-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How to invest without checking the market every day (and still make money)?

Mar 19, 2025

5 min

4 Rating

Discover how a balanced investment approach can help you make money by optimizing returns and managing risks without staying glued to market screens.

In the world of investing, checking the market daily to monitor stock movements could be addictive. There is a myth that one will stay in control of one's investments if one checks the prices daily. In reality, no good comes from looking at the daily prices. These are market noises and only show you the moody and unpredictable nature of Mr. Market.

Why one should not check the market every day

While it is important to review your investments periodically, checking the market every day could affect your physical, mental, and even financial health.

Making decisions in panic: If investors keep looking at their portfolio every day, they could be tempted to trade or change their investment decision out of panic. If stock prices are rising, they might want to take more risk and if stock prices are falling, they might become risk averse. In either case, investors might change the course of their investment in the wrong direction.

Distraction: Daily stock price momentum and an overdose of market news could make one anxious. There might be opportunities one missed and others picked which might create a sense of fear of missing out (FOMO), leading to investors taking undue risks.

Prices won’t give you more control: Daily prices may not give you insights about your investments’ growth potential. Most wealthy investors don’t look at the stock price to make investment decisions. They study the business, the macro factors, the company’s risks, management’s growth strategy, and the company’s annual reports to get a reason to invest. They review the health of the investing reason and whether it is still intact.

You can do more with your time: The whole concept of investing is putting your money to work while you give time to other things that demand your attention. Instead of monitoring the market daily, you can use that time to prepare a smart investment strategy for your portfolio. A strategy that balances risk and reward, a strategy that is market neutral and generates returns in the long term.

Elaborating on the last point, here is a way to invest and make money in the long term without checking the markets daily

A balanced approach to invest and make money

The stock market is dynamic and volatile. Sometimes it is bullish and sometimes bearish. Many investors believe that checking the markets every day will give them the information to buy the dip and sell the rally. However, that is not how things work.

There are asset classes that behave differently in different market conditions.

Equity may be volatile in the short term but could generate wealth in the long term.

Debt may be stable in the short term, giving you an option to preserve your wealth from equity market volatility. However, it may not beat inflation in the long term.

A balanced investment approach is to maintain an asset allocation in equity and debt, depending on the risk profile and market conditions.

Let’s understand it with the help of an example. Suppose you have Rs 1,000. You allocate Rs 500 each in debt and equity (50%). The equity portion performs well, increasing its value to Rs 650, thereby increasing its allocation in your portfolio to 65%. During the periodic review, you rebalance the portfolio to 50% by taking the Rs 75 surplus in equity and shifting it to debt. Both equity and debt have Rs 575 each.

However, the rigidity of asset allocation may not allow you to flow with market moods and you might miss out on future growth of equity if the market has just begun the bull run. This is where Balanced Advantage Funds help.

How Balanced Advantage Fund makes money

A Balanced Advantage Fund has a dynamic asset allocation strategy, wherein the fund manager adjusts the asset allocation between equity and debt depending on the market situation.

Optimize returns: If the fund manager’s analysis suggests that the stock market is bullish, a higher portion of the fund’s assets could be allocated to equity to optimize returns.

Manage risk: If the fund manager anticipates higher volatility and bearishness in the stock market, a higher portion of the fund’s assets could be allocated to debt to reduce the risk of the overall portfolio.

Note that debt instruments also carry interest rates and credit risk, but their risk is relatively lower than equity.

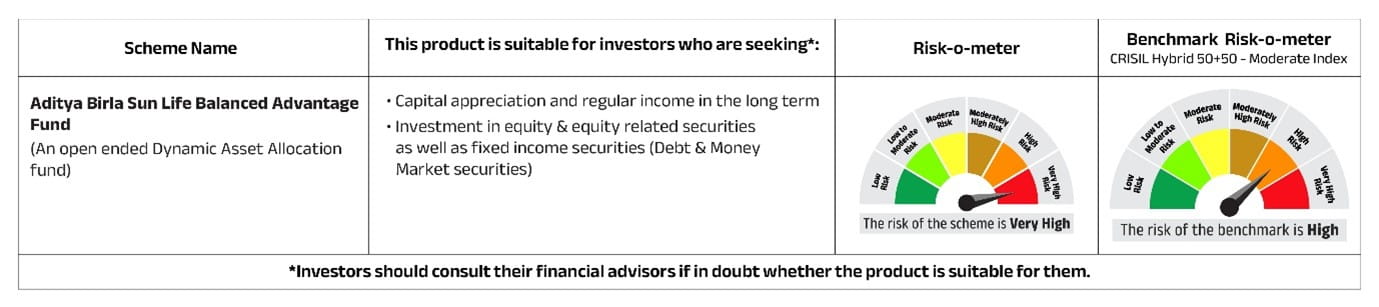

Aditya Birla Sun Life Balanced Advantage Fund helps you diversify across asset classes and can aid in navigating the market moods.. You can get the benefit of a fund manager’s dynamic asset allocation while you invest your time in other things that demand your attention.

Start a SIP today and let the Aditya Birla Sun Life Balanced Advantage Fund manage the risks and rewards in the long run.

Risk-o-meter as on February 28, 2025.

The Risk-o-meter(s) specified will be evaluated and updated on a monthly basis. For updated Risk-o-meters kindly refer to latest factsheet.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000