-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

How to Invest in Mutual Funds : Everything You Need to Know

Jul 14, 2022

4 min

4 Rating

In the last couple of decades, mutual funds have emerged as one of the major investment options for the Indian public. While stock market investments had been around for a long time, mutual funds have gained popularity in the 21st century. The growing popularity of mutual fund investments is due to their simple, affordable, and beneficial nature.

Yet, the majority of Indian investors still don't know how to invest in mutual funds. That’s why we have created this guide that would tell you how you can invest in mutual funds. Let’s dive in.

What is a mutual fund?

A mutual fund, as the name indicates, is an investment option wherein the mutual fund company pools in money from a group of investors who share a common investment objective. Mutual funds are managed by professional fund managers. Mutual funds invest in stocks, bonds, gold, and other SEBI permitted investment instruments to generate returns for investors. Whenever someone invests in mutual funds, the investor is given a small stake in the fund through units.

Functioning of mutual funds

Mutual fund schemes are managed by Asset Management Companies (AMCs). A large AMC would manage and operate several mutual fund types with each one helping achieve specific investment goals. Depending on what a mutual fund’s goal is, the money pooled in from investors is invested in different instruments by fund managers. The return on investments is divided and distributed proportionately amongst the investors after deducting certain expenses, by calculating a scheme’s Net Asset Value or NAV.

Why to invest in mutual funds

There are several benefits of investing in mutual funds.

Professional expertise – Mutual fund managers are financial experts with relevant qualifications and experience. Thus, even when you don’t have time to personally monitor and manage the investments, you can be assured that with mutual funds, your money is managed by professionals.

Ease – Mutual fund investments are easy. Nowadays, you can log on to the Mutual Fund company’s website or even use smartphone apps to invest in a paperless manner from the comfort of your home.

Low entry barrier – Mutual fund SIPs (Systematic Investment Plans) start from as low as INR 500 per month. Thus, even small ticket investors can confidently start investing in different mutual fund types.

Portfolio diversification – Mutual funds are a great way to diversify your portfolio alongside reducing the risk exposure. For instance, a large cap fund is likely to invest in stocks of as many as 100 of the top companies on the S&P BSE 100 list.

Tax Savings – Equity linked Saving Scheme, is a type of mutual fund which offer tax saving investment under Section 80C of the Income Tax Act.

There are several mutual fund types available nowadays. For instance, there are equity funds which invest the pooled money into stocks. The equity funds are further categorized in Large Cap, Mid Cap, Large and Mid-Cap, Small Cap, and multi cap funds depending upon the market capitalization of the companies they invest in. As per one’s individual investment goals, different mutual fund types can be selected for achieving the desired returns.

How to invest in mutual funds?

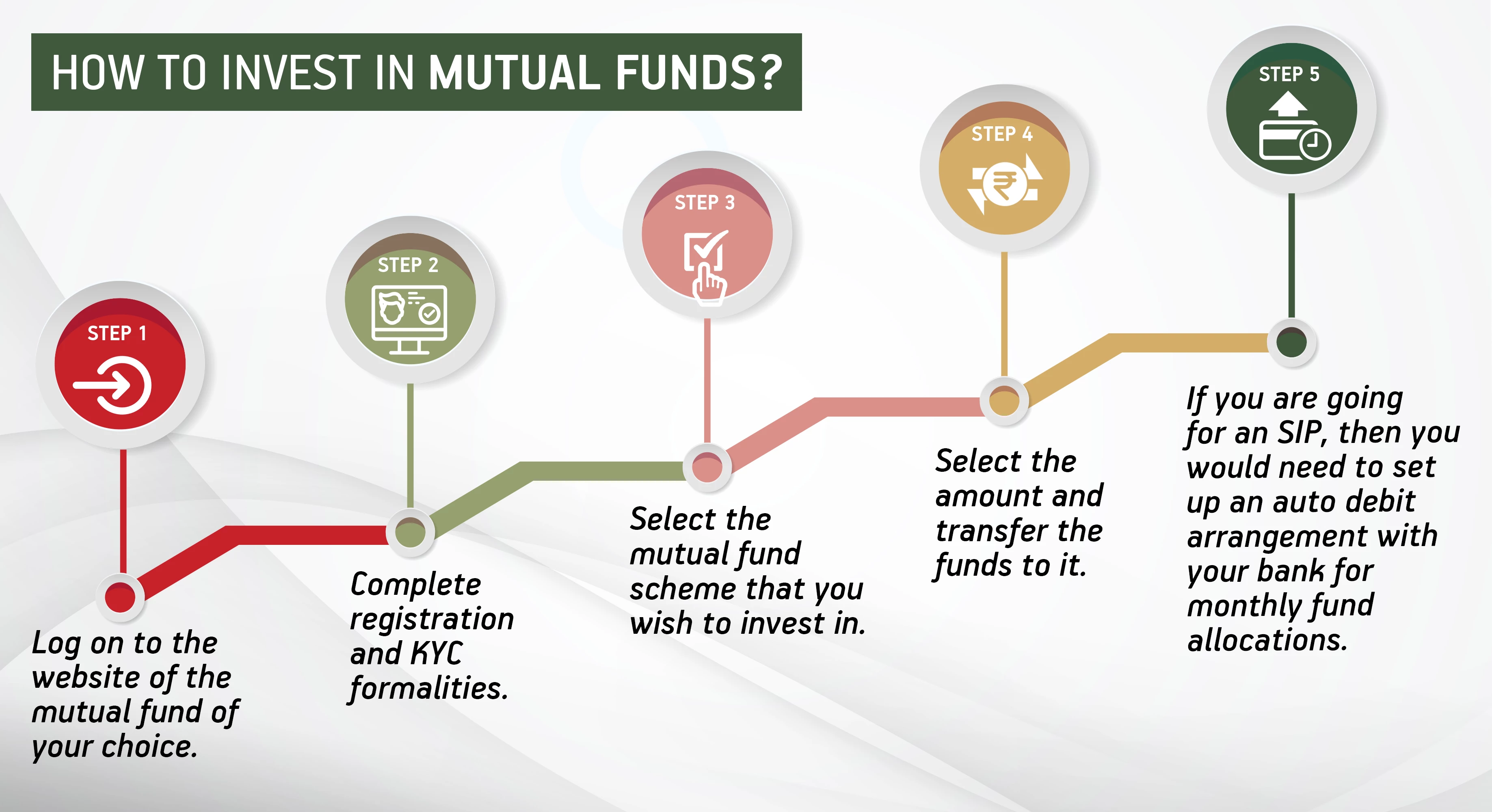

Mutual fund investments are very easy and take hardly a few minutes in the digital age. You would typically need to follow these steps.

Log on to the website of the mutual fund of your choice.

Complete registration and KYC formalities

Select the mutual fund scheme that you wish to invest in

Select the amount and transfer the funds to it

If you are going for an SIP, then you would need to set up an auto debit arrangement with your bank for monthly fund allocations.

That’s all you need to do. It is often said that people become wealthy when their money works for them even when they sleep or take a vacation. Mutual funds do exactly that for you. Go ahead and explore the world of mutual fund investments today!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000