-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How not to confuse Risk Aversion with Risk Ignorance?

Sep 10, 2019

4 mins

5 Rating

Do you find yourself weary of investing your money in stocks? Do you feel a greater sense of security to see your money lying stable in fixed deposits or bonds rather than to see it fluctuate in stocks and funds? If yes, then you are a cautious investor who is ‘risk averse’. But how much caution is too much caution?

In investing parlance, ‘risk’ refers to the level of uncertainty with regards to returns and the likelihood of loss of capital associated with a particular investment type. Higher risk is more often than not associated with higher returns. Click here to know how to can you find your risk appetite?

A risk averse investor is one who shies away from high risk investments and sticks to safer instruments that provide a more certain return. Such an investor generally opts for a larger proportion of investments like government bonds and fixed deposits in his portfolio.

While a risk averse strategy has its benefits and may work for some investors, especially retired individuals, saturating your portfolio with ‘risk-free’ investments and trying to ignore risk completely can do more harm than good. Discounting risk completely in the name of aversion is serious ignorance. Ignorance of risk can lead to ignorance of other factors which can be detrimental to your financial planning

-

Ignoring the effect of inflation

Investors adopt a risk averse strategy to have ‘peace of mind’ when it comes to the safety and security of their money as well as surety of returns. But can complete ignorance of the risk factor really give ‘peace of mind’? Ignoring the importance of bearing risk to achieve growth means ignoring the repercussions of inflation?

Near to risk free investments generally have fixed rate of returns which means you are likely to earn a constant absolute amount of return over the years, can the returns earned today still suffice 5 or 10 years later?

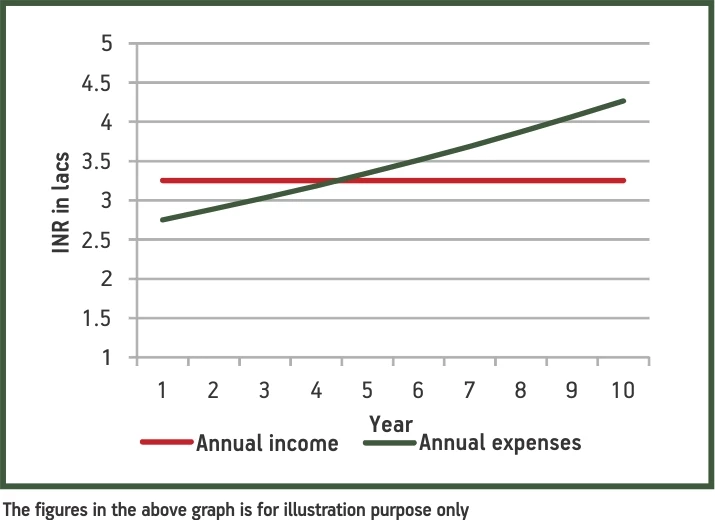

For example – a risk averse investor, having invested a corpus of INR 50lacs in 10 year tax free government bonds at the rate of 6.5%p.a will get an annual return of INR 3.25 lacs. This is sufficient for him to cover his average annual expenses today of say INR 2.75lacs with a buffer of INR 50,000. The aspect that this investor did not consider however is the impact of inflation.

Considering an average annual inflation of 5%, the annual expenses grow steadily from INR 2.75 lacs to INR 4.27 lacs in 10 years, while the annual return remains constant at INR 3.25 lacs. So, while the returns may be certain and the capital safe in this investor’s risk averse strategy, the returns are not able to beat inflation and may ultimately just not be enough.

Risk ignorance in effect can give investors a false sense of security.

-

Ignoring good investment opportunities

Another side effect of being risk ignorant is the opportunity cost of foregone higher return making opportunities.

There may be several higher return opportunities that may emerge during an investor’s lifetime – from IPOs to investing in emerging sector equity or funds.

Having a risk ignorant approach can keep you from capitalising on genuine profitable opportunities.

The key to being risk averse without spilling over into complete risk ignorance is to not to be fearful of risk but to understand risk. Not all risk is bad. Understand the varied investment avenues and the risk associated with each of them and how they align to your investment goals. It can be a better approach to go in for a diversified portfolio to minimise risk than to completely try to avoid it.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000