-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

-

SIP Calculators

- Back

-

Shareholders

IMPORTANT ALERT ! Beware of Fake AMC App, Online Impersonation & Scam WhatsApp Groups

How to select the right schemes for multiple SIPs

Sep 06, 2022

4 Min

4 Rating

SIPs today have gained tremendous popularity, having practically become synonymous with mutual funds itself! SIPs are actually a means to investment in mutual fund schemes - a mode to access a mutual fund investment/s of your choice. With their wide benefits – from financial discipline to rupee cost averaging – SIPs are becoming the preferred investing mode. This prompts many investors to route their savings through SIP.

Must Read - SIP Full Form

Does one SIP mutual fund investment suffice?

Let’s say I have an investable surplus of Rs.20,000 each month. Should I put all of it in a single SIP – say a Blue-Chip Equity fund?

The answer is probably not!

While SIP is a good choice, limiting your SIP investment to a single fund may not be wise.

One size does not fit all!

Every mutual fund has its own unique objective as well as its own risk parameters, return potential and investment horizon.

Just as each of your financial goals require different amounts of money at different stages in your life.

This necessitates setting up multiple SIPs – a separate one assigned for each defined financial goal!

Also Read - Mutual Fund Meaning

Continuing the above example, the blue-chip equity fund may be suitable to fund a home renovation 5 years down the line or your child’s higher education 10 years from now. But, what about your shorter-term goals like your upcoming holiday or critical emergency fund planning? An equity fund may be too risky for these.

So, how do I decide where to allocate my surplus Rs.20,000 each month?

