-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How Multi cap funds are different from Flexi cap funds?

Apr 28, 2021

3 mins

5 Rating

The equity market is flooded with abundant investment opportunities - with market capitalisations ranging from ~ INR 12.69 lac cr to ~ INR 0.83 cr1 and everything in between. So, what end of the spectrum should you choose to invest in? Perhaps a mix?

Consider an example of a multi brand grocery store. It houses both expensive established brands as well as local or new brands, across product lines. When you are out grocery shopping would you pick all the expensive brands or only the inexpensive unbranded items? The answer actually lies somewhere in between. You most likely end up picking some branded ‘tried and tested’ items as well as some unbranded products for their value for money and novelty factor.

The same analogy can apply for when you are out ‘stock shopping’. A mix of large, mid and small cap can give you stability along with growth potential when you are looking for diversified equity exposure.

Enter Multi cap and Flexi cap Mutual Funds

AMCs today offer two types of mutual funds for capturing equity opportunities across market capitalisations – Multi cap and Flexi cap funds.

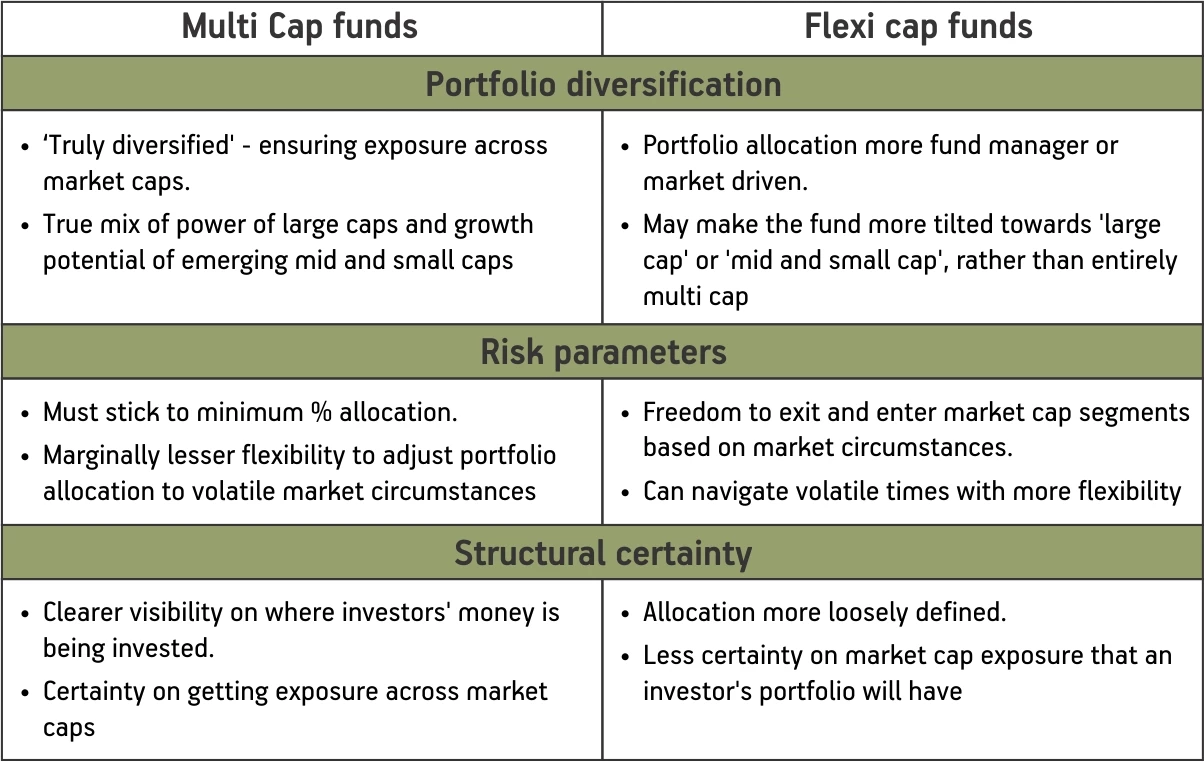

While the common theme running through both these funds is that they can invest across large, mid and small caps, there are several factors that differentiate them…

Also Read - What are Flexi Cap Funds?

Multi cap vis-à-vis Flexi cap funds – The Basics

Where do they invest?

As per SEBI mandate, Multi cap funds must invest a minimum of 75% in equity and equity-based instruments.

