-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How much should you increase your SIPs every year?

Mar 15, 2022

4 min

4 Rating

‘Small acts, when multiplied: can transform the world’. This famous saying is so appropriate for Systematic Investment Plan (SIP) investing - Small SIPs when compounded, too can transform your financial world. SIP investing regular, often small sums of money in mutual funds, consistently and at periodic time intervals. We all know the benefit of SIP investing in mutual funds. A convenient and affordable means that not only inculcates financial discipline but also slowly but steadily gets you closer to your financial goals.

Financial planning however is not stagnant. As times change, goals change and income changes, your financial plan too may call for changes. Is setting up an SIP investment or set of SIPs enough? Or should you revisit this each year too?

Also Read - What is SIP?

As your income and aspirations increase…. So could your SIPs

Do you remember your college days when eating at a restaurant or travelling in an auto over a bus, on a meagre pocket money seemed like a luxury? Cut to today, when on a corporate salary you wouldn’t want to settle for anything less than a 5 star and a luxury sedan. That’s what increasing income does. As your income rises, so do your aspirations and your needs.

The funds you estimate that you may need for a holiday today may not be the same tomorrow – it doesn’t take long for your Goa trip plan to transform into a US tour dream.

This necessitates that your investments reflect this increasing aspiration. Stepping up your monthly SIPs has the power to compound your invested corpus, and thus can be a good way to meet your increasing financial wants.

Also Read - What is SIP?

But by how much?

There generally isn’t a ‘one size fits all’ when it comes to investing. While a lot of factors can affect your SIP planning, broadly there are two factors which can determine how much your SIPs should increase each year:

1. Your current affordability matched with your desired financial goals/corpus

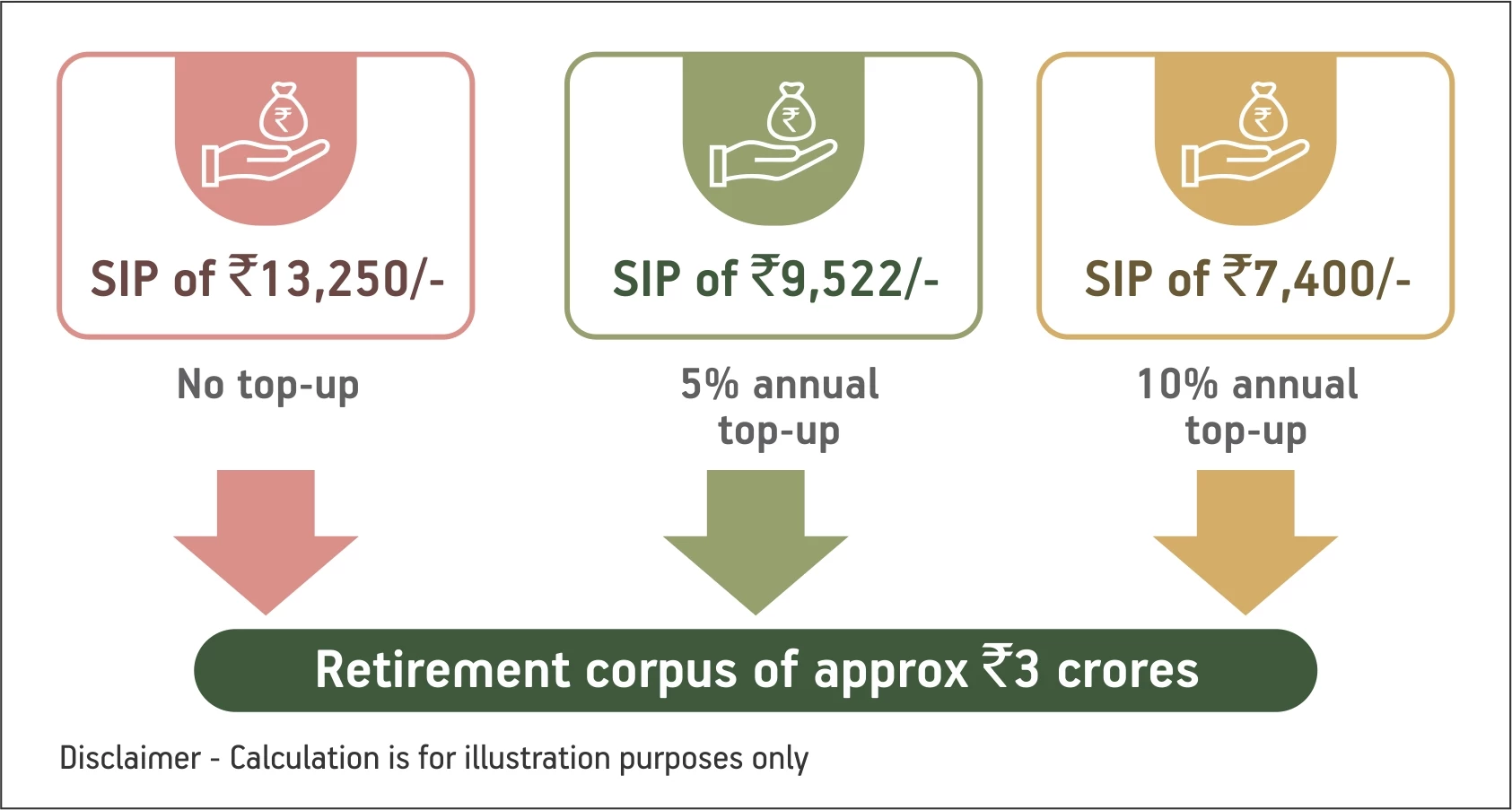

Let’s say you desire a Rs. 3 crore retirement corpus, 30 years from now. If you start investing today, you will need to set up a monthly SIP mutual fund investment of Rs.13,271 to achieve this. (Assuming an interest rate of 10%).

