-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

How to stay ahead without switching funds every time the market shifts

Feb 27, 2025

5 min

4 Rating

Stock markets have been known to go through its fair share of ups and downs. But did you know that even within the stock market different categories of stocks tend to respond to economic shifts differently? This can make navigating the stock market and staying on course with your investments a bit trickier.

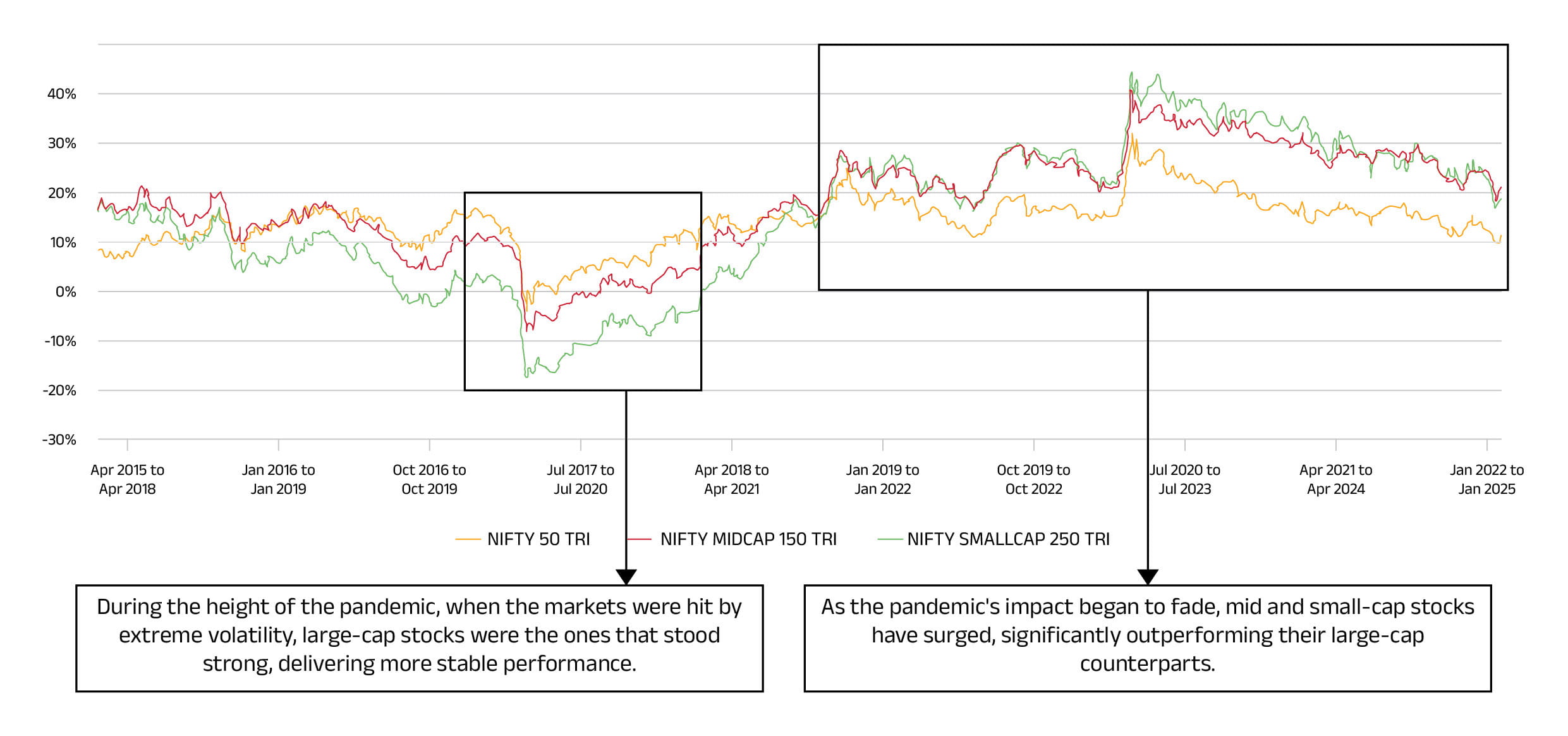

Take a look at this graph – it illustrates the 3-year rolling return performance of three key benchmarks over the past 10 years

NIFTY 50 TRI representing the large cap stocks

NIFTY MIDCAP 150 TRI representing the mid-cap stocks; and

NIFTY SMALLCAP 250 TRI representing the small cap stocks

As an investor aiming to maximize your wealth, you would want to be in the right place at the right time – perhaps by having a larger exposure to large caps before the pandemic and shifting to small and mid-caps afterward.

But is this really feasible for you as an investor? To pull this off, you would need to stay constantly updated on market shifts, while also managing the cyclical entry and exit of funds. Not only is this a logistical hassle, but it can also come with a hefty tax cost.

A better solution to adapt to market shifts?

Looking for a more flexible way to adapt to market shifts? There is a mutual fund category designed with exactly this in mind – Flexi Cap Funds.

What are Flexi Cap funds?

