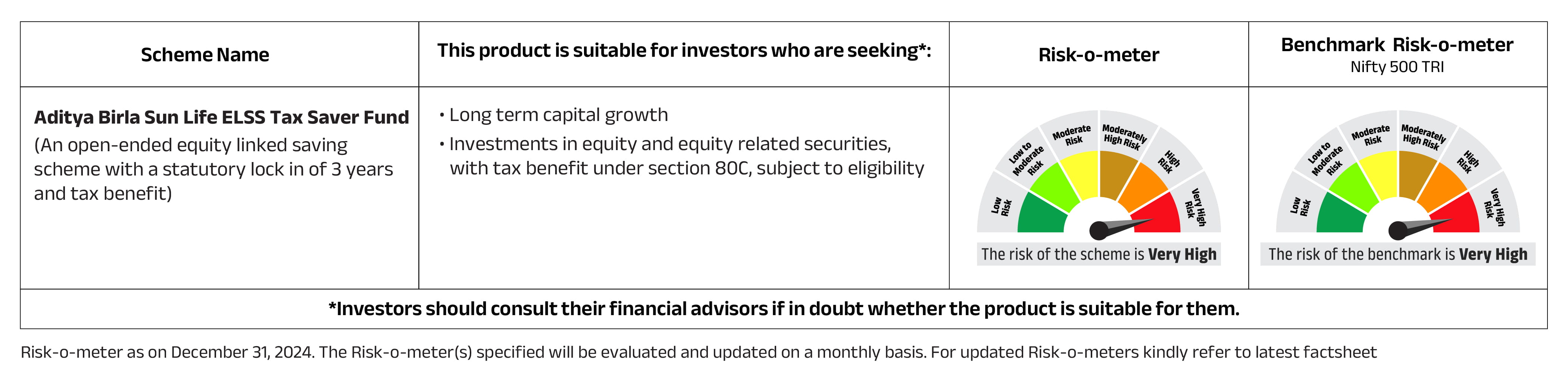

The Aditya Birla Sun Life ELSS Tax Saver Fund allocates 80% of its portfolio to equity and equity-linked securities, with the remaining 20% invested in debt and money market instruments for stability.

What sets ELSS apart is the fund manager’s flexibility to invest across sectors and market caps. With no single stock holding more than 10% of the scheme’s net asset value (NAV), your investment benefits from diversification, reducing risks while capturing growth opportunities across the market.

Lock-In Period as an Investment Discipline

The three-year lock-in period encourages disciplined investing. Unlike other mutual funds, ELSS restricts premature withdrawals, ensuring your money stays invested during market cycles. This allows the equity component to benefit from the power of compounding and market growth over time.

Even after the lock-in period ends, you can choose to remain invested to continue growing your wealth. Equity, as an asset class, performs best over the long term, making ELSS an ideal choice for financial goals such as retirement or wealth creation.

Regular SIPs for Consistent Growth

Starting a Systematic Investment Plan (SIP) in the Aditya Birla Sun Life ELSS Tax Saver Fund allows you to invest regularly, regardless of market conditions. SIPs enable you to take advantage of market fluctuations through rupee cost averaging and instill a habit of disciplined investing, helping you build a strong portfolio over time.

Why ELSS Deserves a Place in Your Portfolio?

Whether you’re planning for retirement, building a corpus for your child’s education, or saving for a major financial goal, ELSS funds can provide better post-tax returns compared to many fixed-income instruments. Here’s why ELSS is a smart choice for investors at all levels:

Tax Efficiency: ELSS helps reduce your tax outgo through Section 80C deductions and favorable LTCG treatment under Old Regime, aiming to maximize your take-home returns.

Wealth Creation: With an equity-heavy portfolio, ELSS funds offer higher growth potential than traditional tax-saving options like fixed deposits or PPF.

Ease of Access: You don’t need to track sectors or market trends. The fund manager’s expertise can ensure that your portfolio is diversified and growth-oriented.

For All Investors:

Beginners: ELSS is an investment option for new investors looking to explore equities with the added benefit of tax savings.

Seasoned Investors: ELSS remains a go-to option for experienced investors seeking tax efficiency alongside market-linked growth.

The Earlier You Start, the better the Benefits

Starting early allows your investments to benefit from the power of compounding. The longer your money stays invested, the greater the potential for wealth creation.

By starting a SIP in the Aditya Birla Sun Life ELSS Tax Saver Fund, you can automate your investments and enjoy the dual benefits of tax savings and long-term growth. This disciplined approach ensures that your money works for you, even during market fluctuations.

Final Thoughts

An ELSS fund like the Aditya Birla Sun Life ELSS Tax Saver Fund can not only help you save tax but also generate wealth in the long term.. Combining tax advantages with the growth potential of equity, it’s an investment that aligns with both your financial and tax-planning goals.

So, whether you’re a novice investor taking your first steps or an experienced investor optimizing your portfolio, ELSS funds can play a pivotal role. Start today and let the power of equity and tax efficiency work in your favor.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000