With several shorter-term responsibilities like high monthly expenses, kids’ education, loan EMIs or SIP payments for shorter term goals, you may fall short of affording this amount.

Using the step-up feature can help here. Just by taking a 10% annual increase in your annual SIPs, you can achieve this target corpus of Rs.3 crores with almost half the SIP amount today – Rs.7,400.

You can use a simple reverse SIP calculator (with top up) to work this out. All you will need to input is the required corpus amount, number of years, annual top up % and expected rate of return.

2. Your expected income increments vis-à-vis your planned expenses

Most of us can gauge our income accretions to some extent. Especially if you are employed, an annual increment is almost a given.

Let’s say you expect an annual increment of 8-10%, does this mean you limit your SIP increments to a commensurate % ?

Probably not, for most people a rise in income does not result in a commensurate hike in expenses. Most of your fixed expenses tend to remain broadly the same (subject to inflation of course). This means you can be left with more surplus to divert to your investments.

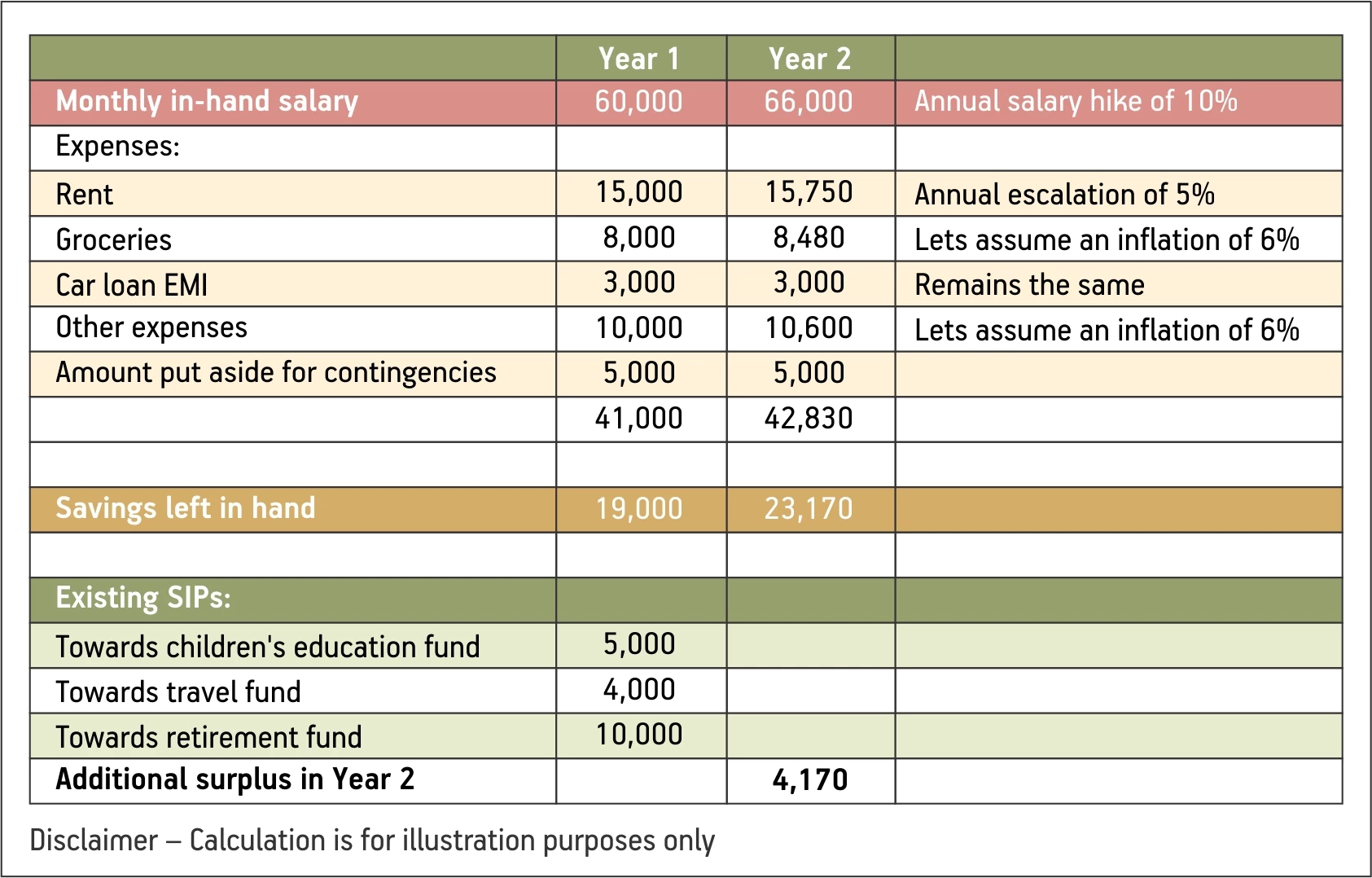

Let’s take an example:

The investor here has a surplus of more than 20% over his existing SIPs, even though he had a 10% salary increment.

Even if you wish to splurge a little or have some luxury expenses you want to account for, you are still likely to be left with a good amount to top up your SIPs.

Picture this:

You can more than double your corpus !

This is the power of compounding with SIP top-ups!

SIP top-ups are like a bonus for your investments; in fact, a substantial one. Stepping up your SIPs can achieve so much - from covering inflation, to funding your increasing needs or contingencies or even putting you on a path to early retirement. So, do not fix SIPs and forget about them, instead try topping them up each year to ‘Compound your investment and discount your worries’!

Remember, the key is to be consistent with your SIPs. Even if an unplanned contingency prevents you from topping up in a certain year, you can always make up for that in subsequent years by re-working your calculations.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000