-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How to enjoy investing without worrying about market moves?

Feb 20, 2025

7 min

4 Rating

Equity and debt are often seen as two very different personalities, much like two cousins with opposite traits. Equity is the bold, adventurous cousin—risky but with the potential for big rewards, always chasing the highs. On the other hand, debt is the quieter, more dependable cousin, staying in the background, offering stability and consistency without the ups and downs of the market.

While equity markets have had their share of impressive growth years, they have also faced significant downturns.

As investors, we want to enjoy the rewards of investing without the constant stress of market fluctuations. While relying solely on debt can provide peace of mind—it might also mean missing out on the higher returns that equity can offer. So, what is the solution for investors who want to enjoy the upside of equity but with a more cautious approach, ensuring stability and peace of mind?

Can this be achieved through a balanced approach?

Switching in and out of equity based on market valuations could be one strategy—but it is often difficult for individual investors to execute. Market timing requires careful analysis, experience, and constant monitoring, which can be exhausting and risky. What then is a simpler and more effective way to manage this balance?

Introducing an innovative hybrid fund offering: Balanced Advantage Funds

Balanced Advantage Funds (BAFs) are a great solution for investors who want to enjoy the potential benefits of equity without sacrificing the stability of debt.

Balanced Advantage funds or Dynamic Asset Allocation funds are hybrid funds that invest

Dynamically between equity and debt i.e.: they can invest as little as 0% and as much as 100% in both equity and debt.

Most BAFs offered today though do ensure a minimum allocation % to equity to meet the growth requirements of investors while continuing to take the support of debt investments.

How these funds work

The funds constantly evaluate market valuations to decide how much to invest in equity and debt. Fund managers monitor various indicators, such as price-to-earnings ratios, interest rates, and overall market conditions, to assess whether equity is overvalued or undervalued.

When equity valuations are high, the fund reduces its exposure to stocks and increases its allocation to debt, protecting the investment from potential market corrections. Conversely, when valuations are more attractive, meaning equity is undervalued, the fund increases its equity exposure to take advantage of growth opportunities. This valuation-driven strategy allows BAFs to adapt to changing market conditions, offering investors the flexibility to benefit from the upside of equity while managing the downside risk through debt when necessary.

What these funds can achieve for an investor:

The joy of investing…

With Balanced Advantage Funds (BAFs), you can enjoy the thrill of equity investing without the constant stress. Fund managers actively seek out undervalued growth opportunities, so you are likely to see good wealth creation over time. Plus, the flexibility of these funds—without any bias towards specific sectors or market caps—means the potential for seizing opportunities in a variety of areas, maximizing your chances for growth.

...And eliminating the worry about market moves

One of the biggest challenges of equity investing is the market's unpredictable ups and downs. With BAFs, you can pass that worry to expert fund managers. Their job is to monitor market conditions closely, adjusting the fund's equity and debt allocations to keep risk levels in check. By switching to debt when market conditions signal potential losses, they help protect your investment while still aiming for steady returns.

Additional benefits of balanced advantage funds:

-

Tax advantage: Most BAFs allocate at least 65% of the fund to equity, which allows them to qualify for the tax benefits typically applied to equity funds. This means your investment could benefit from favourable tax treatment, giving you more of your returns in the long run.

-

Diversification: These funds often invest across different asset classes and sectors, offering you greater diversification and further reducing risk.

With Balanced Advantage Funds, you can enjoy the best of both worlds. You get the thrill of growth, but with the stability that ensures you are not caught off guard during turbulent times. By letting expert managers balance the two, you can sit back and enjoy the ride – after all, investing should be about enjoying the journey of your money growing, not stressing over every twist and turn along the way.

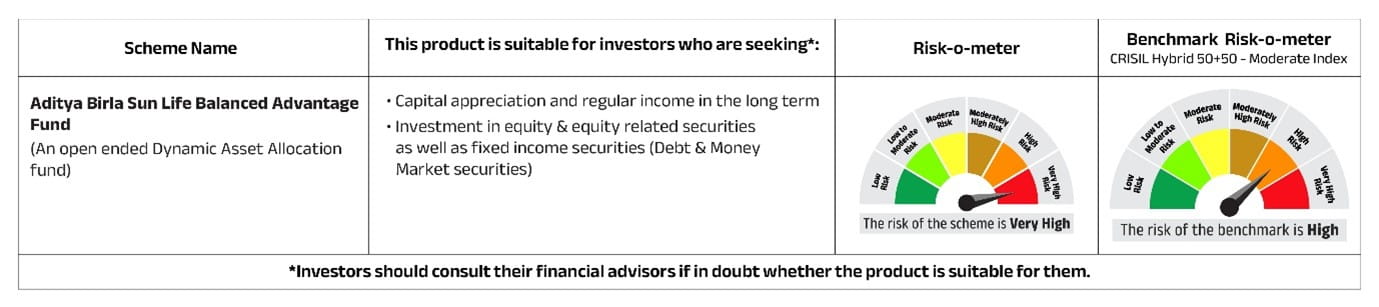

For investors seeking a truly balanced approach, Aditya Birla Sun Life Mutual Fund’s – Aditya Birla Sun Life Balanced Advantage Fund stands out. With its value-based investing style, it aims to achieve that perfect balance between growth and stability.

Risk-o-meter as on 31st January 2025.

The Risk-o-meter(s) specified will be evaluated and updated on a monthly basis. For updated Risk-o-meters kindly refer to latest factsheet.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000