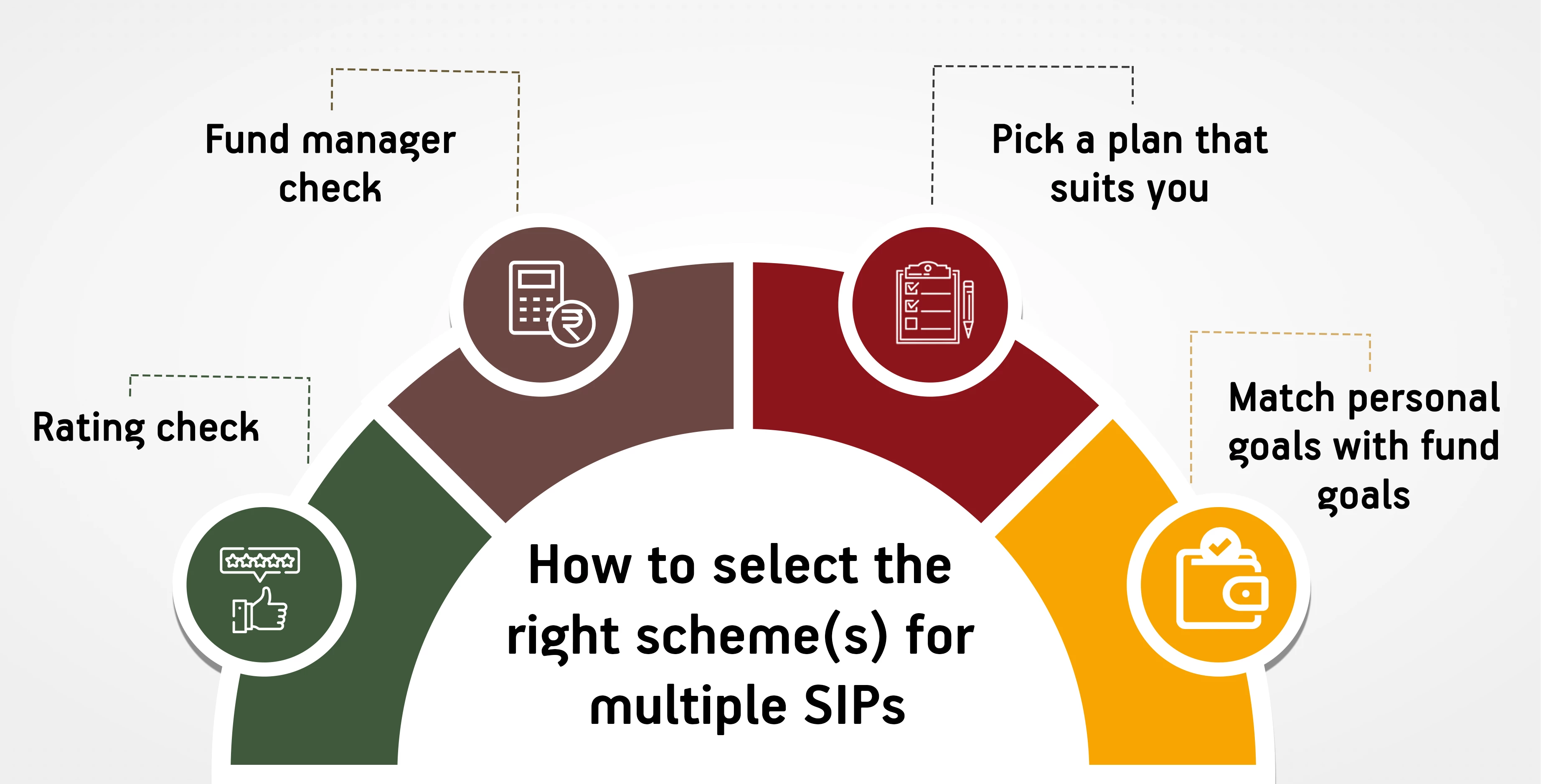

How to select the right schemes for Multiple SIPs?

Match personal goals with fund goals

This is the first and in fact one of the most important steps! It is important to select those funds that match your goals:

Broad type of funds:

There are broadly 5 fund categories. The first step is to select a category of fund for each goal:

Equity funds – you can select these for goals that are long term. This is because equity funds tend to be high risk and this volatility can even out over a long term. Ultimately offering higher returns which get compounded over the long term as well.

Must Read - What is Equity Fund?Debt funds- you can select these for goals that are short term - near term goals like a new car, a holiday or even an emergency fund, etc. Debt funds can offer reasonable returns at relatively lower risk levels.

Also Read - What is Debt Fund?Hybrid funds – you can select these for medium term goals. Hybrid funds combine debt and equity in varying ratios. The ultimate selection of the type of hybrid funds will depend on your risk appetite.

Click here - Hybrid Funds MeaningSolution oriented funds – These are specifically formulated funds that are directed towards specific goals – mainly children education and retirement.

Others mainly passive funds – These can be opted for by novice investors and those who want to limit stock selection risk

Narrow down:

Once you have zeroed in on types of funds for each goal, you can narrow down from the choices and select a specific fund/s.

Within the equity space – If you are looking for high returns and can risk higher volatility, then can pick small and mid-cap funds; if you want a less volatile equity portfolio then you can pick large cap funds. If you want to bet on odds of a specific sector, then you can look out for sectoral or thematic funds.

Within the debt space – If you are looking for practically no risk then you can choose liquid funds or gilt funds. If you are willing to take on moderate risk for better returns, then you can go for longer duration and bond funds. For fixed term goals, you can choose fixed maturity plans.

Within the hybrid space – These funds intend to give you a balance between features of equity and debt. A risk averse investor can opt for conservative end of hybrid funds and risk-taking investor can opt for more aggressive funds

To understand this in more detail, you can check out our earlier blog on “How to save for multiple financial goals”

Must Read - How to Invest in Mutual Funds?

● Pick a plan that suits you

Mutual funds have different plans and options. Direct plans can be taken directly from the mutual fund company and come with a lower expense ratio as compared to regular plans. Regular plans on the other hand can be purchased through your distributor/broker.

Funds also have growth and IDCW options. If you are looking for regular income, you can choose the IDCW pay out mode; if accumulating a corpus is your goal then stick to the growth option.

● Fund manager check

Fund managers play a very key role, especially in actively managed funds. The performance of your investments primarily hinges on their expertise and ability to build a winning portfolio.

Make sure to check on the background of fund managers of your selected funds to gauge their credibility, experience as well track record of other funds managed by them.

● Rating check

Accredited rating agencies study mutual funds and give them ratings based on their performance. These ratings are easily available in the public domain. Picking high rated funds is desirable.

Multi scheme SIP facility to access Multiple SIPs

Many AMCs offer a value-added feature that allows you to access multiple funds through a single SIP investment. Check with the AMC of your choosing to opt for this facility for added convenience.

Diversification is one of the key pillars of successful investing – we choose mutual funds for diversification and with Multiple SIPs you can strengthen this diversification.

Also Read - How to Choose a Mutual Fund?

Do not settle for less by picking and choosing between important financial goals, instead pick and choose the right multiple SIPs that can multiply your wealth and achieve all your financial goals!

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000