-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How to give Digital Edge to your portfolio

Dec 09, 2022

4 min

0 Rating

Digitization is all around us today.

Looking to buy branded goods? You can opt for an e-commerce store over visiting a crowded mall.

Need to make a payment? Can do so digitally via UPI, be it at your local kiraana or at the fanciest mall.

Bored, looking to catch a film? Do so digitally over OTT from the comfort of your home!

In short, ‘digital’ is anything and everything that centres around, enables or is dependent on technology!

Indian markets at the forefront of this widespread digitisation

India is well in this digital game, looking at growing to a whopping USD 1 Trillion digital economy by 20251. This is likely going to boost tech enabled companies across the board.

Does your investment portfolio represent this fast-growing space?

Digital India is represented by stocks from across sectors – IT software and hardware, BPO and KPOs, E-commerce, media and entertainment, telecom and several other tech-enabled companies. This encompasses a number of stocks from fledgling start-ups and small caps to the big guns! So simply buying a few tech stocks may not do the trick.

Then, how can you get a fair representation of the winners across these sub sectors, in your portfolio?

By giving your portfolio a digital edge

A mutual fund can be a great way to achieve this. Opting for a thematic Fund that focuses on stocks across digital sub-sectors can get you in the thick of things, giving you a digital edge portfolio!

Introducing the Aditya Birla Sun Life Digital India Fund

What is it?

It is a thematic fund. It invests 100% of its portfolio into technology dependant stocks from across sectors such as technology, telecom, media, entertainment, and other related sectors.

How it invests?

Using a bottom-up approach, the fund adopts both a value and growth investing style to pick a portfolio of robust tech stocks. From the top names like Infosys and TCS to lucrative start-ups like Zomato, this fund has a wide representation of stocks.

How you can benefit?

Diversify across tech sub sectors

With this fund, you are not limited to stocks of a single tech sector, instead you get a diversified exposure to a variety of tech-related stocks. This gives you access to the growth potential of these diversified sectors through a single investment instrument.

Be part of a fast-growing digital revolution

The IT sector grew by 15.5% in FY’222, the highest growth in a decade; India E-commerce market is also at its all-time high expected to see a high double digit CAGR3. The fintech market is also expected to grow at a CAGR of 20%4

All in all, various tech sectors are growing at a significant pace. Investing in the digital fund can open up your portfolio to these fast-growing sub-sectors.Fund manager expertise

Individually studying, analysing and picking stocks can be a difficult task especially for a new investor. Investing through a mutual fund gives you the advantage of fund manager expertise in picking a potentially winning portfolio combination.

With the added investing convenience

You can access this wide range of digital stocks even with limited investments – as low as INR 1,000.

Additionally like all mutual funds, this fund has convenient investing options such as SIP, STP, SWP etc, so that you can plan your investments accordingly.

In the words of TCS CEO, ‘Going Digital is no longer an option, it is the default!’. For your portfolio too, getting a digital edge is a must-do in today’s digitised times. So go ahead and supplement your portfolio with the top digital picks through our Digital India Fund!

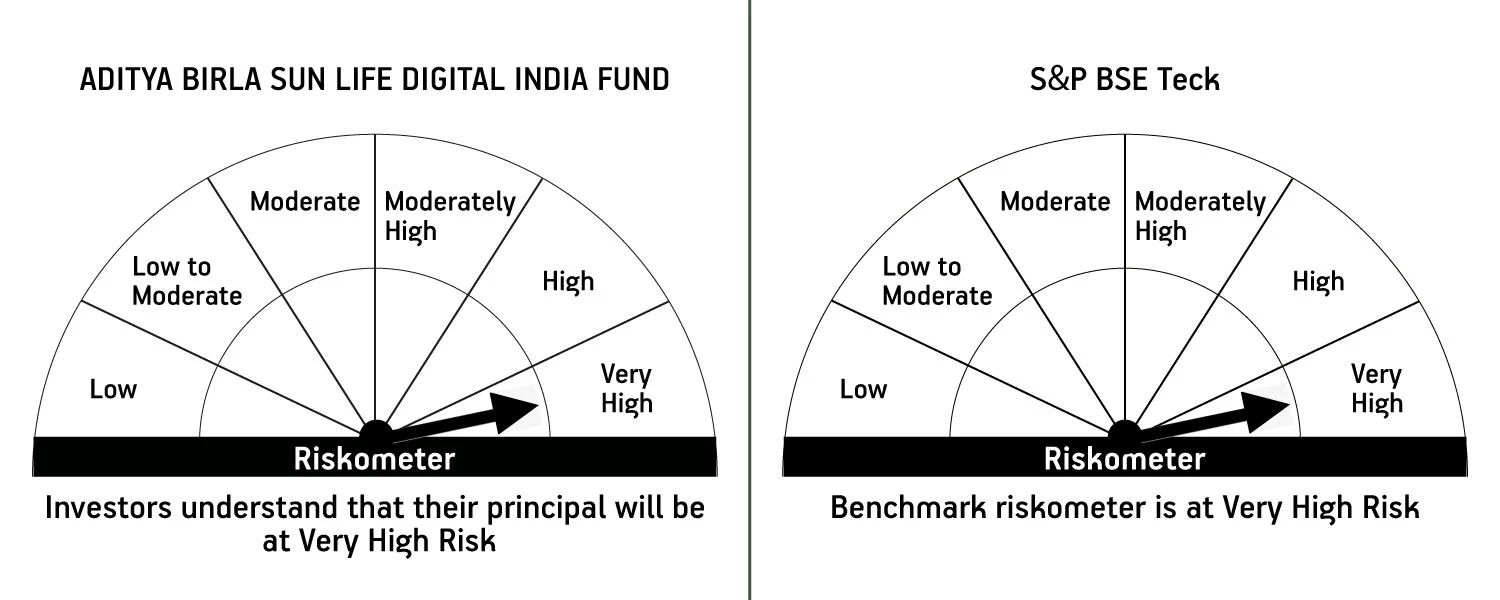

Aditya Birla Sun Life Digital India Fund

(An open ended equity scheme investing in the Technology, Telecom, Media, Entertainment and other related ancillary sectors)

This product is suitable for investors who are seeking*

- Long-term capital growth

- Investments in equity and equity related securities with a focus on investing in Technology, Telecom, Media, Entertainment and other related ancillary sectors.

*Investors should consult their financial advisers if in doubt whether the product is suitable for them

1 https://www.livemint.com/news/india/indias-digital-sector-valuations-will-cross-1-trillion-by-2025-says-pm-modi-11655906031139.html

2 https://www.livemint.com/industry/infotech/indian-it-sector-sees-highest-growth-in-a-decade-adds-4-5-lakh-new-jobs-11644908035968.html

3 https://www.ibef.org/industry/ecommerce/infographic

4 https://www.expresscomputer.in/guest-blogs/fintech-in-india-a-global-growth-story/90619/#:~:text=With%20the%20introduction%20of%20innovative,of%20%24138%20billion%20in%202023.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000