-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How can investors take advantage of Business Cycles

Nov 19, 2021

2 min

4 Rating

Synopsis: Business cycles are cyclical. So, while these can positively or negatively impact the economy, industries and even investor sentiment, can you find benefits in these business cycles? Read on to know how you can use them to your investing advantage.

We are all too familiar with the quote ‘After every dark night comes a bright morning’ – In fact it is often applies to equity investing to explain the market’s cyclical movement. But what if we could tweak this quote- so as to actually ‘find light even in a dark night’?. Can investors actually get benefits from business cycles rather than fearing them?

Enter business cycle fund investing!

What are business cycles?

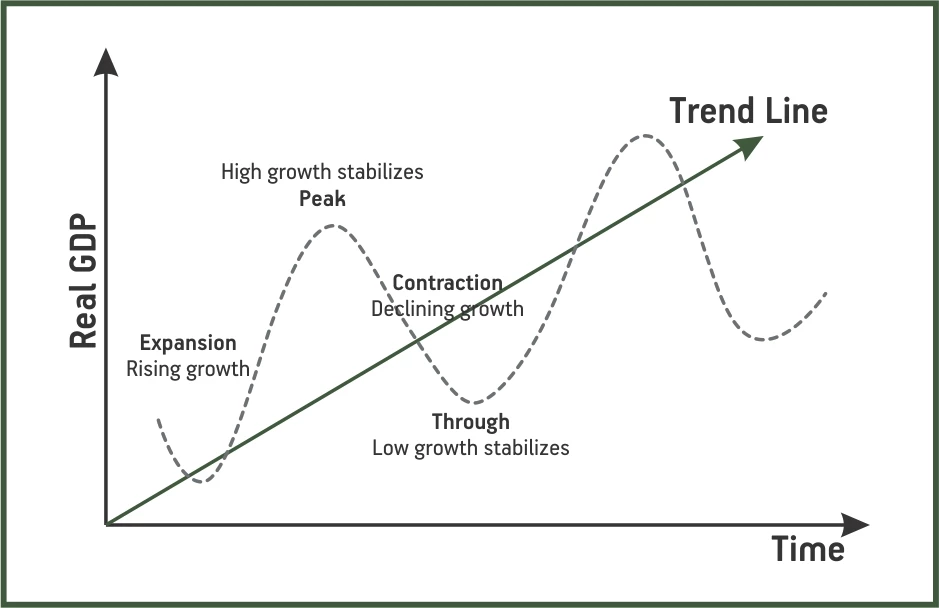

Business cycles represent the oscillation of economic activity between expansion and recession. They can in fact be broken down into 4 phases:

While this is at a macro-economic level, business cycles have a drill down effect as well - across sectors and across industries, as well as in market investing behaviour.

What do these business cycles mean for investors?

Each phase of a business cycle opens up a different set of opportunities. They impact different sectors differently. An expansion phase egged on by favourable interest rates can positively impact high value sectors such as real estate or industry; an expansion egged on by government stimulus can favour the sectors being stimulated.

In most cases, these phases will have some lead indicators. Catching these early can actually multiply the growth opportunities for investors. Think of it as ‘first mover advantage’ for your investments.

So just as, ‘It is the early bird that catches the worm…. it is the proactive investor who can gain from business cycle opportunities.

As an investor, especially a novice investor - How do you navigate these business cycles and identify cyclical and sectoral opportunities to benefit your investment portfolio?

Take the help of experts

Doing this on your own can be a herculean task, so you can rely on experts instead. AMCs today offer ‘business cycle mutual funds’ – mutual funds whose investing strategy is premised on business cycle investing.

What is a business cycle fund? Let's break down its investing style:

True to label, a business cycle fund operates on the premise that changing business cycles change growth opportunities warranting a change in investment strategy.

It seeks to:

Identify

This investing philosophy seeks to first of all identify the phase of the business cycle the economy is operating in

Be pro-active

Not just active investing but pro-active investing as it seeks to pre-empt the sectoral and cyclical opportunities

Be selective

Mixes up stocks from defensive and non-defensive sector based on its assessment of cyclical opportunities and sectoral tailwinds - Defensive sectors are those that have consistent customer demand giving them the ability to remain fairly stable even during contraction phase - Non-defensive sectors are those that operate in cyclical themes or throw up sectoral opportunities which can make them outperform in the expansion phase

What it means for your investment portfolio? • Brings the classic ‘stability-growth’ balance with a twist! • Prepares you for changing business cycles • Can give you first mover advantage by capitalise on cyclical market opportunities

Balances your investment with exposure to both defensive sectors that tend to perform through economic contraction as well select non-defensive sectors that can outperform during economic expansion

While you cannot predict with certainty changing business cycles, being prepared with a pro-active investing strategy can help weather them better

These opportunities tend to be short lived necessitating swift action to create investor value

All in all, these funds and their fund manager expertise, with their ‘all-weather’ approach can maximise long-term growth potential for investors.

Presenting Aditya Birla Sun Life Business Cycle Fund – an open ended fund equity scheme following a business cycle based investing theme. Click here to know more about this fund.

For more information on the scheme, please refer to the SID/KIM of the scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000