-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

In the highest tax bracket? Save additional tax with these options

Apr 26, 2019

5 mins

4 Rating

Does your net income exceed INR 10,00,000? Worried about the additional tax burden as you fall in the highest tax bracket of 30%?

If yes then you are probably always on the lookout of ways to save tax. While most of us are aware of traditional tax saving methods such as bank fixed deposits and post office deposit schemes, we often miss out on lesser known tax saving methods.

There is an entire array of tax saving options offered by the government which can help you reduce your taxes. These are available in the form of deductions from your income which not only reduces your taxable income and hence the resultant tax, but may also help in bringing your income to a lower tax slab rate, resulting in tax saving in both percentage and absolute terms.

Let’s take a closer look at these options:

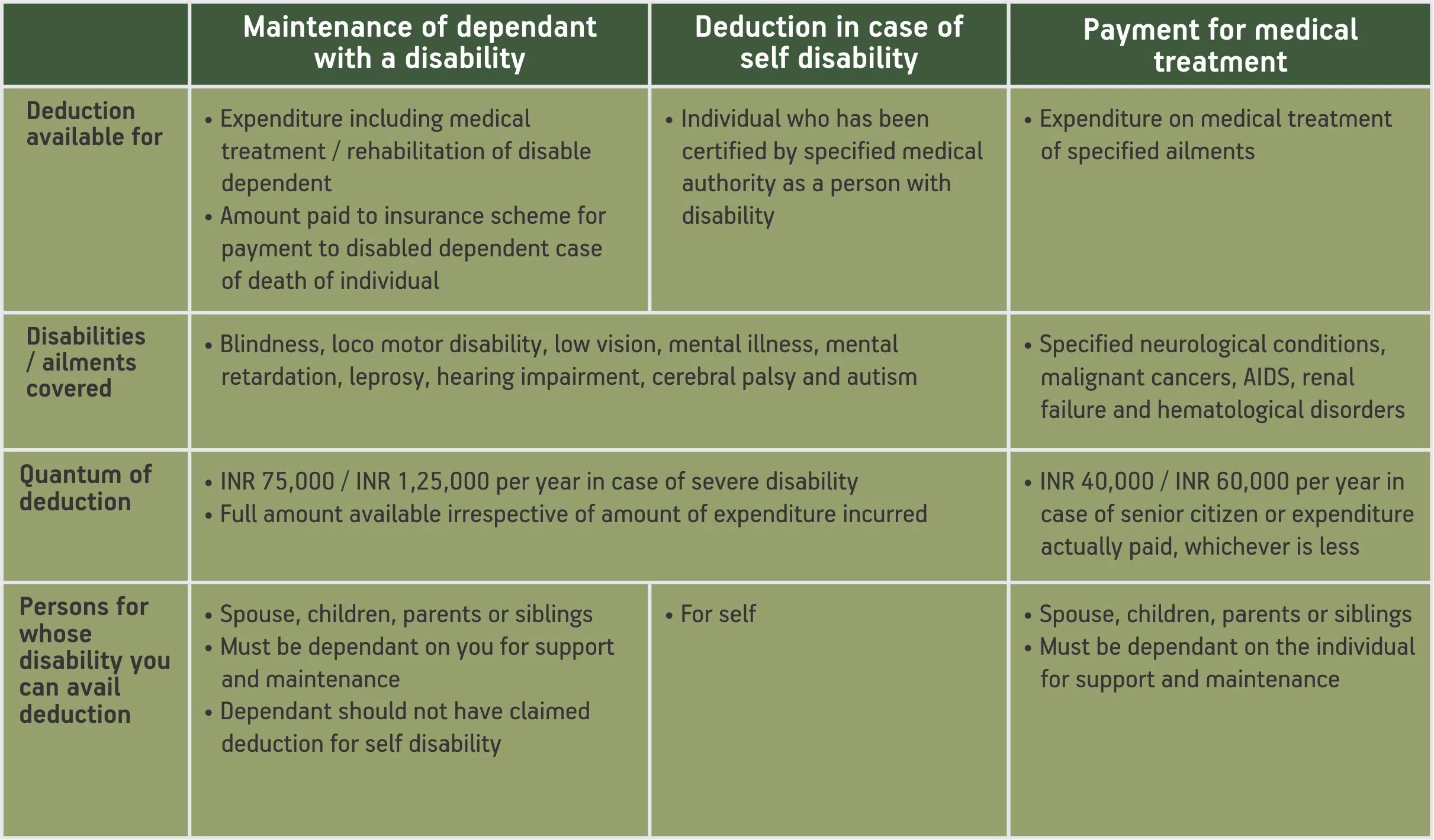

Medical related

While most of us are aware of the deduction available for payment of medical insurance premium taken to insure the health of our self or that of our family members, few of us know that the government also provides considerable tax relief in case of people suffering from certain medical conditions.