Flexi Cap Funds are diversified equity mutual funds that invest across a range of large, mid, and small-cap stocks. Unlike some other funds, they are not restricted by specific limits for each stock category, as long as their overall equity allocation remains at a minimum of 65%. This flexibility allows them to adjust their exposure based on market conditions, offering a more dynamic approach to investing

Stand out features:

An adaptive investment strategy

The beauty of Flexi Cap Funds lies in their ability to adapt to market shifts. The fund managers actively manage the allocation between large, mid, and small-cap stocks, based on their analysis and forecasts of how each segment will perform. This dynamic strategy aims to ensure the fund is optimally positioned to maximize wealth for investors, adjusting to both the ups and downs of the market.

Diversification

Flexi Cap Funds do not just spread their investments across various market caps; they also offer diversification across different sectors and industries. This further reduces risk and helps stabilize returns, as different sectors may perform differently in varying economic environments.

Fund manager expertise

The performance of Flexi Cap Funds largely depends on the expertise of their fund managers. With their in-depth knowledge and experience, fund managers aim to make the right calls to enhance portfolio growth, ensuring that your investments are in capable hands.

How this helps investors stay ahead

The fluid and flexible investment strategy of Flexi Cap Funds allows investors to stay ahead on two crucial fronts – risk and return.

Fund managers can adjust the fund’s allocations by shifting out of underperforming or highly volatile small and mid-cap stocks when the market environment is more favourable for the stability of large caps. When market conditions favour growth, they can then increase exposure to small and mid-caps to take advantage of their higher growth potential. This flexibility helps the fund not only stay aligned with market cycles but also better navigate periods of volatility.

Moreover, Flexi Cap Funds can create an opportunistic portfolio, as fund managers have the freedom to capitalize on high-growth opportunities, regardless of which sector or market cap they come from. Whether it is an emerging trend in a small-cap sector or an opportunity within a large-cap company, the fund can quickly adjust to capture these gains, enhancing its wealth-building potential.

Long term to truly stay ahead

To fully reap the benefits of Flexi Cap Funds, a long-term investment approach is key. Holding a position in these funds for the long term helps amplify both the volatility reduction and wealth maximization potential.

Over time, flexi cap funds benefit from the flexibility of adapting to shifting market conditions, smoothing out short-term volatility. The power of compounding can also work its magic as the fund managers continuously optimize the portfolio.

Staying ahead in the stock market does not have to mean constantly switching funds with every market shift. Instead, adopting a strategy like Flexi Cap Funds allows you to ride the waves of volatility while maximizing returns.

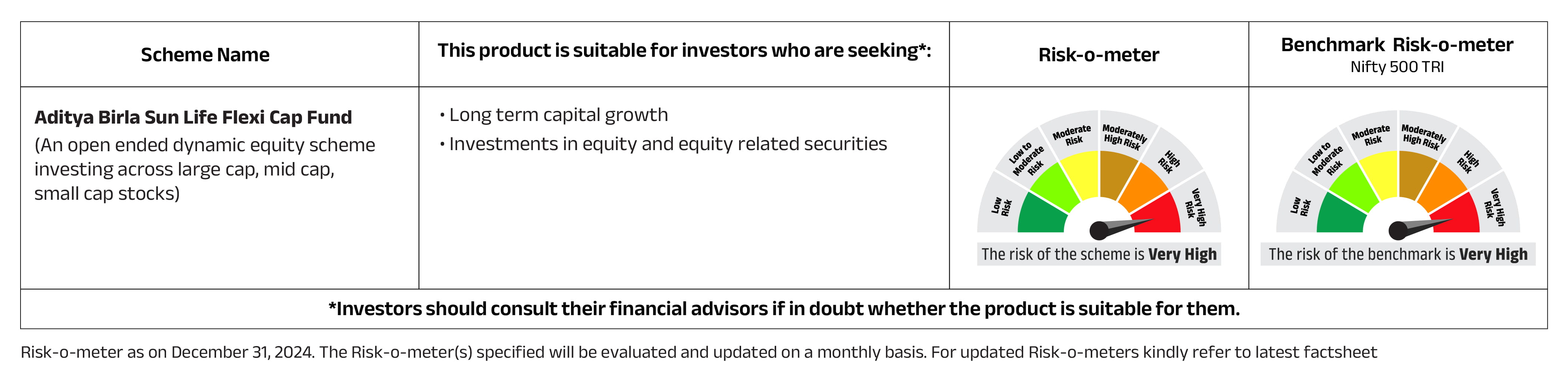

At Aditya Birla Sun Life Mutual Fund, we offer a carefully curated Flexi Cap fund – Aditya Birla Sun Life Flexi Cap Fund, designed to help you stay ahead, no matter the market conditions. Let us help you build a portfolio that is resilient, diversified, and geared towards long-term growth.

Risk-o-meter as on 31st January 2025.

The Risk-o-meter(s) specified will be evaluated and updated on a monthly basis. For updated Risk-o-meters kindly refer to latest factsheet.

Source:

1. www.advisorkhoj.com – Benchmark rolling returns for 3 year period from 01-02-2015 till 25-01-2025

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000