Flexi cap funds on the other hand, have a lower overall allocation criterion. They must invest a minimum of 65% in equity and equity-based instruments.How do they invest?

Multi cap funds have a more specific and fixed mandate with respect to how they must invest. They have a 25-25-25 rule which requires minimum allocation of 25% each to large cap, mid cap and small cap. The balance 25% is at the fund manager’s disposal to be invested in any market cap or in any other investable instrument.

Flexi cap funds have a more flexible mandate. They are free to invest across any market capitalisation without any minimum limit or maximum cap for a specific market cap category, so long as the minimum 65% equity exposure criteria is met.

Multi cap vis-à-vis Flexi cap funds – What does it mean for investors?

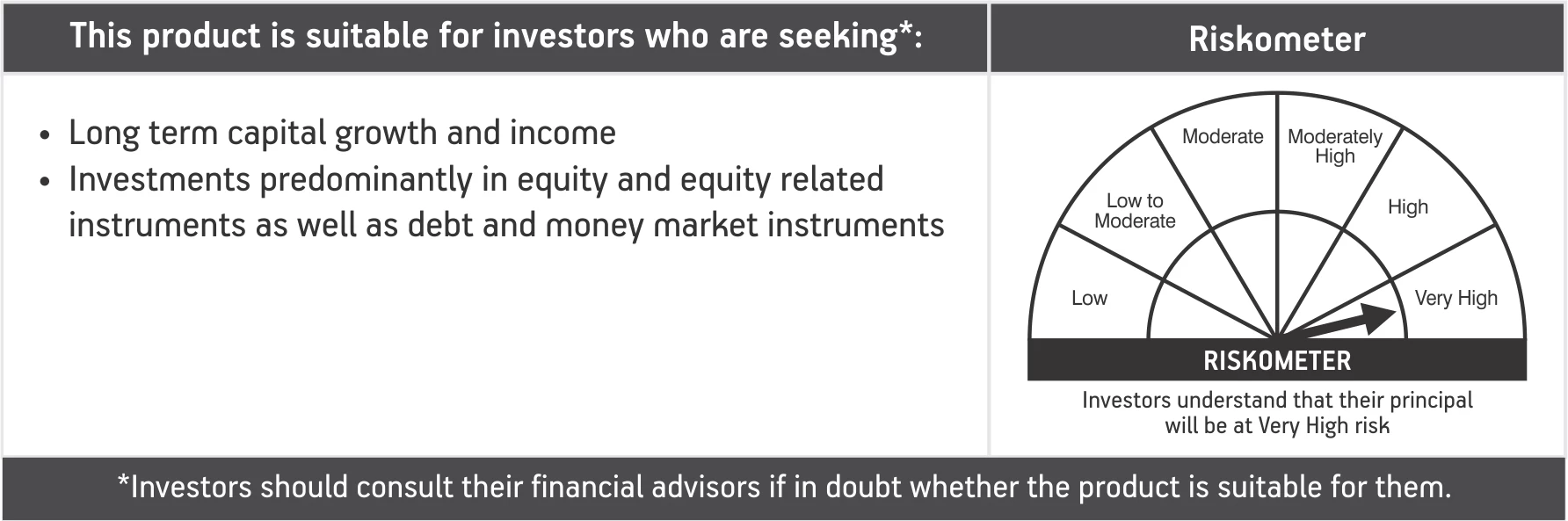

Like most investment decisions, choosing between a multi cap and a flexi fund should be guided by your investment goals and risk and return expectations. In a nutshell, if you are looking for pure diversification across market caps and are willing to take on the higher risk level of the mid and small caps then multi caps can be the right choice for you. On the other hand, if you are looking for a less rigid, more market driven addition to your portfolio then a flexi cap fund could be your choice of investment.

Either way, keeping a long-term investment horizon will be the key to success for investments in both multi cap and flexi cap funds.

Presenting Aditya Birla Sun Life Multi-Cap Fund, an open ended equity scheme investing across large cap, mid cap & small cap stocks. The fund is mandated to invest at least 25% exposure each in Large, Mid & Small Cap segments. NFO Opens: 19th April 2021; NFO Closes 3rd May 2021. To invest, click here: https://bit.ly/3gjl0R1

The product labeling assigned during the NFO is based on internal assessment of the Scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

For more information on the scheme, please refer to the SID/KIM of this scheme.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000