-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups.

Guide to choosing the Best Suited Equity Fund for You

Dec 23, 2019

6 mins

5 Rating

Equity funds are a popular choice for investors who want to dapple in the stock market but do not have the time and the expertise to study and analyse individual stocks. Equity funds are those mutual funds which invest at least 65% or more of its corpus in equity instruments. The balance may be allocated to other instruments such as debt and money market instruments.

There is a plethora of options when it comes to equity funds which can make it very confusing for an investor especially a novice one.

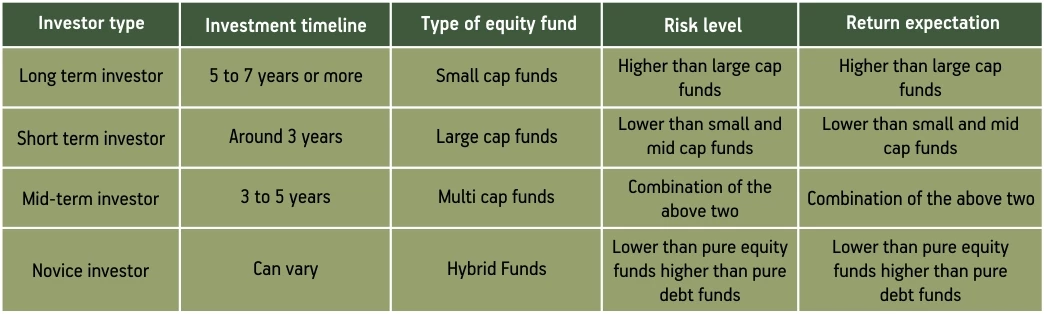

So how do you pick the equity fund that is best for you? Like any other investment planning, the first step is to understand your financial goals, your investment time horizon and your acceptable risk level. We have set out a guide to equity funds which you can select based on your goal parameters.

Long term investor (7 years or more)

Investors who have a high holding period for their investments coupled with a higher risk appetite can opt for Small and mid-cap funds. Small and mid-cap funds typically invest in stocks of emerging newer companies that have lower market capitalisations.

These companies are perceived as having expansive growth potential in the future and thus have potential for high growth. Being newer, less established companies of course brings with it a higher risk level as well. These funds are generally considered more riskier than large cap funds. Investors who can stomach such a risk level can seek to gain from investing in small and mid-cap funds.

Short term investor (3 -5 years)

Investors looking to invest their funds for a shorter period up to around 3 years can opt for Large cap funds. These funds invest in stocks of established large companies who are less susceptible to market fluctuations and are thus generally considered as safer investments in comparison to small and mid-cap funds. Being established companies, there is a lower probability of quantum leap in growth hence they also typically have a lower return rate expectation than small and mid-cap funds.

Mid–term investor (5 – 7 years)

An investor looking for a combination of the above two – potentially higher return than large caps but lower risk than small and mid-caps can opt for Multi-cap funds. These funds invest across market capitalisations – a combination of small and mid-cap funds and large cap funds.

Novice investor

An investor who is a new entrant to the equity market would probably not have the expertise to be able to time the market well. Such investors may also have a lower risk appetite as they are apprehensive of how the market may play out for them. Such investors can opt for a hybrid fund – which invests in a balance of equity and debt. These funds generally have higher returns than debt funds but lower risk than high percentage equity funds.

Investors who have primarily tax saving as a goal

Equity Linked Saving Schemes (ELSS) are equity funds that give tax saving benefit to its investors. These are accompanied by a mandatory 3-year lock-in period. So, investors looking to reduce their tax burden can opt for these funds.

Once you have locked in the type of fund to invest your money in, you can select the specific funds within that category by assessing them based on certain parameters –

-

Historic performance of the fund

-

Rating of the asset management companies managing the funds

-

Experience and expertise of the fund manager

-

Entry and exit loads of the fund

-

Expense ratio of the fund

-

Modes of investing offered – lump sum investment, System Investment Plan, Systematic Transfer Plan (STP) and Systematic Withdrawal plan (SWP)

An investor can also opt for return pay out of the fund based on income regularity required – dividend pay-out or growth option.

It is widely understood that investment in equity funds perform better when they are held for a reasonably long term. Your investment goals as well as risk appetite may however undergo changes at different stages in your life. You can choose to go in for plans such as STPs and SWPs for investment in equity funds which help you maintain longevity of your investments while adjusting them to your changing financial roadmap.

Past performance may or may not be sustained in future.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000