-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Understanding the Impact of GST Reforms on Consumption Funds

Nov 06, 2025

5 min

0 Rating

A consumption fund is a type of mutual fund that invests primarily in companies producing goods and services people use regularly. These include FMCG products, retail, automobiles, personal care items, and more. By focusing on sectors driven by consumer demand, these funds aim to generate long-term growth for investors. Consumption mutual funds, help investors tap into India’s expanding consumer economy, benefiting from the increasing purchasing power of households and rising consumption trends across urban and rural markets.

Overview of GST Changes and Reforms

The GST reforms introduced in September 2025 have been a significant step toward simplifying India’s tax system. By reducing rates across key industries, rationalising slabs, and addressing structural anomalies, the reforms aim to make goods and services more affordable while boosting the competitiveness of Indian businesses.

Sectors such as textiles, handicrafts, automobiles, footwear, food processing, and healthcare have been prioritised, with GST cuts lowering production costs, encouraging innovation, and supporting startups and MSMEs. These changes create an enabling environment for businesses and increase disposable income, which directly affects consumer spending and, in turn, consumption funds.

GST Impact on Consumer Spending

GST rate reductions reduce the cost of goods and services for consumers, leading to increased spending. For example, GST on essential clothing, footwear, daily food items, and educational materials has been cut significantly, making these items more affordable. Similarly, reductions in GST for two-wheelers, small cars, healthcare products, and fitness services enhance accessibility for younger consumers and middle-class households.

For consumption mutual funds, higher consumer spending translates into increased revenues and profits for companies in the fund’s portfolio. Sectors benefiting from GST cuts are likely to see higher demand, while industries facing stable or increased rates may experience a moderate short-term impact. Overall, lower GST encourages household consumption, which positively influences consumption fund performance.

Sectoral Effects on FMCG, Retail, and Automobiles

GST changes impact sectors differently:

FMCG: Reduced GST on items like packaged foods, baby care products, and personal care items increases affordability, boosting sales for FMCG companies. This benefits consumption funds with exposure to FMCG.

Retail: Simplified GST and lower rates on essential goods improve profitability for retailers and ease compliance, supporting both organised and local retail chains.

Automobiles: GST reductions on two-wheelers and small cars lower costs, improving sales and supporting manufacturers, dealerships, and related service providers.

By influencing consumption behaviour across these sectors, GST reforms directly affect the performance of mutual funds that invest in consumer-driven businesses.

How GST Influences Consumption Fund Performance

The performance of a consumption mutual fund depends largely on consumer demand and company earnings. GST reforms affect production costs, retail pricing, and overall consumption patterns, which in turn impact fund returns.

For instance, reduced GST on textiles, footwear, packaged foods, and healthcare products lowers costs for producers and prices for consumers, creating higher sales volumes and profits. Aditya Birla Sun Life Consumption Fund , which invest in these sectors, can benefit from this growth. Conversely, sectors where GST remains unchanged may see slower short-term growth. Overall, GST changes create both opportunities and temporary adjustments for investors in consumption-focused funds.

Investment Strategies Post-GST

Investors can consider the following strategies after the GST reforms:

Long-Term Focus:Emphasise sectors that benefit from structural growth, such as FMCG, retail, and automobiles.

Diversification: Choose consumption funds that hold a mix of consumer-driven companies to manage risk.

Monitor GST-Linked Trends: Stay updated on tax changes, as these can impact short-term consumption and fund performance.

Systematic Investment Plans (SIPs): Regular investments in funds like Aditya Birla Consumption Fund can help average market volatility and benefit from long-term growth in consumption.

These strategies can help investors capitalise on GST-driven growth while mitigating short-term market fluctuations.

Long-Term Considerations for Investors

While GST changes can create short-term volatility, the long-term outlook for consumption mutual funds remains strong. India’s rising disposable incomes, urbanisation, and demographic advantage ensure consistent demand for consumer goods, retail, and automobiles.

Investing in a Consumption Fund enables investors to capitalise on these structural trends. Patience and a long-term perspective are essential, as short-term fluctuations due to tax changes are normal. Over time, well-managed consumption funds can offer steady growth by capturing the increasing demand from consumers across India’s economy.

Sources:

https://www.pib.gov.in/FactsheetDetails.aspx?Id=150302

Disclaimers:

The information herein is meant only for general reading purposes and the views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. The document has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Recipients of this information are advised to rely on their own analysis, interpretations & investigations. Readers are also advised to seek independent professional advice in order to arrive at an informed investment decision.

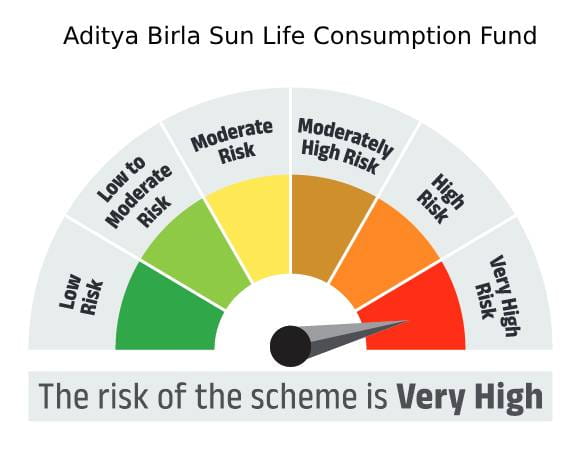

Aditya Birla Sun Life Consumption Fund

An open ended equity scheme following Consumption theme

This product is suitable for investors who are seeking

- Long term capital growth

- Investments in equity and equity related securities of companies that are expected to benefit from the rising consumption patterns in India fuelled by high disposable incomes

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Consumption funds are the funds that invest in companies producing goods and services that consumers use regularly, such as FMCG, retail, and automobiles.

GST changes affect product pricing, consumer spending, and company profits, which can influence fund performance both in the short and long term.

Yes. They benefit from India’s growing consumer base and can deliver consistent returns over time.

Yes. Funds like the ABSL Consumption Fund and Aditya Birla Consumption Fund are positioned to benefit from increased consumer demand and structural growth trends, making them suitable for long-term investment.

1800-270-7000

1800-270-7000