-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

How to save tax the smartest way?

Apr 26, 2019

4 mins

5 Rating

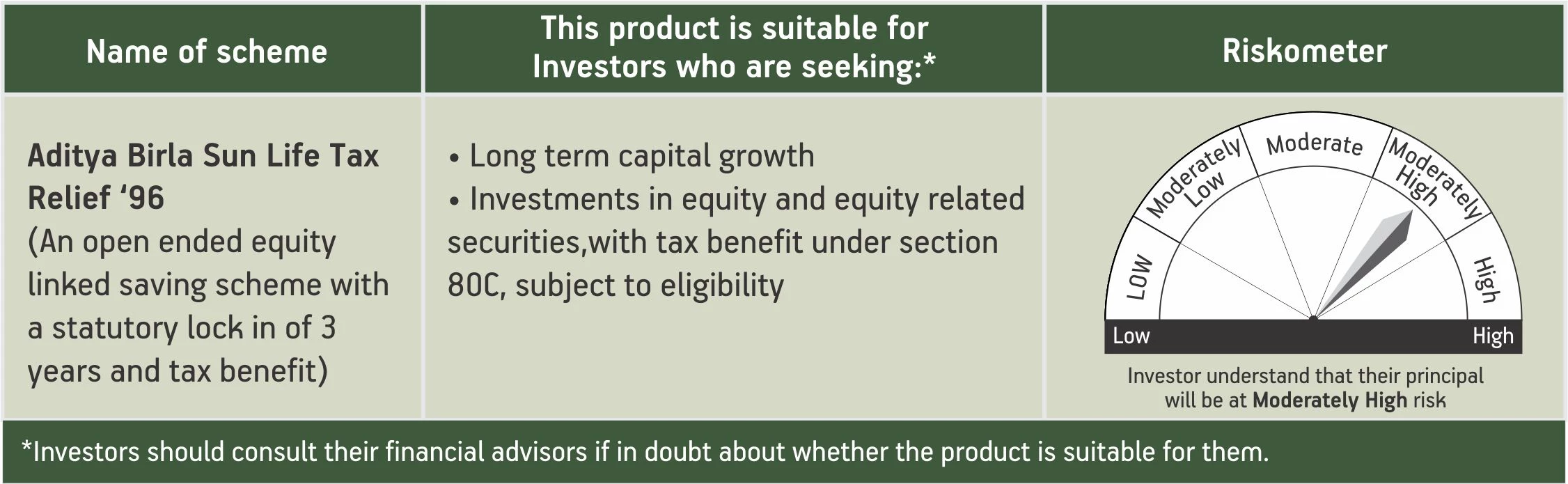

This new financial year, Rachna, a software professional, has decided not to repeat her last year mistake and do an early tax planning. Rachna has planned to invest in an instrument which not only helps her to save tax but aids her in her investment portfolio as well. While researching online, Rachna comes across a fund called the Aditya Birla Sun Life Tax Relief ’96 (An open ended Equity Linked Saving Scheme with a statutory lock in of 3 years and tax benefit)

What is Aditya Birla Sun Life Tax Relief’96?

It is an open- ended Equity Linked Saving Scheme or ELSS Fund is offered by Aditya Birla Sun Life Mutual Fund. ELSS funds are mutual fund investments with a tax advantage. These schemes could be one of the good avenues for investment if you aim to earn reasonable returns as well as save tax. Additionally, the capital gains earned from these are subject to 10% (plus applicable cess & charges) of tax. As a result, you can almost fully enjoy the maturity proceeds or earnings from your ELSS investments.

Tax Advantage

As the name suggests, investment in this scheme will help you get the relief from taxes. These investments (up to a maximum of Rs. 1.5 Lakhs) qualify for deductions under the Section 80C of the Income Tax Act, 1961.

Salient Features:

Category

It falls in the category of Equity Linked Saving Schemes (ELSS).

Exit Load

This scheme has no exit load. However, there is a 3-year statutory lock-in period.

Minimum amount for application

Rs. 500

Systematic Investment Plan

One can start with minimum amount of Rs. 500 as the monthly SIP.

Total Expense Ratio*

2.04% (Regular) and 0.99% (Direct)

*Data as on 23rd April’19

Investment Strategy

This scheme aims to have a well-diversified multi-cap portfolio to provide reasonable returns to the investors along with tax savings with an exposure of 55-60% in large cap equity stocks and the rest in mid and small cap stocks. A combination of the top down approach and bottom up approach is followed in the stock selection process. The top down approach focuses on an analysis of macroeconomic factors, economic changes & trends, key policy changes, infrastructure spending, etc. The bottom-up approach seeks to identify companies with high profitability and scalability supported by sustainable competitive advantage.

The Team Behind

At the helm of this scheme, is an industry veteran who goes by the name of Mr. Ajay Garg. With an experience of more than two decades in the financial services industry, he has been successfully managing this scheme since 2006 along with his team of experts.

Who should invest in this?

If you find yourself nodding your head to any of the following things, you may consider investing in this fund:

Thinking about investing in ELSS Funds

Looking for long-term appreciation in capital

Wanting to score the twin benefits of investing in equity (or equity related) schemes and qualifying for tax deduction under Section 80C of the Income Tax Act, 1961

Final Word

Rachna did an extensive research on this fund and opted for the same. It is true that money does not grow on trees, but at least we can choose tax saving schemes like this with an aim to make the most out of your “khoonpaseenekikamai”! What are you waiting for?

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000