Consider these especially if you support your aged parents or have a spouse or sibling or child suffering from any of the specified medical conditions.

To avail the above deductions you will need to obtain a certification from the relevant certified medical practitioner.

Loan for higher education

If you are looking to pursue higher education along with your existing job or are supporting your spouse or children in their higher education and would be availing an education loan for the same, then there is an additional tax benefit that you can avail.

A deduction is available for the interest paid on a higher education loan availed from specified charitable/financial institutions

The loan can be taken for the benefit of your own education or that of your spouse or children

No monetary limit on the quantum of deduction that can be availed

The deduction is available for a maximum period of 8 years

Deduction allowed in respect of loan taken for education in India as well as education abroad

An additional benefit for senior citizens

While individuals receive the benefit of a deduction of up to INR 10,000 in case of interest on saving bank accounts, senior citizens are eligible to receive an additional deduction up to INR 50,000 in case of interest on bank/post office deposits.

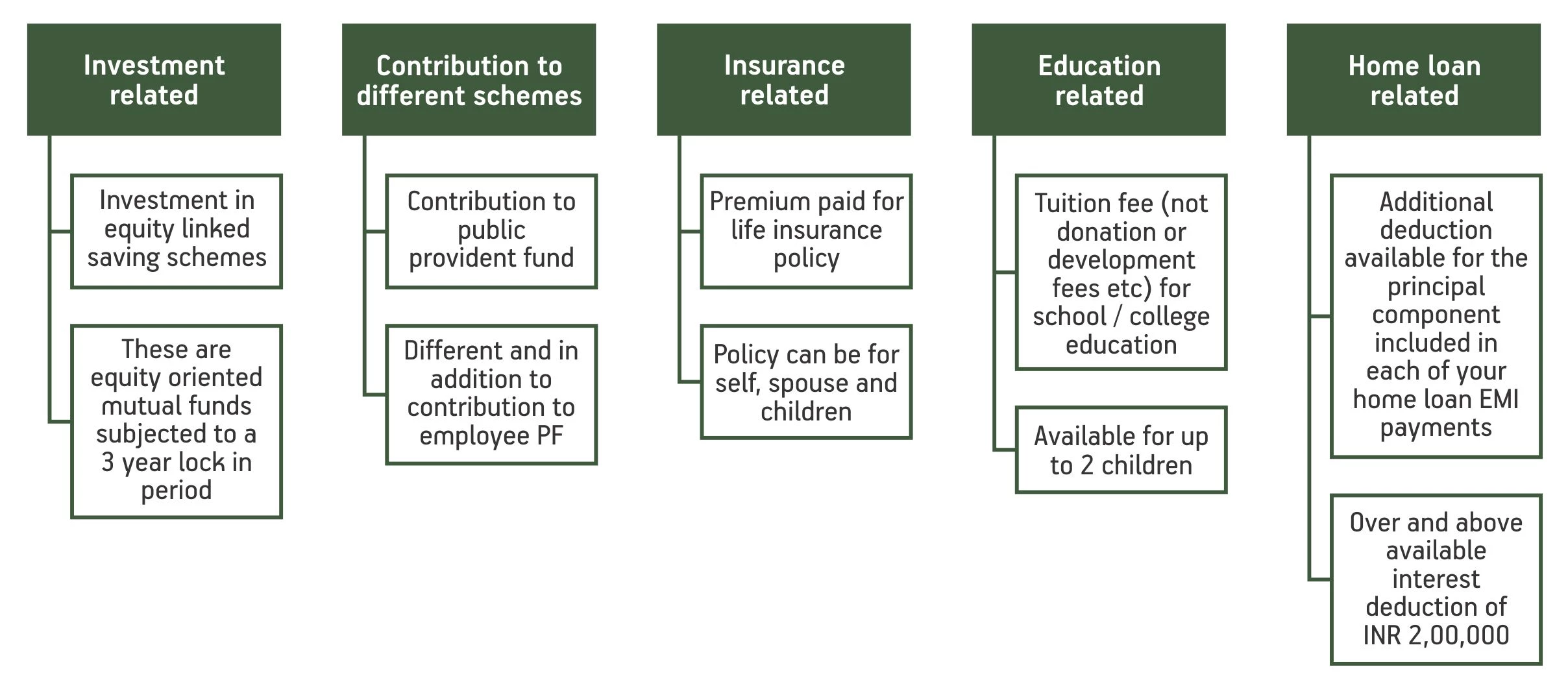

Cumulative deductions available in the same category as provident fund (PF) deduction (cumulatively availed up to INR 1,50,000 per year):

While a large portion of this deduction could be met by your employee provident fund contribution, you may consider these lesser known options for the shortfall up to INR 1,50,000 or in case you are self employed and do not contribute to an employee provident fund:

With the financial year coming to a close, take some time to look at these options and identify those applicable to you to reduce your taxable income and consequently reduce the taxes you need to pay.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

1800-270-7000

1800-270-7000