-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

How a Low Duration Fund could help you achieve your short-term goals?

Jan 07, 2021

3 mins

4 Rating

All of us have many dreams and wishes, these can be as complex as buying your dream home to something as simple as buying the latest electronic gadget. While planning for more expensive and long-term goals is crucial, you should give attention to your short-term goals as well. Its rightly said that one should ‘enjoy the little things in life’. But is planning for these long-term goals making you lose sight of your smaller and short-term dreams?

Say you are an avid biker, you might have your eyes set on your next bike – probably the latest model, fully loaded and due for launch a few months later. How could you fund this?

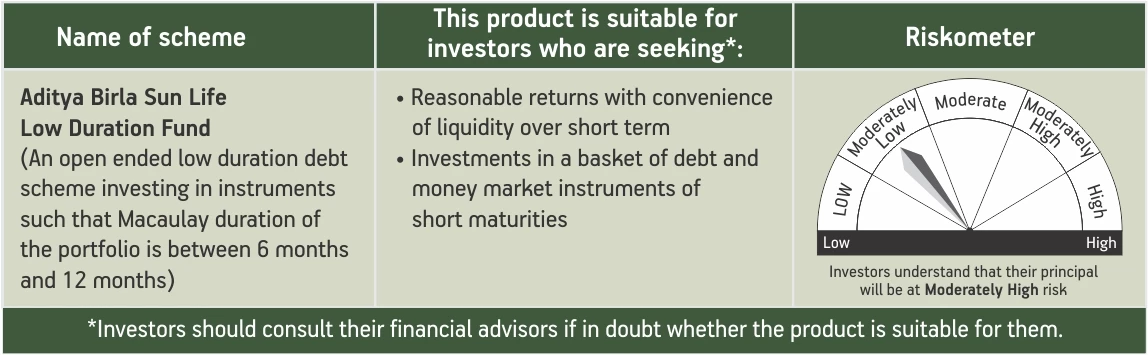

Instead of keeping money idle in your account, you can invest money earmarked towards your specific short-term goals in a fund which could provide you with the required liquidity and yet relatively reasonable returns on your invested money. You can consider investing in Aditya Birla Sun Life Low Duration Fund* for your short-term investment needs.

*an open ended low duration debt scheme investing in instruments such that Macaulay duration of the portfolio is between 6 months and 12 months

This scheme invests in a basket of debt and money market instruments of short maturities with an aim to earn reasonable returns with convenience of liquidity over short term.

Let’s look at how the Aditya Birla Sun Life Low Duration Fund can take you a step closer to achieving your short-term goals:

Return potential

The scheme invests in debt & money market instruments which have a pre-determined coupon rate attached to them. These coupon rates can help allow the fund to earn reasonable returns.

Liquidity

This scheme invests in basket of debt and money market instruments of short maturities– keeping the average duration of the portfolio between 6 to 12 months. Additionally, the open-ended nature of the fund means that you can redeem your investment at any time, with funds being credited into your bank account in T+1 day.

Thus, this scheme aims to give you liquidity allowing you to withdraw your fund to utilize for your goal whenever you wish.Keeps you on track to meet your short-term goals

Most investors struggle with differentiating between productive and frivolous expenditure, between wants and needs – especially if there are considerable funds lying idle in your account. Human psychology can make you spend more when visually you see more funds available. This scheme can keep you from falling prey to this kind of spending behaviour. Once funds are earmarked and invested for a specific purpose in this scheme, money can be accumulated rather than being spent on unnecessary day to day expenses.

Now that you know why one can invest in Aditya Birla Sun Life Low Duration Fund, here are few steps you can take with an aim to achieve your short-term goals:

Aim to invest money accumulated for your short-term goals to this fund

You can even opt for Systematic Investment Plan mode to invest in this fund

Redeem your investment whenever you wish to fund the earmarked purpose

Reassess and Reinvest as short-term goals change continuously each year

So do not let your smaller money accumulations sit idle, aim to invest in Aditya Birla Sun Life Low Duration fund to fund your short-term goals

For further information on the scheme, please refer SID/KIM of this scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000